Note

21/2/2023: Revised. Section sequence re-ordered.

11/1/2021: Typo corrected.

3/4/2020: Revised.

24/12/2014: Moved from wiki.

Intro

- Quantity Surveyors value the amounts of payments to Contractors periodically. Payments are to facilitate Contractors’ cash flow. Payment valuations can only be an approximation and should not take unduly long time to do just to improve the accuracy of minor significance to the effect of unduly deferring the payments to Contractors.

Terms of payment

- There can be broadly two types of payment terms:

- Progress payments which are made at regular intervals, usually monthly, based on valuation of value of actual work done and materials delivered, with provisions for retention

- Stage payments which are made not at regular intervals, but are made when certain stage of construction has been achieved, e.g. upon concreting of the floor at mid-height of the building, upon concreting of the roof, upon submission for Occupation Permit, etc.

- The progress payment method is the usual method used and will be described in detail first. Discussion of stage payments will be given at the end.

- The terms “milestone payments”, “regular milestone payments” and “time-related milestone payments” are also used. It should be noted that these terms are not terms with established definitions in the industry but are used here for identification purposes only.

- The terms of payment and payment processes must follow the specific terms and conditions of the Contract.

- This paper is based on the Standard Forms of Building Contract 2005/2006 versions. Some terms used in the pre-2005 versions have also been mentioned.

- Government General Conditions of Contract follow similar principle, though the retention percentages and limits of retention are smaller than those adopted by the private sector. The form signed by the Quantity Surveyor is called a payment certificate rather than a payment valuation.

Advance payments and deposit payments

Meaning

-

Advance payment or deposit payment is a portion of the Contract Sum to be paid upon the award of the Contract as a security for the Contract and to facilitate the Contractor to procure materials and to cover his early expenses.

- Both terms usually mean the same thing for everyday use. However, there can be some important difference between deposit payments and advance payments in some contracts. For some sales contracts, deposit is a consideration for securing the formal execution or further performance of the contract. If the buyer fails to proceed, the deposit he paid would be forfeited. If the seller fails to proceed, he has to refund the deposit in double. Advance payments do not have such implied meaning. However, the actual meaning of the two terms would depend on the terms of the individual agreements or contracts.

- Advance payments in the following discussions include deposit payments.

Advance payments not preferred by Employers

- Normal progress payments do not provide for advance payments.

- Advance payment is an over-payment from the point of view of the Employer, and the over-payment would possibly exist until the end of the Contract, depending on the terms of recovering the advance payments in subsequent payments.

Situation where advance payments are adopted

- Advance payments are usually required by suppliers or contractors for sales contracts, lift and escalator contracts, fitting out contracts, minor contracts of short duration, contracts in Mainland China.

- Advance payments are also appropriate for contracts which involve substantial up-front expenditure before materials are delivered to site.

Terms of payment with advance payment

- Terms of payment in the form of “10% advance payment upon commencement, 85% progress payment, 2.5% retention to be released upon Substantial / Practical Completion and 2.5% retention to be released at the end of the Defects Liability Period” is quite common for less formal contracts. This means that after payment of the 10% advance payment, 85% of the value of work done and materials delivered is to be paid during the course of the Works.

- If the Contract Sum changes, the above terms are not clear whether the already paid amounts will need to be adjusted.

- Expressing in cumulative percentages such as 10%, 95%, 97.5% and 100% may resolve the problem.

Recovery of advance payments relative to progress payments

- If the advance payment is in the form of a lump sum, how and when the advance payment is to be recovered should be stated.

- Advance payment is not expected to be subject to retention. The normal way to calculate retention should be adjusted.

- A way to present the payment valuation is as follos:

- Advance payments made up-front are recovered from subsequent payments. Recovery of the advance payments in subsequent payments is pro-rata to the progress value of work done and materials delivered.

- In this example, the recovery is based on:

- (Original advance payment / Original Contract Sum) x gross amount of progress payment = 10% x gross amount of progress payment.

