Note

- 28/10/2025: Whole life carbon assessment mapping figure added. Examples of Different Kinds of Cost Estimates, Key Quantities and Key Units, and Further Reading added

- 15/3/2022: Expanded.

- 7/3/2022: Split from Pre-Contract Cost Planning and Control.

Intro

- International Cost Management Standard (ICMS) (https://icms-coalition.org/the-standard/), formally called "International Construction Measurement Standards", is intended to provide global consistency in presenting construction life cycle costs and carbon emissions.

Aims

- Provide global consistency in classifying, defining, measuring, recording, analysing and presenting entire construction life cycle costs and carbon emissions at a project, regional, state, national or international level.

- Allow costs and carbon emissions to be managed and potentially reduced.

- Allow:

- construction life cycle costs and carbon emissions to be consistently and transparently benchmarked (comparative benchmarking)

- the causes of differences in life cycle costs and carbon emissions between projects to be identified (option appraisal)

- properly informed decisions on the design and location of construction projects to be made at the best value for money (investment decision-making) and

- data to be used with confidence for construction project financing and investment, decision-making, and related purposes (certainty).

Characteristics

- Global: co-existing with the locals.

- High level.

- For the first time, building works, civil engineering works and carbon emissions are now also covered by the same classification at the high level.

- Same for costs and carbon emissions.

Timeline

- 17 June 2015: Formation of ICMS Coalition – a non-governmental, not-for-profit professional coalition.

- November 2015: Standards Setting Committee starting to work.

- July 2017: Release of the 1st Edition covering capital construction costs of building and civil engineering works,

- August 2019: Release of the 2nd Edition extended to cover other life cycle costs and more civil engineering project types at the PAQS Congress in Malaysia.

- November 2021: Release of the 3rd Edition extended to cover carbon emissions and more civil engineering project types. Change of names to International Cost Management Standard and Standard Setting Committee.

Evolution of cost classification

- "elements" in the traditional QS sense was called "Cost Groups" and "Cost Sub-Groups" in ICMS 1 and 2.

- With the addition of carbon emissions in ICMS 3, it is now called "Groups" and "Sub-Groups" to make them common for costs and carbon emissions.

Hierarchical framework

- Simple

- This framework is simpler than that commonly used in Hong Kong, which is for building works only.

- Shared groups

- Construction, Renewal and Maintenance all share the same Groups.

- Composite and prefabricated work

- It is covered.

- Development budget

-

For new developments, the total of the Acquisition Costs and Construction Costs represents the capital cost of development or development budgetary cost.

-

Codes

- Code: 01.2.03.030

- Meaning: Buildings: Construction: Structure: Frames and slabs (above top of ground floor slabs).

| Level 1 | Project Type | 01. | Buildings |

| Level 2 | Category | 2. | Construction |

| Level 3 | Group | 03. | Structure |

| Level 4 | Sub-Group | 030 | Frame and Slabs |

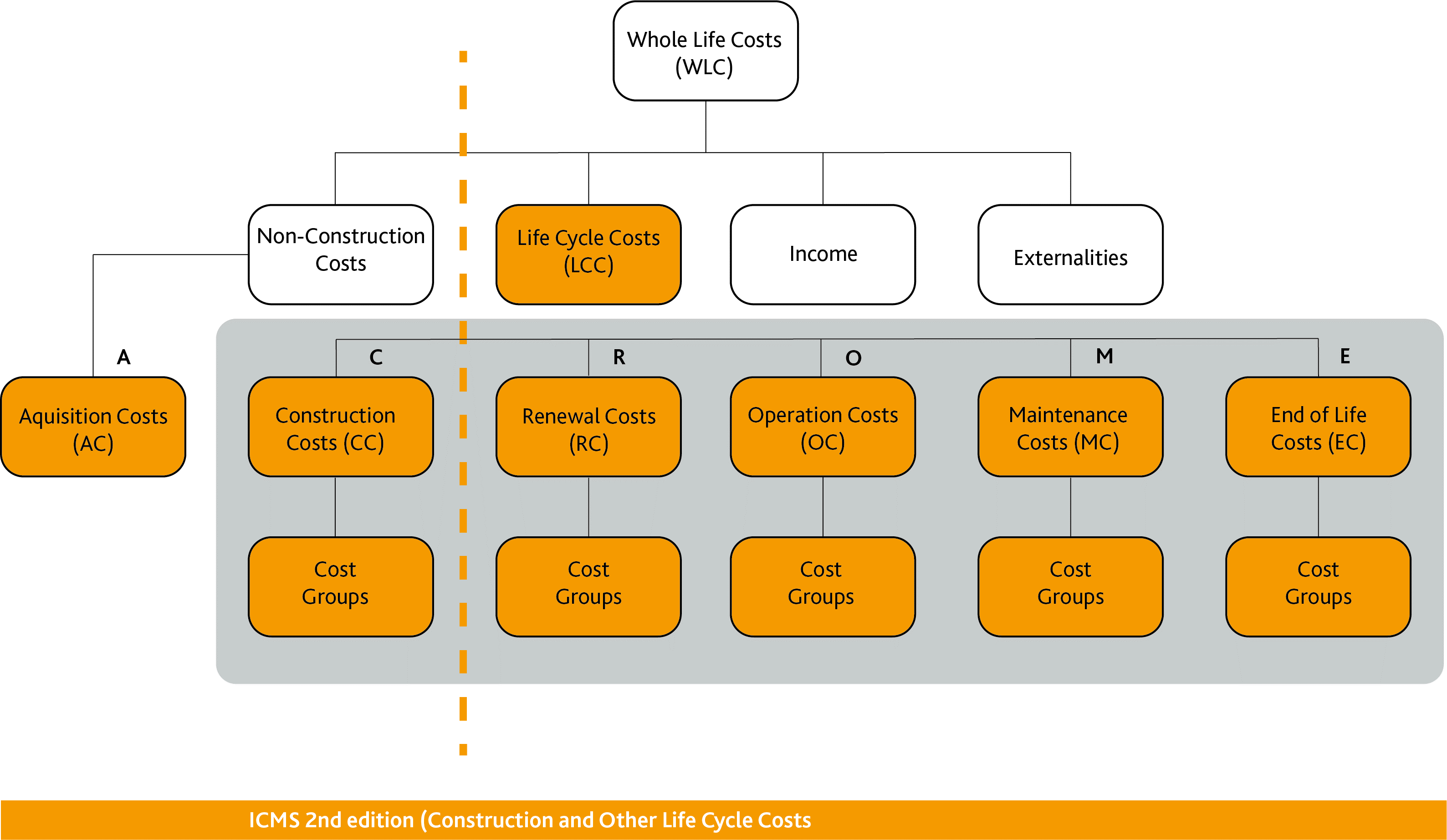

Relationship between ICMS, LCC and WLC

- 'Occupancy Costs' are considered as part of the 'Non-Construction Costs'.

- Compatible with ISO 15686-5:2017 Buildings and constructed assets – Service life planning – Part 5: Life-cycle costing.

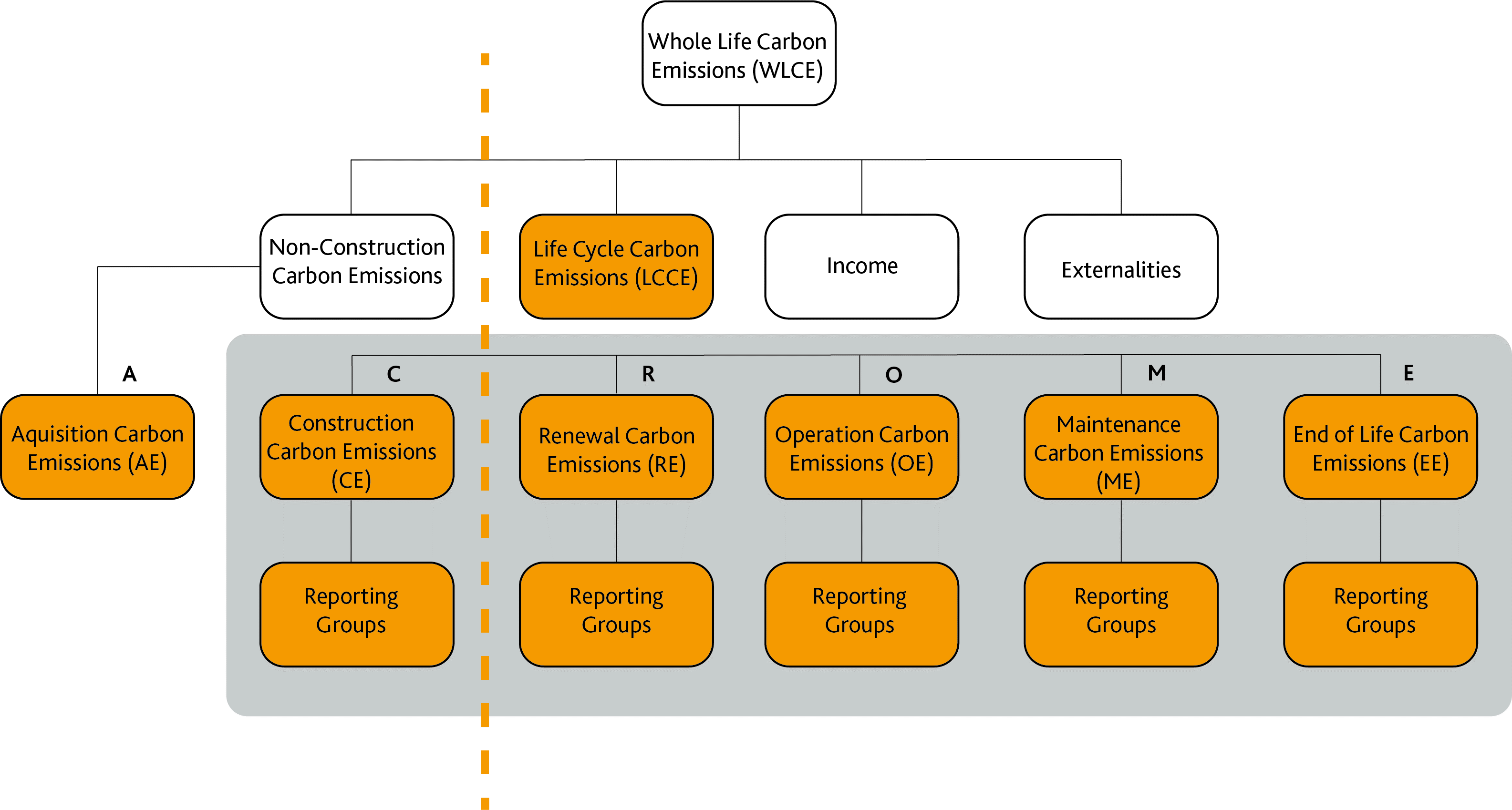

Carbon reporting framework

- The reporting structures for costs and carbon emissions are identical.