- If the Contract Sum is increased during the course of the Works, the recovery of deposit will be quicker. However, if the Contract Sum is reduced during the course of the Works, the recovery will be slower and it will leave a portion unrecovered upon Substantial / Practical Completion. It is advisable that the formula should be revised to relate to the Estimated Final Contract Sum instead of the Original Contract Sum as follows:

- Original advance payment x (Gross amount of progress payment / Estimated Final Contract Sum) = Original advance payment x percentage of work done and materials on site.

- No matter which of the above calculations are used, only until the contract works are fully completed will the advance payment be fully recovered. That is why advance payment creates over-payment until Substantial / Practical Completion or beyond.

Faster recovery of advance payments

- To avoid leaving the advance payments there for too long, other methods to ensure quicker recovery of advance payments can be used, subject to agreement by both contract parties.

- A method which would not be welcome by contractors would be full recovery in the second Interim Certificate.

- Other more moderate methods are:

- Rate of recovery of advance payments being faster than the progress of work – for example advance payment made equal to 10% of the Contract Sum to be recovered at 20% of the gross amount of progress payment

- Recovery by instalments at specified number of Interim Certificates, e.g. at the 3rd, 5th and 7th payments

- Recovery by instalments at Interim Certificates issued after specified days, e.g. x, y, z months after commencement of the Works.

- The last two methods described above are not dependent on the progress of work, it has the advantage of forcing the Contractor not to be late in progress, otherwise he may receive less cash inflow due.

Bonds

- Advance payments or deposits are a kind of over-payment before they are fully recovered. If the Contractor or Supplier disappears or repudiates the Contract after receipt of advance payments or deposits, the Employer will have no redress unless measures like the following are implemented:

- The amount of surety bond to be increased to cover the advance payments or deposit payments and the surety bond to be obtained before payment

- Advance payment bond to be provided by the Contractor or Supplier as security.

Stage payments

Meaning

- Under a “stage payment” method, the Works are broken down into a number of stages of completion each with a value which will be paid on completion of the relevant stage of the Works. Unlike the normal progress payment method where work done and materials on site are valued and paid for at regular intervals, stage payments are not made at regular intervals but are made only when a certain stage of the Works is completed.

- For some contracts when the various stages of completion of the Works are defined by means of milestones, the stage payment method is called “milestone payment” method.

- An example of stage or milestone payment would be:

- The value assigned to each stage or milestone should preferably be equal to the value of the work required to achieve the stage or milestone, but they can also be made different purposely.

Use of stage or milestone payments

- Stage payment method is usually for sales contracts, lift and escalator contracts, fitting out contracts, contracts for single block speculative residential building, minor contracts, civil engineering contracts.

- Stage payment method would be appropriate for contracts which can have easily defined stages of completion of the Works, for contracts which are of simple nature, for contracts which the Architect would not like to spend time to value the quantities of work and materials delivered on regular basis.

- Stage or milestone payments are simple to operate if not subjected to Employers’ changes or Contractors’ abuse.

- Stage or milestone payments are not suitable for complex projects which are prone to design and programme changes.

- Substantial design and programme changes may render the original terms of payments not workable and require revisions which may be too frequent and laborious that the original intent to save work in carrying out normal valuation based on work done and materials delivery is no longer realized.

Problems with stage or milestone payments

- The definitions of stages (or milestones) should be broad and simple enough to enable easy judgment as to their achievement by visual inspection without requiring detailed valuation.

- If the definitions of the stages are too rigid, literal interpretation of the definitions may result in non-achievement of the stages and hence non-payment. A definition of “100% completion”, if interpreted literally, would always lead to argument.

- If the definitions of the stages are too complex thus requiring detailed calculations, the original intent to have a simple payment valuation method is defeated.

- On the other hand, if the definitions are too loose, the Contractor may take advantage to do work just enough to match the definitions while the value assigned for the stage may in fact have already allowed for a greater extent of work.

Regular milestone payments

- A variance of the stage payment or milestone payment method is to break down the Works into greater number of more detailed stages or milestones and to value the Works at regular intervals. By the regular valuation date, the various stages or milestones are checked to see if they are achieved. The corresponding amounts of those stages or milestones achieved will be included in the current payment certificate. No payment will be made in respect of those not achieved. An example of such milestone payment calculation is as follows:

- The time factor is made a factor in making payments.

Use of regular milestone payments

- The advantage of the regular milestone payment method is that valuation is made at regular intervals, such that the Contractor can receive money regularly though smaller in amount as compared to non-regular stage payment method.

Problems with regular milestone payments

- To enable regular milestone payments to work, the Works have to be broken done into greater number of milestones. Some degree of concurrency would be created. A case may be encountered where the Contractor may be so unlucky that substantial number of milestones are only 95% achieved and therefore he cannot be entitled to payment though the Works if viewed as a whole may be 40% complete.

- Furthermore, the milestones are usually defined with reference to a programme planned before tendering. The programmed activities planned before tendering without the Contractor’s input may not be realistic when compared to the Contractor’s intended sequence of work after contract award. If there is any further critical variation to the Works or serious disruption to the original programme and logic such that the definitions of the activities can no longer be achievable or can only be achieved until the very late stage of the Works, payments will be seriously deferred. The milestone payment schedule needs to be revised to be realistic or workable. The task of making such revision may be similar to that required to do a normal progress valuation. If the milestone payment schedule needs to be constantly revised to be realistic, it may be better to use normal progress method.

Time-related milestone payments

- A more stringent form of time-related milestone payments is to relate the milestone to a specific calendar day or a specific period after commencement. Failure to achieve the milestone by the prescribed date or within the prescribed period will lead to no payment and payment will have to wait till a subsequent qualifying milestone. An example would be like this:

- If Milestone B cannot be achieved by 1/6/2002, no payment will be made. If Milestone C is achieved by 1/9/2002, payment will be made for Milestones B and C, otherwise, depending on the detailed terms of the milestone payment method, no payment will be made for both or payment will be made for Milestone B only.

Use of time-related milestone payments

- Time-related milestone payments put strong emphasis on achievement in relation to time and greater commitment from contractors towards time.

- Time-related milestone payment method is suitable for time critical projects.

Possible solutions to alleviate problems

- To alleviate some of the problems with stage or milestone payments mentioned above, the following measures may be adopted:

- Use realistic definitions for stages or milestones with margin for interpretation

- Minimize concurrent activities when devising the stages or milestones

- Minimize post contract changes

- Include a condition to the effect that in case the cumulative total of stage payments deviates from the value based on work done and materials delivery by a certain percentage then payments will be based on the latter. (Valuation needs not be done every time but would be done only when it is suspected that the deviation is great.)

- Re-agree the terms when it is considered necessary to better represent the latest situation.

Payment processes

- The usual processes for payment are:

- Contractor’s Payment Application → QS’s Valuation → Architect’s Certification → Contractor’s Presentation → Employer’s Honouring.

- A more detailed description is as follows:

- the Contractor, Nominated Sub-Contractors and Nominated Suppliers supply materials and, where applicable, carry out work

- the Contractor, Nominated Sub-Contractors and Nominated Suppliers calculate the values of materials supplied and work done by them

- the Nominated Sub-Contractors and Nominated Suppliers submit their payment applications to the Contractor, with copies to the Architect, the Quantity Surveyor, the M&E Consultant (where applicable), and the Employer (usually)

- the Contractor submits his payment application (incorporating applications from the Nominated Sub-Contractors and Nominated Suppliers) to the Architect, with copies to the Employer, the Quantity Surveyor, the M&E Consultant (where applicable)

- the Quantity Surveyor visits the Site, inspects and records the extent of unfixed materials and work done on site, in the presence of the Contractor’s representative (usually site quantity surveyor) and, if considered necessary, representatives from the Nominated Sub-Contractors and Nominated Suppliers

- the Quantity Surveyor calculates the values of unfixed materials and work done on site

- the M&E Consultant similarly visits the Site, values M&E works, and issues his payment valuation to the Quantity Surveyor