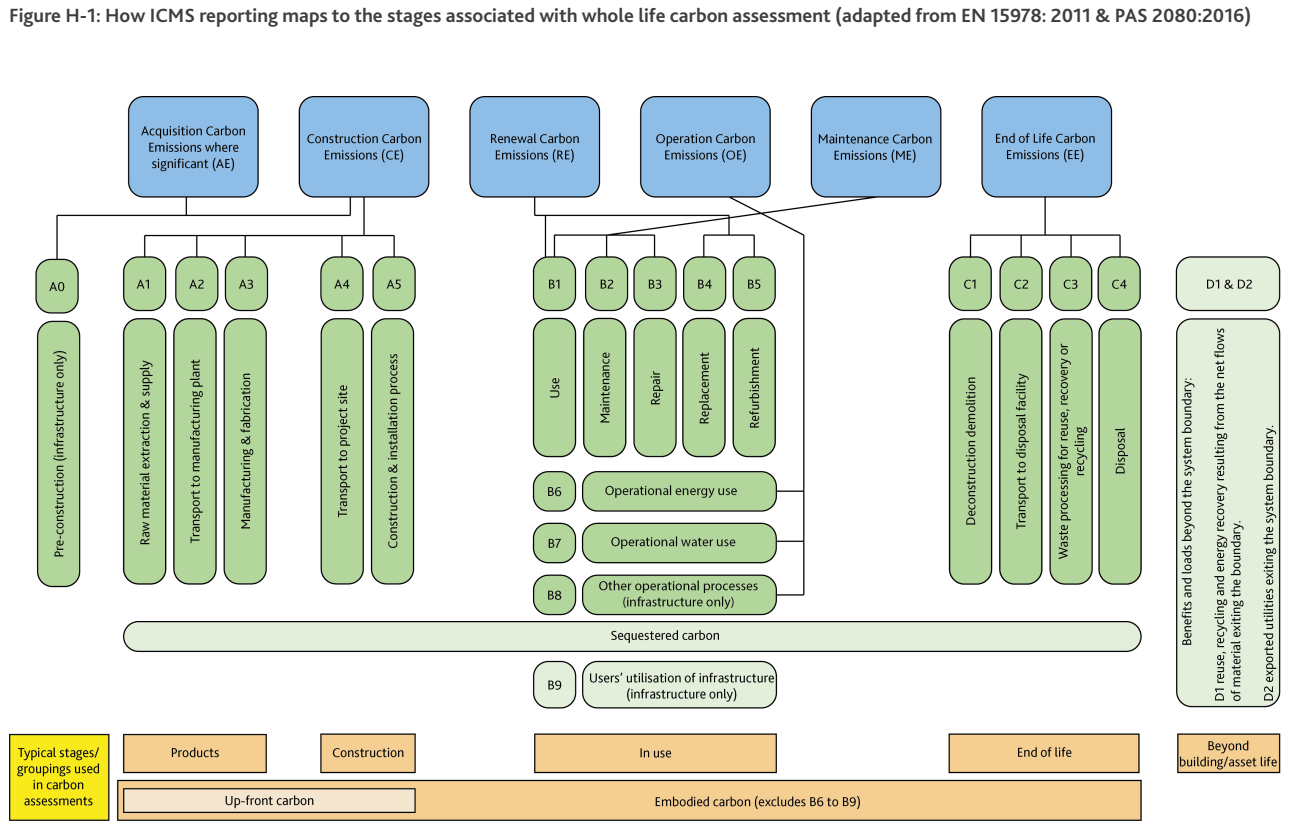

- Mapping to EN 15678: 2011 & PAS 2080:2026:

(Figure added, 29/10/2025)

Groups and Sub-Groups

Acquisition Groups and Sub-Groups

-

Carbon emissions are reported for Acquisition only if they are significant.

-

2-digit code for Groups and 3-digit code for Sub-Groups.

| Code | Description | |

| Group (Level 3) | ||

| Sub-Group (Level 4) | ||

| 1. | Acquisition Costs (AC) | Acquisition Carbon Emissions (AE) (each Sub-Group includes Risk Allowances | |

| 01. | Site acquisition | |

| 01.010 | Costs and premium required to procure site | |

| 01.020 | Compensation to existing occupiers | |

| 01.030 | Demolition, removal and modification of existing properties by way of payment to existing owners instead of carrying out physical work | |

| 01.040 | Contributions for the preservation of heritage, culture and environment | |

| 01.050 | Related fees to agents, lawyers, and the like | |

| 01.060 | Related taxes and statutory charges | |

| 02. | Administrative, finance, legal and marketing expenses | |

| 02.010 | Client’s general office overheads | |

| 02.020 | Client’s project-specific administrative expenses: | |

| • in-house project management and design team | ||

| • supporting project staff | ||

| • project office venue, furniture and equipment if not included in Constructor’s preliminaries | site overheads | ||

| • stores and workshops | ||

| • safety and insurances | ||

| • staff training | ||

| • accommodation and travelling expenses for in-house team and external parties | ||

| 02.030 | Interest and finance costs | |

| 02.040 | Legal expenses | |

| 02.050 | Accounting expenses | |

| 02.060 | Sales, leasing, marketing, advertising and promotional expenses | |

| 02.070 | Taxes and statutory charges related to sales and lease | |

| 02.080 | License and permit charges for operation and use | |

Construction | Renewal | Maintenance Groups and Sub-Groups: Buildings

-

Carbon emissions are reported at the Sub-Group level by exception.

-

2-digit code for Groups and 3-digit code for Sub-Groups.

| Code | Description | |

| Group (Level 3) | ||

| Sub-Group (Level 4) | ||

| 2. | Construction Costs (CC) | Construction Carbon Emissions (CE) | |

| 3. | Renewal Costs (RC) | Renewal Carbon Emissions (RE) | |

| 5. | Maintenance Costs (MC) | Maintenance Carbon Emissions (ME | |

| (CC | CE, RC | RE, and MC | ME share the same Groups below, so far as applicable. Those separated by ‘ | ’ in [ ] are respective alternative terms.) | ||

| 01. | Demolition, site preparation and formation | |

| 01.010 | Site survey and ground investigation | |

| 01.020 | Environmental treatment | |

| 01.030 | Sampling of hazardous or useful materials or conditions | |

| 01.040 | Temporary fencing | |

| 01.050 | Demolition of existing buildings and support to adjacent structures | |

| 01.060 | Site surface clearance (clearing, grubbing, topsoil stripping, tree felling, minor earthwork, removal) | |

| 01.070 | Tree transplant | |

| 01.080 | Site formation and slope treatment | |

| 01.090 | Temporary surface drainage and dewatering | |

| 01.100 | Temporary protection, diversion and relocation of public utilities | |

| 01.110 | Erosion control | |

| 02. | Substructure | |

| 02.010 | Foundation piling and underpinning: | |

| • mobilisation and demobilisation | ||

| • trial piles and caisson | ||

| • permanent piles and caisson | ||

| • pile and caisson testing | ||

| • underpinning | ||

| 02.020 | Foundations up to top of lowest floor slabs: | |

| • excavation and disposal | ||

| • lateral supports | ||

| • raft footings, pile caps, column bases, wall footings, strap beams, tie beams | ||

| • substructure walls and columns | ||

| • lowest floor slabs and beams (excluding and beyond basement bottom slabs) | ||

| • lift pits | ||

| • composite or prefabricated work | ||

| 02.030 | Basement sides and bottom: | |

| • excavation and disposal | ||

| • lateral supports | ||

| • bottom slabs and blinding | ||

| • sides | ||

| • vertical waterproof tanking, drainage blanket, drains and skin wall | ||

| • horizontal waterproof tanking, drainage blanket, drains and topping slab | ||

| • insulation | ||

| • lift pits, sump pits, sleeves | ||

| • composite or prefabricated work | ||

| 03. | Structure | |

| 03.010 | Structural removal and alterations | |

| 03.020 | Basement suspended floors (up to top of ground floor slabs): | |

| • structural walls and columns | ||

| • beams and slabs | ||

| • staircases | ||

| 03.030 | Frames and slabs (above top of ground floor slabs): | |

| • structural walls and columns | ||

| • upper floor beams and slabs | ||

| • roof beams and slabs | ||

| • staircases | ||

| • fireproofing to steel structure | ||

| 03.040 | Tanks, pools, sundries | |

| 03.050 | Composite or prefabricated work | |

| 04. | Architectural works | Non-structural works | |

| 04.010 | Non-structural removal and alterations | |

| 04.020 | External elevations: | |

| • non-structural external walls and features | ||

| • external wall finishes except cladding | ||

| • facade cladding and curtain walls | ||

| • external windows | ||

| • external doors | ||

| • external shop fronts | ||

| • roller shutters and fire shutters | ||

| 04.030 | Roof finishes, skylights and landscaping (including waterproofing and insulation): | |

| • roof finishes | ||

| • skylights | ||

| • other roof features | ||

| • roof landscaping (hard and soft) | ||

| 04.040 | Internal divisions: | |

| • non-structural internal walls and partitions | ||

| • shop fronts | ||

| • toilet cubicles | ||

| • moveable partitions | ||

| • cold rooms | ||

| • internal doors | ||

| • internal windows | ||

| • roller shutters and fire shutters | ||

| • sundry concrete work | ||

| 04.050 | Fittings and sundries: | |

| • balustrades, railings and handrails | ||

| • staircases and catwalk not forming part of the structure, cat ladders | ||

| • cabinets, cupboards, shelves, counters, benches, notice boards, blackboards | ||

| • exit signs, directory signs | ||

| • window and door dressings | ||

| • decorative features | ||

| • interior landscaping | ||

| • access panels, fire service cabinets | ||

| • sundries | ||

| 04.060 | Finishes under cover: | |

| • floor finishes (internal and external) | ||

| • internal wall finishes and cladding | ||

| • ceiling finishes and false ceilings (internal or external) | ||

| 04.070 | Builder’s work in connection with services: | |

| • plinth, bases | ||

| • fire-proofing enclosure | ||

| • hoisting beams, lift pit separation screens, lift shaft separator beams | ||

| • suspended manholes | ||

| • cable trenches, trench covers | ||

| • sleeves, openings and the like not allowed for in ‘Fittings and sundries’ | ||

| 04.080 | Composite or prefabricated work | |

| 05. | Services and equipment | |

| 05.010 | Heating, ventilating and air-conditioning systems/air conditioners: | |

| • seawater system | ||

| • cooling water system | ||

| • chilled water system | ||

| • heating water system | ||

| • steam and condensate system | ||

| • fuel oil system | ||

| • water treatment | ||

| • air handling and distribution system | ||

| • condensate drain system | ||

| • unitary air-conditioning system | ||

| • mechanical ventilation system | ||

| • kitchen ventilation system | ||

| • fume and smoke extraction system | ||

| • anaesthetic gas-extraction system | ||

| • window and split-type air conditioners | ||

| • air-curtains | ||

| • fans | ||

| • related electrical and control systems | ||

| • submissions, testing and commissioning | ||

| 05.020 | Electrical services: | |

| • high-voltage transformers and switchboards | ||

| • incoming mains, low-voltage transformers and switchboards | ||

| • mains and submains | ||

| • standby system | ||

| • lighting and power | ||

| • uninterruptible power supply | ||

| • electric underfloor heating | ||

| • local electrical heating units | ||

| • earthing/lightning protection and bonding | ||

| • submissions, testing and commissioning | ||

| 05.030 | Fitting out lighting fittings | |

| 05.040 | Extra low voltage electrical services: | |

| • information and communications technology system | ||

| • staff paging/location | ||

| • public address system | ||

| • building automation | ||

| • security and alarm | ||

| • close circuit television | ||

| • communal aerial broadcast distribution and the like | ||

| • submissions, testing and commissioning | ||

| 05.050 | Water supply and drainage above ground or inside basement: | |

| • cold water supply | ||

| • hot water supply | ||

| • flushing water supply | ||

| • grey water supply | ||

| • cleansing water supply | ||

| • irrigation water supply | ||

| • rainwater disposal | ||

| • soil and waste disposal | ||

| • planter drainage disposal | ||

| • kitchen drainage disposal | ||

| • related electrical and control systems | ||

| • submissions, testing and commissioning | ||

| 05.060 | Supply of sanitary fittings and fixtures (installation included in ‘Water supply and above ground drainage’ unless not separable from costs of ‘Fittings and sundries’) | |

| 05.070 | Disposal systems: | |

| • refuse | ||

| • laboratory waste | ||

| • industrial waste | ||

| • incinerator | ||

| • submissions, testing and commissioning | ||

| 05.080 | Fire services: | |

| • fire hydrant and hose reel system | ||

| • wet risers | ||

| • sprinkler system | ||

| • deluge system | ||

| • gaseous extinguishing system | ||

| • foam extinguishing system | ||

| • audio/visual advisory system | ||

| • automatic fire alarm and detection system | ||

| • portable hand-operated appliances and sundries | ||

| • related electrical and control systems | ||

| • submissions, testing and commissioning | ||

| 05.090 | Gas services: | |

| • coal gas | ||

| • natural gas | ||

| • liquid petroleum gas | ||

| • medical gas/laboratory gas | ||

| • industrial gas/compressed air/instrument air | ||

| • vacuum | ||

| • steam | ||

| • submissions, testing and commissioning | ||

| 05.100 | Movement systems: | |

| • lifts | elevators | ||

| • platform lifts | ||

| • escalators | ||

| • travellators | moving walkways | ||

| • conveyors | ||

| • submissions, testing and commissioning | ||

| 05.110 | Gondolas | |

| 05.120 | Turntables | |

| 05.130 | Generators | |

| 05.140 | Energy-saving features | |

| 05.150 | Water and wastewater treatment equipment | |

| 05.160 | Fountains, pools and filtration plant | |

| 05.170 | Powered building signage | |

| 05.175 | Audio/visual entertainment system | |

| 05.180 | Kitchen equipment | |

| 05.190 | Cold room equipment | |

| 05.200 | Laboratory equipment | |

| 05.210 | Medical equipment | |

| 05.220 | Hotel equipment | |

| 05.230 | Car park or entrances access control | |

| 05.240 | Domestic appliances | |

| 05.250 | Other specialist services | |

| 05.260 | Builder’s profit and attendance on services | |

| 06. | Surface and underground drainage | |

| 06.010 | Surface water drainage | |

| 06.020 | Storm water drainage | |

| 06.030 | Foul and wastewater drainage | |

| 06.040 | Drainage disconnections and connections | |

| 06.050 | CCTV inspection of existing or new drains | |

| 06.060 | Buried Process Pipe | |

| 07. | External and ancillary works | |

| 07.010 | Permanent retaining structures | |

| 07.020 | Site enclosures and divisions | |

| 07.030 | Ancillary structures | |

| 07.040 | Roads and paving | |

| 07.050 | Landscaping (hard and soft) | |

| 07.060 | Fittings and equipment | |

| 07.070 | External services: | |

| • water supply | ||

| • gas supply | ||

| • power supply | ||

| • communications supply | ||

| • external lighting | ||

| • utility disconnections and connections | ||

| 08. | Preliminaries | Constructors’ site overheads | general requirements | |

| 08.010 | Construction management including site management staff and support labour | |

| 08.020 | Temporary access roads and storage areas, traffic management and diversion (at the Constructors’ discretion) | |

| 08.030 | Temporary site fencing and securities | |

| 08.040 | Commonly shared construction plant | |

| 08.050 | Commonly shared scaffolding | |

| 08.060 | Other temporary facilities and services | |

| 08.070 | Technology and communications: telephone, broadband, hardware, software | |

| 08.080 | Constructor’s submissions, reports and as-built documentation | |

| 08.090 | Quality monitoring, recording and inspections | |

| 08.100 | Safety, health and environmental management | |

| 08.110 | Insurances, bonds, guarantees and warranties | |

| 08.120 | Constructor’s statutory fees and charges | |

| 08.130 | Testing and commissioning | |

| 08.140 | Extras for extreme climatic or working conditions (if priced separately according to local pricing practice) | |

| 09. | Risk Allowances | |

| 09.010 | Design development allowance | |

| 09.020 | Construction contingencies | |

| 09.030 | Price Level Adjustments: | |

| • until tendering | ||

| • during construction | ||

| 09.040 | Exchange rate fluctuation adjustments | |

| 10. | Taxes and Levies | |

| 10.010 | Paid by the Constructor | |

| 10.020 | Paid by the Client in relation to the construction contract payments | |

| 11. | Work and utilities off-site (including related risk allowances, taxes and levies) | |

| 11.010 | Connections to, diversion of and capacity enhancement of public utility mains or sources off-site up to mains connections on-site: | |

| • electricity | ||

| • transformers | ||

| • water | ||

| • sewer | ||

| • gas | ||

| • telecommunications | ||

| 11.020 | Public access roads and footpaths | |

| 12. | Production and loose furniture, fittings and equipment (including related risk allowances, taxes and levies) | |

| 12.010 | Loose production, process and operating furniture, fittings and equipment not normally provided before completion of construction | |

| 12.020 | Fixed production, process and operating furniture, fittings and equipment installed before completion of construction | |

| • production (including process and operating) equipment (including furniture and fittings) | ||

| • related instrument and control systems | ||

| • related safety and environmental control systems | ||

| • related storage and transfer systems | ||

| • services and equipment as described in Group 05 but dedicated to serve production equipment | ||

| • surface and underground drainage as described in Group 06 but dedicated to serve production equipment | ||

| • testing and commissioning | ||

| • licences and certifications to start production | ||

| • risks allowances | ||

| • taxes and levies | ||

| 13. | Construction-related consultants and supervision (including related risk allowances, taxes and levies) | |

| 13.010 | Consultants’ fees and reimbursable: | |

| • architects (architectural, landscape, interior design, technical, etc.) | ||

| • engineers (geotechnical, civil, structural, mechanical, electrical and plumbing, technical, etc.) | ||

| • project managers | ||

| • surveyors (quantity surveying, land surveying, building surveying, cost engineering, etc.) | ||

| • specialist consultants (environmental, traffic, acoustic, facade, BIM, etc.) | ||

| • value management studies | ||

| 13.020 | Charges and levies payable to statutory bodies or their appointed agencies (in connection with planning, design, tender and contract approvals, supervision and acceptance inspections) | |

| 13.030 | Site supervision charges (including their accommodation and travels) | |

| 13.040 | Payments to testing authorities or laboratories | |

Construction | Renewal | Maintenance Groups and Sub-Groups - Civil Engineering Works

-

Carbon emissions are reported by exception at the Sub-Group level.