- the Quantity Surveyor issues his draft payment valuation incorporating the M&E Consultant’s valuations) to the Contractor to seek his agreement, with copies to the Employer, the Architect and the M&E Consultant for their information and, if they so desire, comments

- the Quantity Surveyor issues his formal payment valuation (incorporating the M&E Consultant’s valuation) to the Architect, with copies to the Employer, M&E Consultant, and the Contractor

- the Quantity Surveyor issues advice individually to Nominated Sub-Contractors and Suppliers to inform them the amounts of payment included in the main payment valuation

- the Architect issues his payment certificates certifying the amounts payable to the Contractor, Nominated Sub-Contractors and Nominated Suppliers

- the Contractor presents the payment certificate to the Employer for payment

- the Employer pays the Contractor.

Time

Dates

- “Date of Application” means the date of the Contractor’s payment application.

- “Date on Site” means the date when the QS visits the Site to carry out valuation.

- “Date of Valuation” means the cut-off date to calculate work done and materials on site. This is usually the same as the Date on site.

- "Date of Issuing Valuation" / "Date of Recommendation":

- Traditionally, the QS’s valuation is called a payment recommendation.

- “Date of Issuing Valuation” or “Date of Recommendation” means the date of the QS’s letter issuing the valuation for payment. This can only be later than the Date of Valuation.

- “Date of Certificate” means the date of the Architect’s Interim Certificate.

Frequency of Interim Certificates

- The Contract should state the time interval between successive payment certificates. This is usually one month.

- “Period of Interim Certificates” is used to mean such time interval.

- The 2005/2006 versions of the Standard Forms of Building Contract specify that the first Interim Certificate should not be issued later than 42 days after the Commencement Date of the Contract.

- The 2005/2006 versions also specify that the payment application should be submitted not later than 14 days before the due date for Interim Certificate, and the payment valuation should be submitted not later than 7 days before the due date for Interim Certificate. The exact date of the valuation has not been expressly stated. It should be a day between the 14 days and the 7 days.

Period for payment of certificates / Period for Honouring Certificates

- The Contract should state the grace period to pay after the issue of a payment certificate.

- This period is called “period for payment certificate” in the 2005/2006 versions of the Standard Forms of Building Contract. The default period is 14 calendar days from the date of the certificate.

- This period is called “Period for Honouring Certificates” in the pre-2005 Standard Forms of Building Contract. The default is 14 calendar days after the presentation by the Contractor of the certificate to the Employer. This is longer.

- The Contractor usually would issue an invoice for the same amount when requesting payment or presenting the Certificate.

- Some developers would require a period long than 14 days.

Payment to Nominated Sub-Contractors and Suppliers

- The Contract should state the period to pay the Nominated Sub-Contractors and Suppliers.

- The Standard Forms of Building Contract require this to be within 14 days of receipt by the Contractor of the relevant payment from the Employer.

Pay-when-paid

- Payment to Nominated Sub-Contractors and Suppliers is a “pay-when-paid” arrangement. The Contractor would not pay if he has not received the same money from the Employer.

- Argument would arise if due to deductions as a result of certain defaults of the Contractor, the total amount certified as due to the Contractor is less than that certified as due to Nominated Sub-Contractors and Suppliers, but the Contractor denies that the defaults are his, then the Contractor would declare that he has not received sufficient payment in respect of the Nominated Sub-Contracts and Supply Contracts and therefore he would not pay in full. The situation would become messier if the defaults in question relate to delays and disruptions where the Nominated Sub-Contractors and Suppliers are implicated as well.

- The 2005/2006 versions of the Standard Forms of Building Contract intend to remedy the problem by using the expression “within 14 days of the Contractor receiving payment or the accounting of payment from the Employer, as the case may be” meaning that once the relevant payment has been accounted for, this should be paid, notwithstanding that this has been set-off by other deductions from the payment to the Contractor.

- Some countries forbid pay-when-paid arrangement, meaning that the Contractor has to pay irrespective of his receipt of payment.