-

2-digit code for Groups and 3-digit code for Sub-Groups.

| Code | Description | |

| Group (Level 3) | ||

| Sub-Group (Level 4) | ||

| 2. | Construction (CC | CE) | |

| 3. | Renewal (RC | RE) | |

| 5. | Maintenance (MC | ME) | |

| (CC | CE, RC | RE, and MC | ME share the same Groups below, so far as applicable. Those separated by ‘|’ in [ ] are alternative terms for respective Groups) | ||

| 01. | Demolition, site preparation and formation | |

| 01.010 | Site survey and ground investigation | |

| 01.020 | Environmental treatment | |

| 01.030 | Sampling of hazardous or useful materials or conditions | |

| 01.040 | Temporary fencing | |

| 01.050 | Demolition of existing structures and support to adjacent structures | |

| 01.060 | Site surface clearance (clearing, grubbing, topsoil stripping, tree felling, minor earthwork, removal) | |

| 01.070 | Tree transplant | |

| 01.080 | General site formation and slope treatment (including embankments / cuttings required by more than one Sub-Project) | |

| 01.090 | Temporary surface drainage and dewatering | |

| 01.100 | Temporary access roads and storage areas (provided under an advance contract) | |

| 01.110 | Temporary protection, diversion and relocation of public utilities | |

| 01.120 | Erosion control | |

| 01.600 | Water surface development (including common facilities and services, and dredge spoil recovery area) | |

| 01.610 | Dredge spoil recovery area | |

| 01.620 | Hydrographic / bathymetry surveys | |

| 01.630 | Water quality monitoring | |

| 01.640 | Excavation (of soft silt, peat, sands, gravels, clay, rock, etc., including mobilisation and demobilisation of excavators, blasting, transportation, disposal, reclamation, compaction and monitoring) | |

| 01.650 | Dredging (of soft silt, peat, sands, gravels, clay, rock, etc., including mobilisation and demobilisation of dredgers and barges, blasting, transportation, disposal, reclamation, compaction and monitoring) | |

| 01.660 | Special disposal and treatment of contaminated sediment | |

| 01.670 | Reclamation or filling (with imported rock, concrete, or other hard materials) | |

| 01.680 | Reclamation or filling (with dredged materials) | |

| 01.690 | Surcharging or consolidation of lands and monitoring of settlement | |

| 01.700 | Habitat protection systems | |

| 02. | Substructure | |

| 02.010 | Embankments / cuttings (specifically required for the Project or Sub-Project) | |

| 02.020 | Excavation, disposal and lateral supports (specifically to receive any substructure construction but excluding general site formation and slope treatment) | |

| 02.025 | Geotextile or other geomembranes | |

| 02.030 | Trenching / common trenches | |

| 02.040 | Drilling / boring | |

| 02.050 | Piling / anchoring | |

| 02.060 | Structural backfill / ground remediation | |

| 02.070 | Earth-retaining structures | |

| 02.080 | Abutments / wing walls | |

| 02.090 | Pile caps / footings / bases (nearest to the ground level or water level if constructed in water) | |

| 02.100 | Sub-base to pavements and rail track structures | |

| 02.110 | Bases to supports for tanks, pipes, well heads and the like | |

| 02.120 | Beds and surrounds to underground pipes | |

| 02.600 | Pile retaining walls (combi walls / H-pile walls / secant piled walls | |

| • sheet piled walls | ||

| • gravity quay walls | ||

| • relieving platforms | ||

| • pile supported structures | ||

| • special types | ||

| 02.610 | Diaphragm walls | |

| 02.620 | Quays / docks / wharfs / moorings / piers /dry dock structure foundations | |

| 02.630 | Marine anchor systems | |

| 02.640 | Mooring dolphins | |

| 02.650 | Breakwaters | |

| • cores | ||

| • primary armour (interlocking units) | ||

| • secondary armour | ||

| 02.660 | Rock revetments / gabions | |

| 02.670 | Cofferdams | |

| 02.680 | Bank protection | |

| 03. | Structure | |

| 03.010 | Piers and towers | |

| 03.020 | Suspension system | |

| 03.030 | Decks | |

| 03.040 | Bearings | |

| 03.050 | Tunnel lining | |

| 03.060 | Roads / track bases | |

| 03.070 | Pavements | |

| 03.080 | Service roads and approaches | |

| 03.090 | Parapets / edge treatment | |

| 03.100 | Main structures (in case of land formation and reclamation, referring to those of project types not separately reported as Sub-Projects) | |

| 03.105 | Service stations and houses for district utility services | |

| 03.110 | Tanks, rigs, storage containers and the like | |

| 03.120 | Supports for tanks, pipes and the like | |

| 03.130 | Civil pipework | |

| 03.140 | Valves and fittings | |

| 03.600 | Seawalls | |

| 03.610 | Lake and river lining | |

| 03.620 | Prefabricated marine structures – off-site fabrication | |

| 03.630 | Prefabricated marine structures – transport to site location | |

| 03.640 | Prefabricated marine structures – installation on site location | |

| 03.650 | Slipways / gangways / linkways | |

| 03.660 | Dock and lock gates | |

| 03.670 | Pontoons | |

| 03.680 | Coastal protection systems | |

| 03.690 | Deck / surface structures (ground bearing or suspended concrete slabs) | |

| 03.700 | Locks and guidance structures | |

| 03.710 | Revetments | |

| 03.720 | Flood defences | |

| 03.730 | Navigational aids | |

| 03.740 | Dry docks structures | |

| 03.750 | Weirs | |

| 03.760 | Aqueducts | |

| 04. | Non-structural works | |

| 04.010 | Non-structural removal and alterations | |

| 04.020 | Non-structural construction | |

| 04.030 | Running surface | |

| 04.040 | Signage, markings and the like | |

| 04.050 | Gantries and the like | |

| 04.060 | Safety facilities | |

| 04.070 | Barriers / rails and means of access | |

| 04.080 | Special equipment and fittings | |

| 04.090 | Interior landscaping | |

| 04.100 | Builders’ work in connection with services | |

| 05. | Services and equipment | |

| 05.005 | District heating, ventilating and cooling systems | |

| 05.010 | Mechanical systems | |

| 05.020 | Lighting systems | |

| 05.030 | Illuminations | |

| 05.040 | Low-voltage power supply | |

| 05.050 | Cables/cable trays | |

| 05.060 | Other electrical services | |

| 05.070 | Control systems and instrumentation | |

| • signalling systems | ||

| • telecommunications systems | ||

| 05.080 | Pipe racks / supports (localised) | |

| 05.090 | Water supply and drainage above ground or inside underground construction (localised) | |

| 05.100 | Refuse and waste disposal systems | |

| 05.110 | Fire services | |

| 05.115 | Gas services | |

| 05.120 | Movement systems: lifts / elevators / conveyors | |

| 05.600 | Boat lifts | |

| 05.610 | Cranes / rigs/ rails | |

| 05.620 | Under water / sea service pipe installation | |

| 05.630 | Under water / sea electrical / data cabling | |

| 06. | Surface and underground drainage | |

| 06.010 | Surface water drainage | |

| 06.020 | Storm water drainage | |

| 06.030 | Foul and waste water drainage | |

| 06.040 | Pumping systems | |

| 06.050 | Drainage connections | |

| 07. | External and ancillary works | |

| 07.010 | Site enclosures and divisions | |

| 07.020 | Ancillary structures | |

| 07.030 | Roads and paving (not amounting to a Sub-Project) | |

| 07.040 | Landscaping (hard and soft) | |

| 07.050 | Fittings and equipment | |

| 08. | Preliminaries | Constructors’ site overheads | general requirements | |

| 08.010 | Construction management including site management staff and support labour | |

| 08.020 | Temporary access roads and storage areas, traffic management and diversion (at the Constructors’ discretion) | |

| 08.025 | Temporary concrete batching yard, precast concrete casting yard | |

| 08.030 | Temporary site fencing and securities | |

| 08.040 | Commonly shared construction plant | |

| 08.045 | Marine plant and equipment (e.g. ships / barges / vessels, floating cranes, dredgers, floating drill rigs, cofferdams, caissons, etc.) | |

| 08.050 | Commonly shared scaffolding | |

| 08.055 | Workpeople living accommodation | |

| 08.060 | Other temporary facilities and services | |

| 08.065 | Mobilisation and demobilisation where significant and not elsewhere reported | |

| 08.070 | Technology and communications: telephone, broadband, hardware, software | |

| 08.080 | Constructor’s submissions, reports and as-built documentation | |

| 08.090 | Quality monitoring, recording and inspections | |

| 08.100 | Safety, health and environmental management | |

| 08.110 | Insurances, bonds, guarantees and warranties | |

| 08.120 | Constructor’s statutory fees and charges | |

| 08.130 | Testing and commissioning | |

| 08.140 | Extras for extreme climatic or working conditions (if priced separately according to local pricing practice) | |

| 09. | Risk Allowances | |

| 09.010 | Design development allowance | |

| 09.020 | Construction contingencies | |

| 09.030 | Price level adjustments | |

| • until tendering | ||

| • during construction | ||

| 09.040 | Exchange rate fluctuation adjustments | |

| 010. | Taxes and Levies | |

| 010.010 | Paid by the Constructors | |

| 010.020 | Paid by the Client in relation to the construction contract payments | |

| 11. | Work and utilities off-site (including related risk allowances, taxes and levies) | |

| 11.010 | Connections to, diversion of and capacity enhancement of public utility mains or sources off-site up to mains connections on-site: | |

| • electricity | ||

| • transformers | ||

| • water | ||

| • sewer | ||

| • gas | ||

| • telecommunications | ||

| 11.020 | Public access roads and footpaths | |

| 12. | Production and loose furniture, fittings and equipment (including related risk allowances, taxes and levies) | |

| 12.010 | Loose production, process and operating furniture, fittings and equipment not normally provided before completion of construction | |

| 12.020 | Fixed production, process and operating furniture, fittings and equipment installed before completion of construction | |

| 13. | Construction-related consultants and supervision (including related risk allowances, taxes and levies) | |

| 13.010 | Consultants’ fees and reimbursable: | |

| • architects (architectural, landscape, interior design, technical, etc.) | ||

| • engineers (geotechnical, civil, structural, mechanical, electrical and plumbing, technical, etc.) | ||

| • project managers | ||

| • surveyors (quantity surveying, land surveying, building surveying, cost engineering, etc.) | ||

| • specialist consultants (environmental, traffic, acoustic, facade, BIM, etc.) | ||

| • value management studies | ||

| 13.020 | Charges and levies payable to statutory bodies or their appointed agencies (in connection with planning, design, tender and contract approvals, supervision and acceptance inspections) | |

| 13.030 | Site supervision charges (including their accommodation and travels) | |

| 13.040 | Payments to testing authorities or laboratories | |

Operation Groups and Sub-Groups

- Carbon emissions are reported by exception at the Sub-Group level.

- 2-digit code for Groups and 3-digit code for Sub-Groups.

| Code | Description | |

| Group (Level 3) | ||

| Sub-Group (Level 4) | ||

| 4. | Operation Costs (OC) | Operation Carbon Emissions (OE) | |

| 01. | Cleaning | |

| 01.010 | External cleaning (routine and periodic) | |

| 01.020 | Internal cleaning (routine and periodic) | |

| 01.030 | Specialist cleaning (define type) | |

| 02. | Utilities | |

| 02.010 | Fuel (state type: gas / electricity / oil and other fuel sources) | |

| 02.020 | Water, drainage and sewerage | |

| 03. | Waste management | |

| 03.010 | Waste collection and disposal | |

| 03.020 | Recycling and savage | |

| 04. | Security | |

| 04.010 | Physical security | |

| 04.020 | Remote monitoring | |

| 05. | Information and communications technology | |

| 05.010 | Communication systems | |

| 05.020 | Specialist technology / sensors | |

| 06. | Operators’ site overheads | general requirements | |

| 06.010 | Administration | |

| 06.020 | Property insurance | |

| 07. | Risk Allowances | |

| 07.010 | Operation related (user definable) | |

| 07.020 | Contractual obligations | |

| 08. | Taxes and Levies | |

| 08.010 | Taxes | |

| 08.020 | Levies | |

End of Life Groups and Sub-Groups

- Carbon emissions are reported by exception at the Sub-Group level.

- 2-digit code for Groups and 3-digit code for Sub-Groups.

| Code | Description | |

| Group (Level 3) | ||

| Sub-Group (Level 4) | ||

| 6 | End of Life Costs (EC) | End of Life Carbon Emissions (EE) | |

| 01. | Disposal inspection | |

| 01.010 | Dilapidations report | |

| 01.020 | Contractual hand-back obligations | |

| 02. | Decommissioning and decontamination | |

| 02.010 | Shutdowns and decommissioning | |

| 02.020 | Decontamination | |

| 03. | Demolition, reclamation and salvage | |

| 03.010 | Demolition | |

| 03.020 | Reclamation | |

| 03.030 | Salvage | |

| 04. | Reinstatement | |

| 04.010 | Agreed reinstatement works | |

| 04.020 | Contractual obligations | |

| 05. | Constructors’ site overheads | general requirements | |

| 05.010 | Administration | |

| 05.020 | Overheads (project specific) | |

| 06. | Risk Allowances | |

| 06.010 | End of life specific (user definable) | |

| 06.020 | Abnormal risks (user definable) | |

| 07. | Taxes and Levies | |

| 07.010 | Taxes | |

| 07.020 | Levies | |

| 07.030 | Credit for grants | |

Rationale for some classifications

Composite or prefabricated work

- There are items for ‘composite or prefabricated work’, but in principle their costs and/or carbon emissions are to be split into the relevant Groups and Sub-Groups as much as possible to facilitate analysis and comparison with non-composite or prefabricated work.

- Include in the ‘composite or prefabricated work’ only if the composite or prefabricated work integrates different construction components across different Groups and Sub-Groups serving the functions of more than one Sub-Group and is priced without further breakdown in the contract.

-

It is also possible to put all the composite or prefabricated work under a Sub-project showing the relevant Groups and Sub-Groups.

(item 3 added, 28/10/2025)