Valuation

Valuation format

- The simplest form of a payment valuation can be as follows:

- This shows that each BQ item is valued against the quantity of work done.

- In actual practice, to calculate the quantity of each item at each payment application and valuation will take a lot of time and is an impracticable task. People actually estimate the percentage done first by quick alternative approximations and apply the percentage to the original quantity to get the quantity done.

- The number of items is also too many to handle. The same percentage done may be applied to different items which in fact should have slight variances.

- Therefore, instead of calculating each quantity done individually, it is more practicable to value based on a group of related items or items under the same heading, and estimate the percentage done based on the whole group.

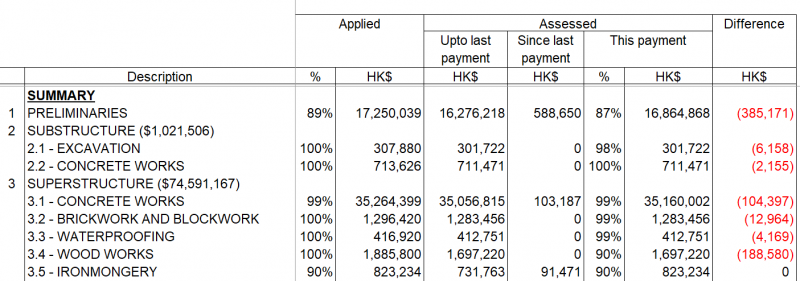

- A valuation detail with items grouped may look like this:

- A valuation summary may look like this:

-

-

- A valuation statement may look like this:

-

-

First payment format and procedure

- Set up payment valuation pro-forma.

- Pro-forma to be converted from BQ.

- Change the BQ file into a file format capable of doing calculations, such as EXCEL, if not already in such file format.

- If QS software is used for BQ and payment valuation, facilitate the Contractor to use the same software.

- Group BQ items into suitable groups (e.g. under sub-headings) to reduce the items to be valued.

- Valuation to be based on percentages rather than based on absolute quantities.

- Valuation to be based on gross value to-date rather than nett value since last payment.

- Discuss with the Contractor to agree format and procedure.

- Agree with the Contractor the principle and calculation methods for paying preliminaries.

- Running totals to be kept for material delivery.

- A.I. as authority for paying variations.

Payment for preliminaries

- Preliminaries prices should be broken down into initial costs, time related running costs, work related running costs and removal costs for payment purposes. The breakdown is usually not done when pricing the BQ but is agreed before the payment application.

- A valuation for the preliminaries (for another project) may look like this:

-

-

- Time-related items may be paid as work-related items if clauses similar to the following are included in the Contract:

- In the event of the amount inserted in respect of an item in this Preliminaries Section for which whole payment or substantially whole payment would normally be made at the outset of the Contract (e.g. insurances) being higher than the amount which the Contractor can substantiate, payment for the excess amount will be effected over the period of the Contract or such prolonged period caused by the Contractor

- Payments for amounts inserted against time related items in this Preliminaries Section such as overtime, plant, foreman, watching etc. will be effected over the period of the Contract or such prolonged period caused by the Contractor in the same proportion as the value of Contractor's work carried out is to the total value of Contractor's work (excluding Preliminaries)

- In the event of no amounts being inserted by the Contractor in respect of this Section, no relative payment whatsoever will be included in interim payments.

(Mistake in swapped use of "time-related" and "work-related" in the first sentence corrected, 11/1/2021)

Arrive at the value

- Proven with photos and records.

- Systematic.

- Clear.

- Reasonable factors.

- Arithmetically correct calculations.

- As soon as possible.

Amounts

Gross valuation

- “Gross valuation” of payment is the estimated value of:

- the work properly executed and of

- the materials and goods delivered to or adjacent to the Works for use thereon.

- Any adjustments to the Contract Sum should also be reflected in the gross valuation.

- This includes variations, remeasurement, loss and expense compensation, etc. based on their currently assessed values, but excludes liquidated damages which are to be handled not as part of the payment valuation or payment certificate but as a separate deduction or set-off procedure against the payment due.