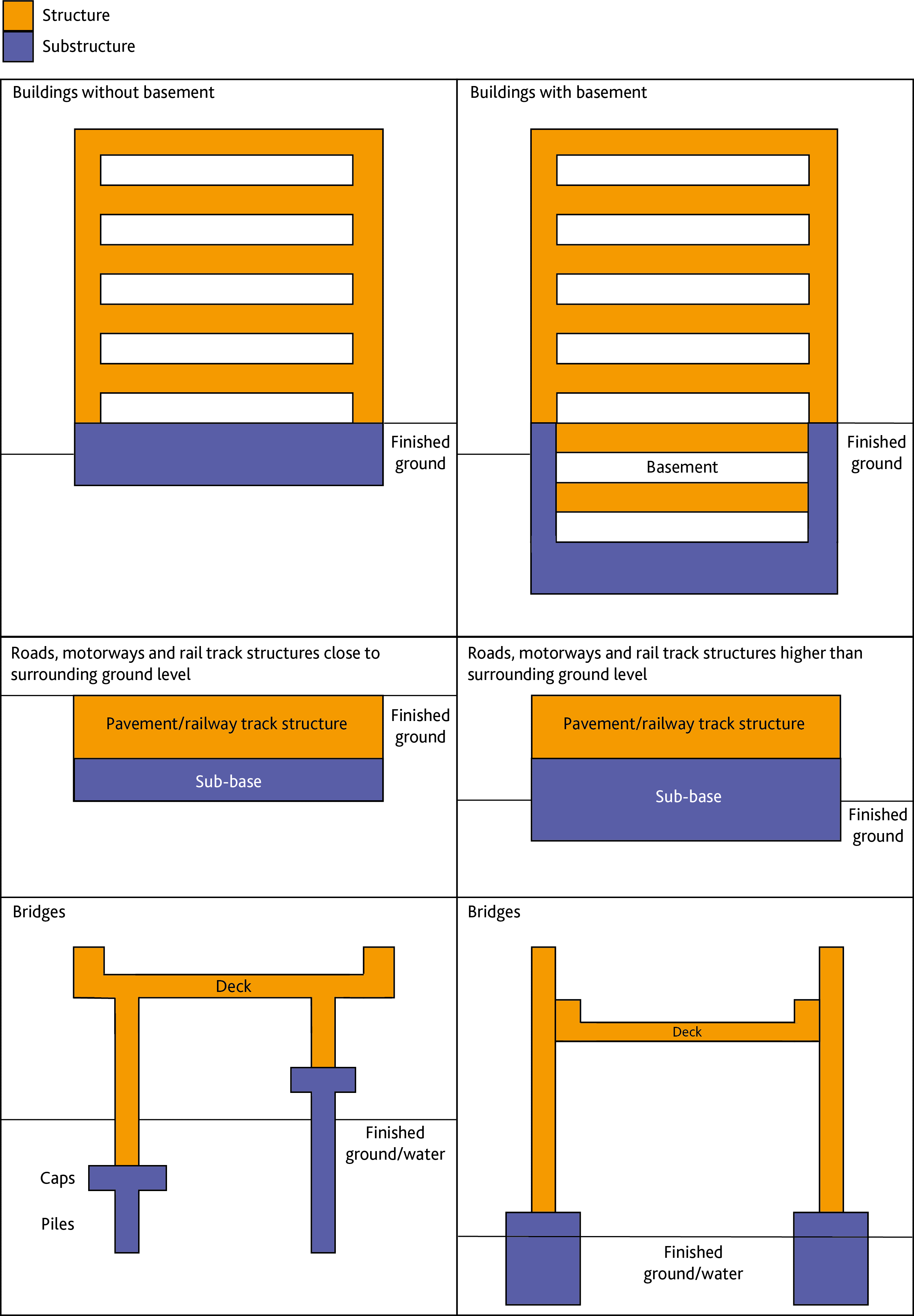

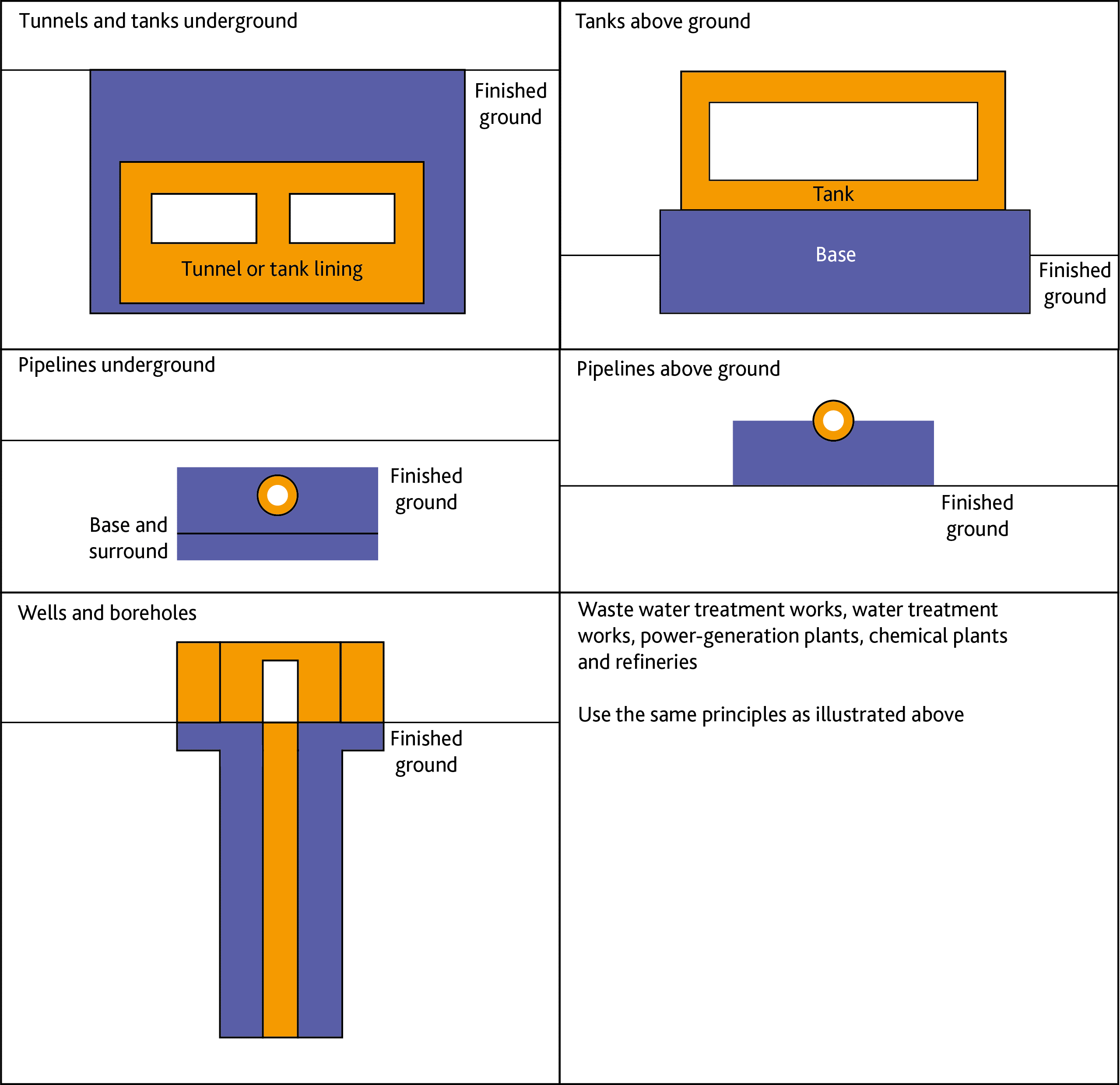

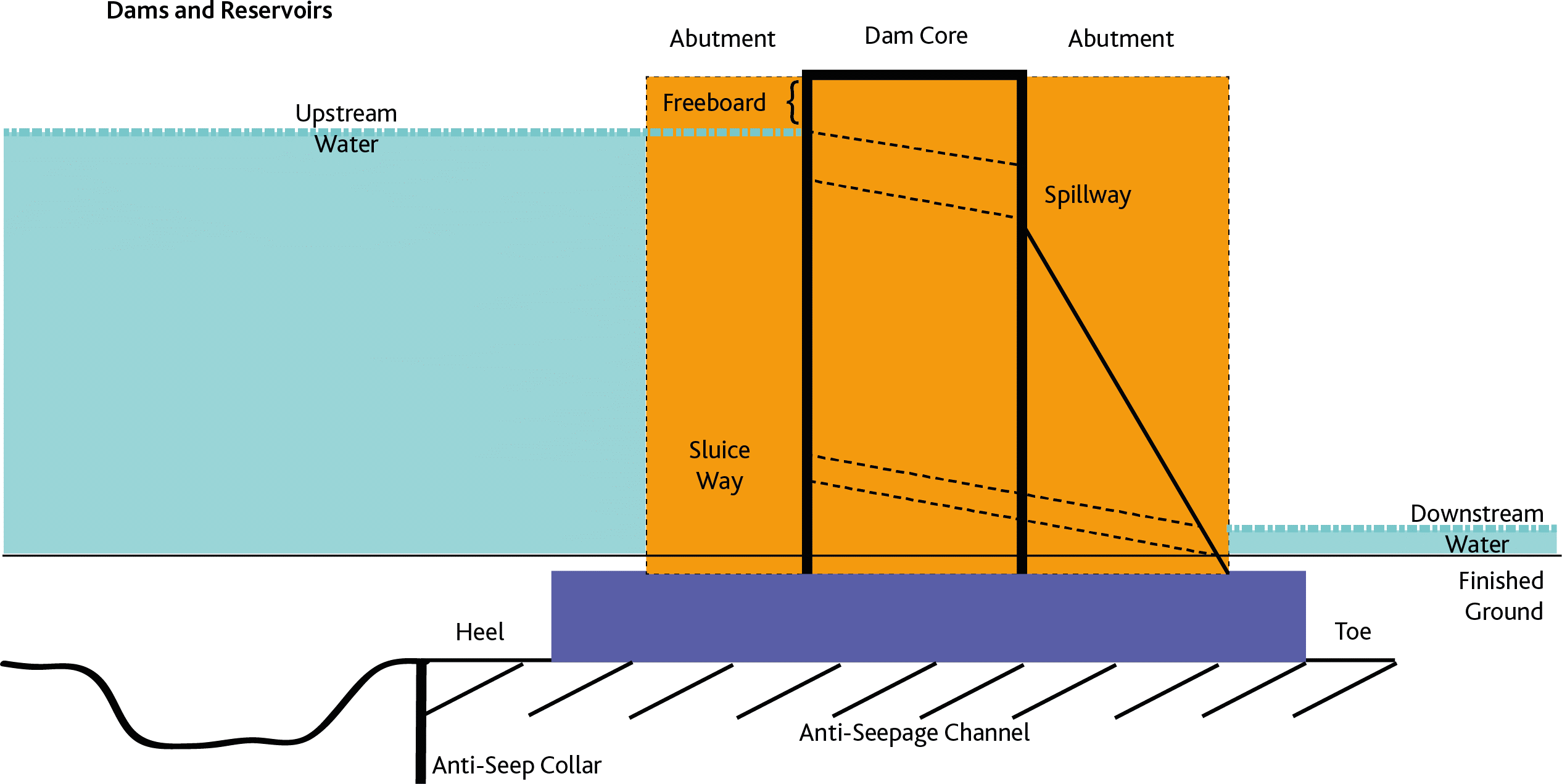

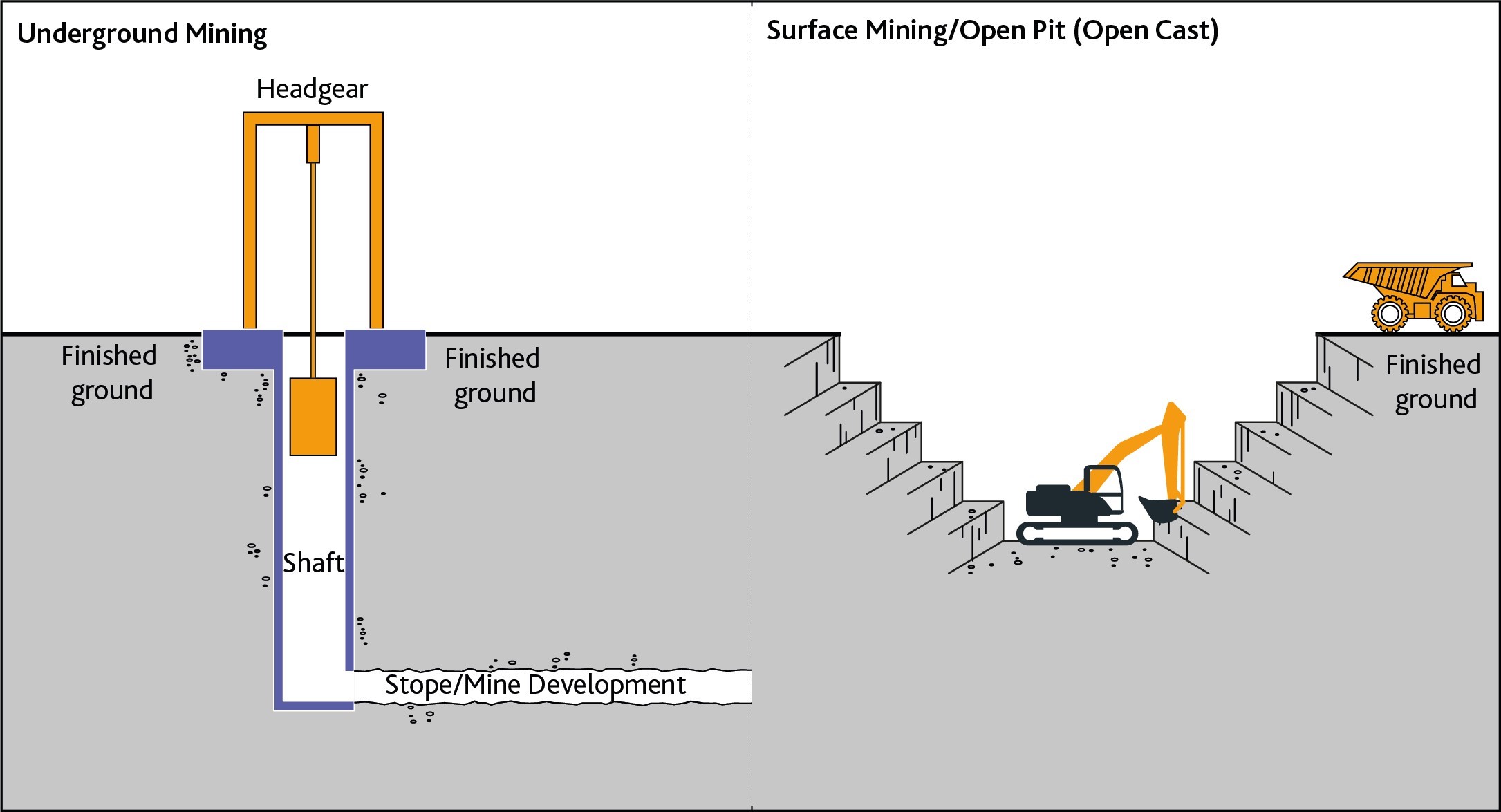

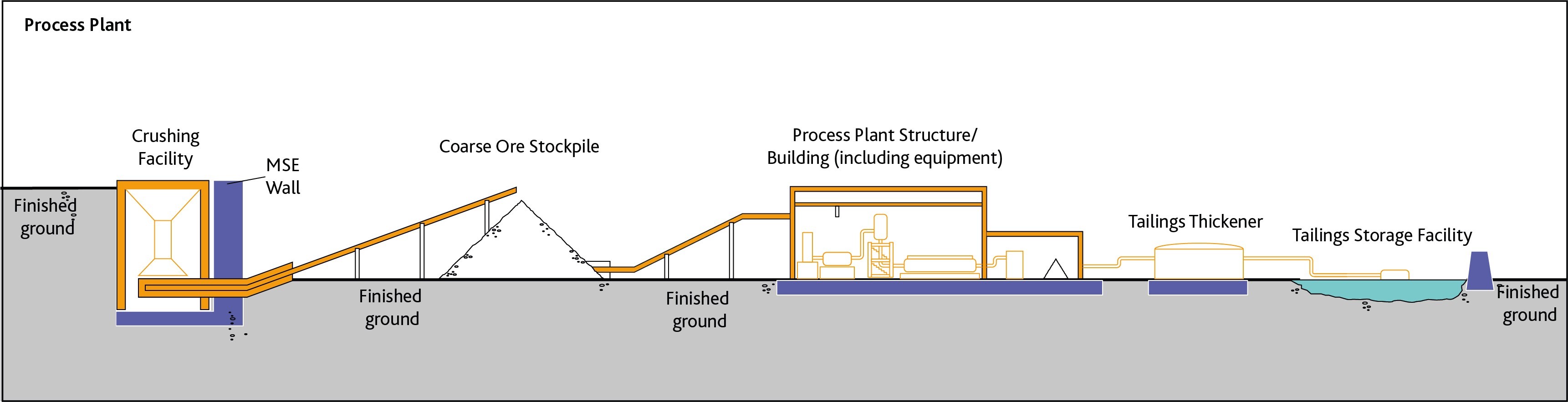

Substructure and Structure Delineation

- “Superstructure” is not used.

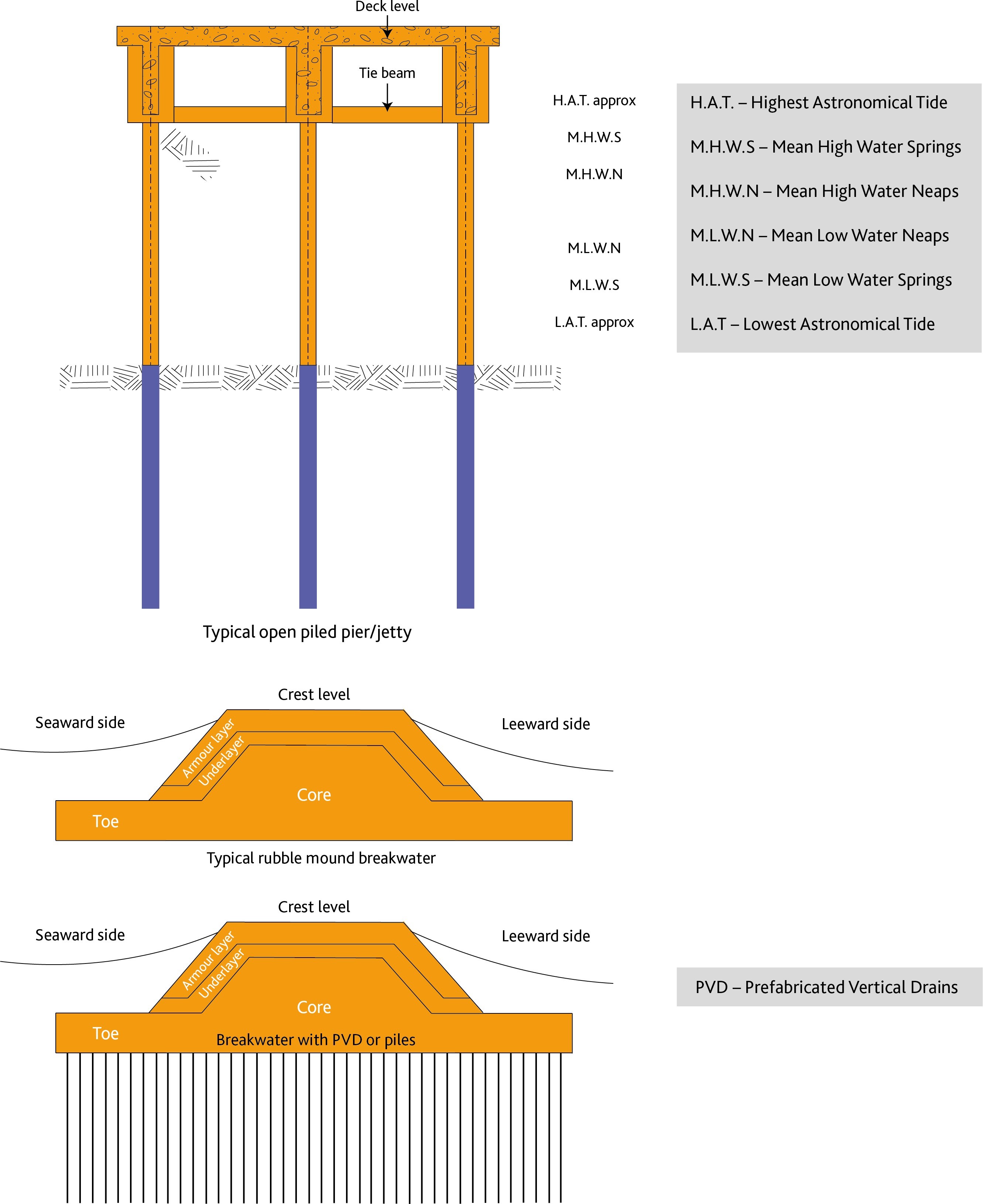

- The “Substructure” and “Structure” delineation for various project type is shown in the diagrams below.

- Why are they delineated into “Substructure” and “Structure”, not “Substructure” and “Superstructure”?

- Usually, substructure refers to the structure below the ground surface and superstructure refers to the structure above ground.

- However, as shown in the diagrams, many of the main structures for civil engineering works (such as roads, tunnels, tanks, pipelines, wells, boreholes, etc.) can be totally below the ground surface, if these main structures are classified as substructure, there would be nothing left to be reported for the superstructure.

- Therefore, ICMS classifies all the main structures as “Structure” whether or not they are underground or underwater, and classifies all structures supporting or encasing the main structures as “Substructure”.

Split of Basement for Buildings

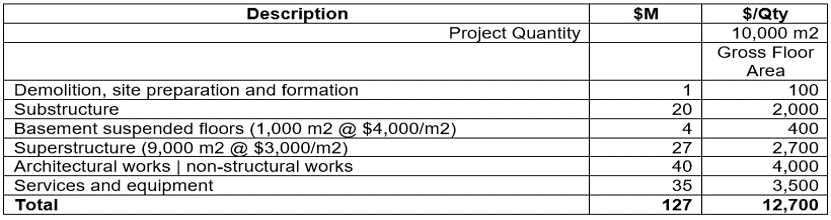

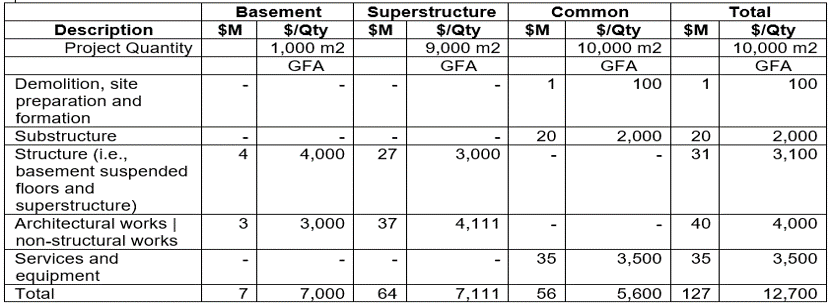

- The basement sides and bottom (shown in deep blue in the diagram below) are classified as an item (code [2|3|5].02.030.030) under the Substructure Group, while the basement suspended floors (shown in red box in the diagram below) are classified as a Sub-Group (code [2|3|5].03.020) under the Structure Cost Group.

- Why are the basement sides, bottom and suspended floors not grouped together as substructure or basement, like common language use? It is also usual for tender pricing to group the basement works under a section.

- Answers:

- The design of the basement sides and bottom do not vary in direct proportion to the total building floor area nor to the total basement floor area, and is highly dependent on the site conditions even for the same building design. The cost of the basement sides and bottom should therefore be reported separately from the cost of the basement suspended floors.

- If the basement suspended floors are reported separately from the superstructure, the “unit cost per total building floor area” of the basement suspended floors ($400/m2) and of the superstructure ($2,700/m2) as given in the high-level cost summary, as shown in the example below, would not be useful when one wants to roughly estimate how much a similar building of 12,000 m2 would cost. One would need to know the floor areas of the basement and the superstructure or their proportions, and use $4M and $27M for pro-rata calculations.