Retention

- “Retention” is a portion of the Gross Valuation retained from payment and is to be released until after Substantial Completion / Practical Completion.

Nett valuation

- “Nett valuation” of payment is gross valuation less retention.

Nett amount due

- “Nett amount due” is the nett valuation less previous payments. The relationship of the various terms can be illustrated by the following example:

Gross valuation

Work properly executed

- The value of work done should include all those items of work partially or wholly done on site but shall exclude those non-conforming or defective work.

- If an item of work is specifically rejected by the Architect, its value should not be included the Gross Valuation.

- If defects are found in an item of work which has partially been done but the defects are not serious enough for rejection of the whole of the work, then when calculating the proportion of the value of the work to be included in the Gross Valuation, some reductions should be made to account for the defects.

- Difficulties would arise upon Substantial Completion / Practical Completion when substantially all items of work are done but there are still defects to be made good. Contractors would obviously not like to see that all items in questions are subject to a reduction. They would argue that there is still retention to be retained. Whether reduction on top of retention should be made would depend on the seriousness of the defects. In theory, defective work should be rejected and therefore not paid. However, if the work is basically all right but with some minor imperfections which require making good but not complete replacement of the work, and if the cost of making good such minor imperfections can be covered by the retention money, then the full value of the work should be included in the Gross Valuation.

- To avoid doubt, it is advisable for the Architect to formally reject the whole of those items of work which have serious defects.

Unfixed materials on site

- A simplified term for “materials and goods delivered to or adjacent to the Works for use thereon” would be “unfixed materials on site”. If the materials and goods have been fixed, their value would be included in the value of work done. If materials are not on or adjacent to the Site, they would not normally be included in the Gross Valuation.

- Materials and goods can be easily taken out of the Site or may be stolen. Unfixed materials and goods are more vulnerable to loss and damage whether due to natural or human causes. Some materials such as cement and lime may easily deteriorate if they are not stored with proper protection. Therefore, to qualify for inclusion in the Gross Valuation, materials and goods must have been:

- reasonably, properly and not prematurely brought to or placed adjacent to the Works

- adequately protected against weather or other casualties.

- Most materials and goods should be delivered not more than one month in advance of the time required for use. Quantities delivered more than one month in advance should be queried.

- Possibly acceptable reasons are:

- The total quantity involved is so small that it is not economical to divide into more than one delivery

- The quantity must be delivered in one batch to ensure consistency in colour, e.g. stone.

- The following reasons which are for the contractor’s own benefit and convenience would not be acceptable:

- Larger quantities are delivered to secure earlier payment

- Larger quantities are delivered to secure the cheaper supply price

- Larger quantities are delivered to reduce off-site storage costs.

- Prompt delivery in accordance with the original programme without regard to the actual progress may still be a premature delivery.

- Quantities delivered more than two months in advance can be reviewed as premature.

Wastage

- Wastage is to be allowed for when considering supply quantities for materials on site.

- Wastage factors are to be used for different items of work, depending on the difficulty of work.

- However, a flat wastage factor may be acceptable as a quick method in case of small differences in the total quantities.

Quantities unfixed

- Can be based on counting or measurement of materials stored on site.

- Can also be done based on:

- Quantities delivered to site evidenced by delivery notes – quantities valued as done x (1 + wastage factor)

- But a check with the materials found on site should still be done to ensure no significant discrepancy.

Acceptability of Contractor’s suppliers’ quotations

- Suppliers’ invoices and receipts should be submitted to support the prices paid or payable by the Contractor.

- Note that quotations are not necessarily contracts.

- Beware of false quotations and contracts.

- Counter-check against BQ rates is required.

Effect of BQ rates on value payable for materials on site

- The materials on site should be paid their costs delivered to site with an allowance for the Contractor’s profit.

- However, in case of underpriced all-in rates, the material costs should not be paid in full but should only be a reasonable proportion of the all-in rates.

Materials off-site

- Payment is not normally made for materials not yet delivered to site.

- If payments for materials off-site are to be permitted, the following conditions should be made and observed:

- The materials or goods are intended for inclusion in the Works

- The materials or goods are in accordance with the Contract

- The Contractor furnishes to the Architect reasonable proof that the premises where the materials or goods have been assembled or stored are owned or leased by the Contractor

- The materials or goods have been and are set apart at the premises where they have been assembled or stored, and have been clearly and visibly marked, individually or in sets, so as to identify

- the person to whose order they are held

- their destination as being the Works

- (i.e. distinguishable from other materials and goods in the same storage place)

- The Contractor furnishes to the Architect evidence that such materials or goods are insured against the perils similar to those set out in the insurance clause of the Contract (i.e. insurance cover against loss or damage after payment and prior to delivery)

- The Contractor furnishes to the Architect reasonable proof that the property in such materials or goods is in the Contractor.

- The last requirement is very important. If the Contractor does not validly possess the property in the materials or goods, the property cannot validly pass to the Employer even if the Employer has paid for it. This is particularly so if the materials and goods are store off-site and mixed with other materials and goods not for the Works.

Total value to-date instead of value since last

- One very important rule in making payment valuation is: always value the total value to-date since the beginning instead of value the value since the last payment. This rule is implied by the Standard Forms of Building Contract and is a golden rule to follow.

- Valuation every month cannot be exact. There could be errors in previous valuations. Work or materials included in previous valuation could subsequent be found to be defective. Therefore, by valuing the total value to-date since the beginning and subtracting from it whatever was previously valued, whether the previously valued was correct or incorrect, previous errors would not perpetuate unnoticed.

Retention

Use of retention

- The primary intention to have retention is to reserve some money in case the contractors fail to make good defects and the Employer has to employ others to do so.

- However, the Employer is entitled to make other deductions from the retention so long as he is entitled to make deductions from the Contract.

No interest paid for retention

- Retention is held by the Employer.

- The Standard Forms of Building Contract state the Employer has no obligation to invest. No interest will be paid for retention upon release.

Retention percentage / percentage of Certified Value retained

- The percentage of the Gross Valuation that the Employer may retain is called “Retention Percentage” (2005/2006 versions) or “Percentage of Certified Value Retained” (pre-2005 versions) where “Certified Value” means the Gross Valuation.

- The percentage is usually 10%.

- The Standard Forms of Building Contract state that the following are not subject to retention:

- Direct loss and/or expense due to delay and disruption

- Value of work carried out by Nominated Sub-Contractors

- Value of materials or goods supplied by Nominated Suppliers

- Value of any adjustment for fluctuations in the costs of labour or materials.

- Retention in respect of Nominated Sub-Contractors shall be dealt with in accordance with the Nominated Sub-Contracts. The provisions and percentages would usually be similar to the Main Contract.

- Nominated Supply Contracts usually do not have retention.

- Nominated Sub-Contractors’ retention is also held by the Employer.

Limit of Retention

- When the amount of retention reaches certain limit, the retention would not be increased further. That limit is called “Limit of Retention” or “Limit of Retention Fund”.

- The Limit of Retention is usually 5% of the Contract Sum.

- If the Contract Sum includes Prime Cost Sums for Nominated Sub-Contracts, the Limit of Retention would be stated as “5% of the Contract Sum excluding prime cost sums for Nominated Sub-Contractors’ works (to the nearest one thousand dollars) plus the Retention Funds held in respect of Nominated Sub-Contractors”. This means that the limit in respect of the Contractor’s own work is calculated separately from the Nominated Sub-Contractors’ works. The Contractor’s own Limit of Retention is calculated based on “the Contract Sum excluding prime cost sums for Nominated Sub-Contracts”. Therefore, this is less than that based on the Contract Sum. However, it should be noted that prime cost sums for Nominated Supply Contracts are not subtracted. This means that the Contractor has to share a burden of retention in respect of the value of Nominated Supply Contracts which usually do not have retention.

Release of one moiety of retention upon Substantial / Practical Completion

- “One moiety” means “half”. One moiety of the retention is to be released upon the issue of the Certificate of Substantial / Practical Completion and the other moiety is to be released upon the issue of the Defects Rectification Certificate / Certificate of Completion of Making Good Defects.

- It the time is not too distant or the Contractor does not have serious objection, the release of the first moiety of retention can be included in the next Interim Certificate following Substantial / Practical Completion, otherwise, a special Interim Certificate should be issued to release the retention.

Release of balance of retention

- The balance of the retention is to be released on the expiration of the Defects Liability Period or on the issue of the Defects Rectification Certificate / Certificate of Completion of Making Good Defects, whichever is the later.

- It is rare that the Defects Rectification Certificate / Certificate of Completion of Making Good Defects would be issued before the expiration of the Defects Liability Period. The Defects Rectification Certificate / Certificate of Completion of Making Good Defects would usually be issued after the expiration of the Defects Liability Period and the completion of the making good of defects discovered prior to the expiration of the Defects Liability Period.

- A payment certificate is to be issued to release the balance of the retention.

Other things to check before release of balance of retention

- The release of the balance of the retention does not have to wait till the settlement of the Final Account. However, the Final Contract Sum assessed at that moment should be checked to see if there has been over-payment. If there has been over-payment, part of the balance of the retention may need to be used to off-set the over-payment.

- The Contract may also specify in the Special Conditions, the Bills of Quantities or the Specification that the release of retention is subject to submission of all guarantees, warranties, bonds, maintenance manuals, operating instructions, as-built drawings, etc. The contract provisions should be checked to ensure compliance before release of the balance of the retention.

Final Certificate and Payment

Final Certificate

- Payment of the balance of the Final Account to the Contractor is certified by means of the Final Certificate.

- The 2005/2006 versions of the Standard Forms of Building Contract states that the Final Certificate is to be issued as soon as practicable after the issue of the Defects Rectification Certificate for the whole of the Works and 28 days after the issuance of the signed Final Account.

- The Final Certificate shall state the balance of money payable to the Contractor or the money owed by the Contractor to the Employer.

- The Contractor may in the end owe money to the Employer due to, without limitation:

- Over-payment of variations and provisional items

- Retention being inadequate to cover the Employer’s cost of making good defects not made good by the Contractor

- Deduction for loss and expense arising from defaults of the Contractor

- Deduction for liquidated damages

- The Employer’s general rights of set off at law.

- Subject to any deductions authorized under the Contract, the Contractor shall be entitled to receive the amount certified 28 days after the issue of the Final Certificate.

- Usually the Final Account shall cover all deductions authorized under the Contract. However, if the Final Account is agreed much earlier than the issue of the Final Certificate, the Final Certificate should take into account of all authorized deductions arising after the agreement of the Final Account. Further deduction from the amount stated as due in the Final Certificate should be a very rare occurrence.

Final payment prerequisites

- Before the Final Certificate is issued, the following should have been done:

- Issue of Defects Rectification Certificate / Certificate of Completion of Making Good Defects

- Settlement of Final Account

- Settlement of extension of time and liquidated damages

- Submission of proof of previous payments to Nominated Sub-Contractors and Suppliers

- Submission of warranties and guarantees

- Submission of as-built records

- Handover of specified spares, and handover of surplus materials supplied by the Employer and specified to be returned.

Final Certificate as conclusive evidence

- Final Certificate is not only a certificate of payment but is also a certificate of satisfaction of the work done by the Contractor.

- The 2005/2006 versions of the Standard Forms of Building Contract state that the Final Certificate shall be conclusive evidence in any proceedings arising out of the Contract whether by arbitration or otherwise that the Works have been properly carried out and completed in accordance with the terms of the Contract and that any necessary effect has been given to all the terms of the Contract which require an adjustment to the Contract Sum:

- except where any defect in or omission from the Works was not reasonably discoverable at the time of the issue of the Defects Rectification Certificate

- except to the extent the Final Certificate has been rendered erroneous by reason of fraud, dishonesty or fraudulent concealment

- unless contested by the dispute resolution proceedings within the specified time and only to the extent contested.