- While it may be easy to separate the architectural works | non-structural works into basement and superstructure, it would not be logical from the costing point of view to do a similar separation for services and equipment because it is often required to put main services and equipment serving the whole building in the basement, but allocating the costs of main services and equipment based on their locations would give a misleading unit cost per basement floor area and unit cost per superstructure floor area for further use.

- If the basement suspended floors and superstructure are grouped together, the unit cost per total building floor area ($400+2700/m2=$3,100/m2) as shown in the example above would then be more useful for quick pro-rata calculation and comparison. Furthermore, per their respective floor areas, the design of the basement suspended floors is generally heavier than that of the superstructure, but the former is exclusive of external structural walls, while the latter is inclusive. The two aspects can have an off-setting effect such that $4,000/m2 and $3,000/m2 in the above example can be closer to each other, and grouping together would be appropriate.

- ICMS is for high-level cost presentation for comparative benchmarking and option appraisal, etc. The above classification should make the unit costs more readily useful for such purposes. For tender pricing, users can choose to group the basement works in their preferred ways.

- If one wants to show the basement and superstructure costs separately in the cost report to match the sections in tender pricing, one can adopt the following presentation:

External structural walls as structural parts vs External elevations

- Some cost classifications classify external structural walls as part of the “External elevations” or as “External walls” whether above or below ground. Why does ICMS 2 not so classify but classify the external structural walls as structural parts?

- Answers:

- External structural walls serve two functions, one taking structural loading of the building, and the other enclosing the building.

- It is considered difficult to separate the external structural walls (reinforcement in particular) at “A” below from the rest of the core structure, and it would give an incomplete structural cost if both the external structural walls at “A” and “B” below are grouped under “External elevations”, say, when answering the question “what would be the structural cost without non-structural parts?”.

- For construction, the structural parts should come first before the non-structural parts are added on. Therefore, the external structural walls are classified as structural parts under:

- [2|3|5].02.030: Basement sides and bottom – sides

- [2|3|5].03.030: Structure – Frames and slabs – structural walls and columns

- For present day buildings, the design of the external structural walls above ground and that below ground can be very different, the walls are therefore separated as above.

Fitting out lighting fittings / Supply of sanitary fittings

- Lighting fittings (decorative) and sanitary fittings are usually chosen by the architects instead of the building services engineers, and their costs are not usually included in the cost estimates provided by the engineers, they are therefore separately as two Sub-Groups.

- However, since they are more related to Services and Equipment, they are therefore included as part of “Services and Equipment”.

Builder's profit and attendance on services

- Services and equipment are likely the subject of nominated sub-contracts on which the builders price profit and attendance separately. This Sub-Group is intended for such profit and attendance.

- The costs of other works should include profit and attendance.

Project Attributes and Values

- To enable consistent and concise evaluation and comparison between different Projects or different design schemes, ICMS provides a set of Project Attributes and Values describing the principal characteristics of each Project or Sub-Project.

- The Project Attributes are given under the following groups:

| Common | Each Project Type |

|

|

- Examples:

Project Quantities

- ICMS provides the following Project Quantities (physical or functional) such that the total costs can be expressed as unit cost per unit project quantity for comparison and benchmarking purposes.

| Projects | Project Quantities (Physical) | Project Quantities (Functional) |

| Buildings |

|

|

| Roads and motorways |

|

|

| Railways |

|

|

| Bridges |

|

|

| Tunnels |

|

|

| Wastewater treatment works |

|

|

| Water treatment works |

|

|

| Pipelines |

|

|

| Wells and boreholes |

|

|

| Power-generating plants |

|

|

| Chemical plants |

|

|

| Refineries |

|

|

| Refineries |

|

|

| Dams and reservoirs |

|

|

| Mines and quarries |

|

|

| Offshore structures |

|

|

| Nearshore works |

|

|

| Ports |

|

|

| Waterway works |

|

|

| Land formation and reclamation |

|

Examples of Using ICMS Classification to Prepare Different Kinds of Cost Estimates

(Section added, 28/10/2025)

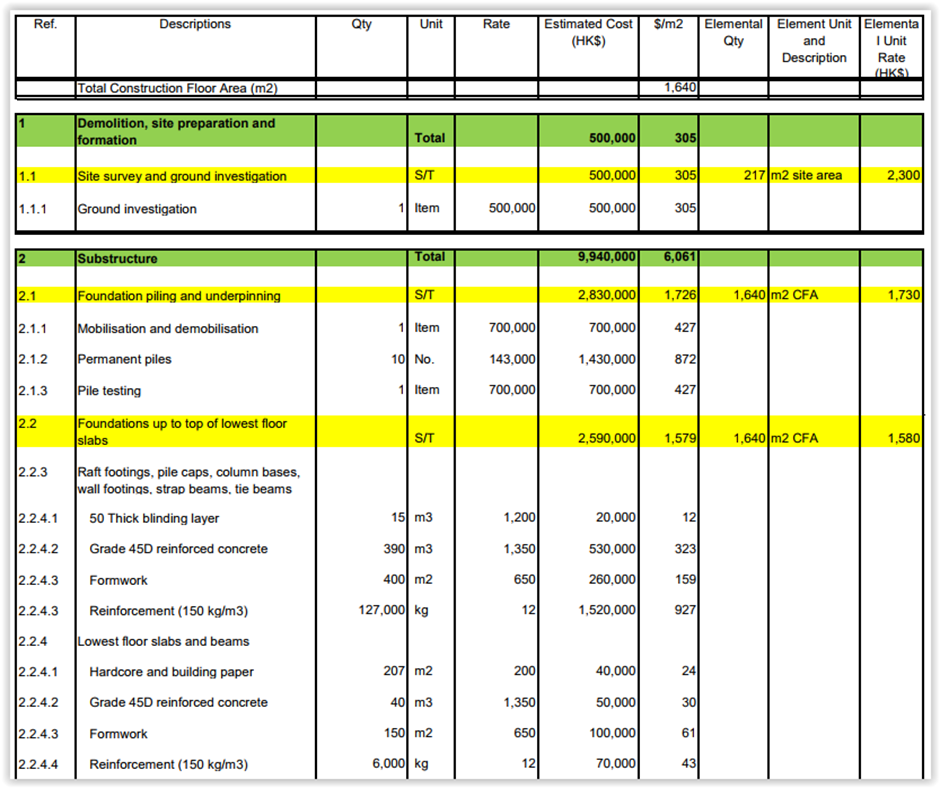

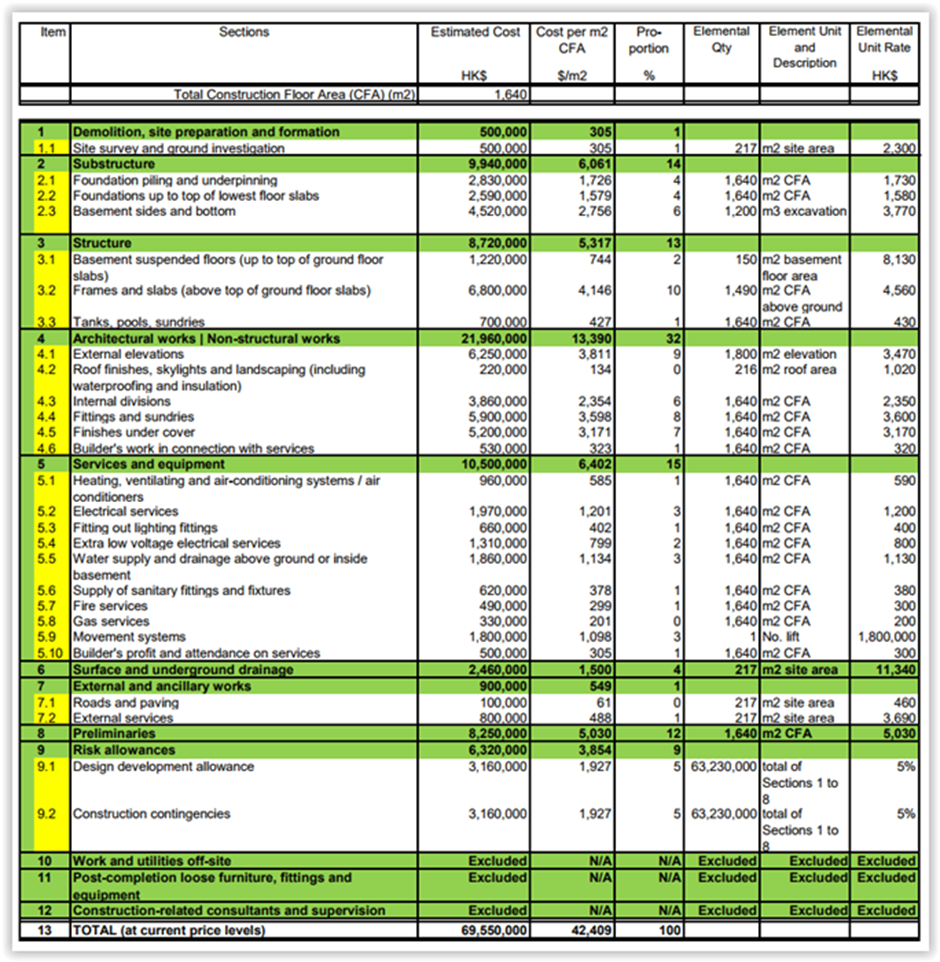

Approximate quantities Cost Estimate

- Approximate quantities of cost significant items are measured and priced to give the costs.

- The total cost per each Cost Sub-Group is then divided by its most representative quantity (elemental qty with unit and description of what it is) to give the unit cost per Cost Sub-Group.

The corresponding cost summary

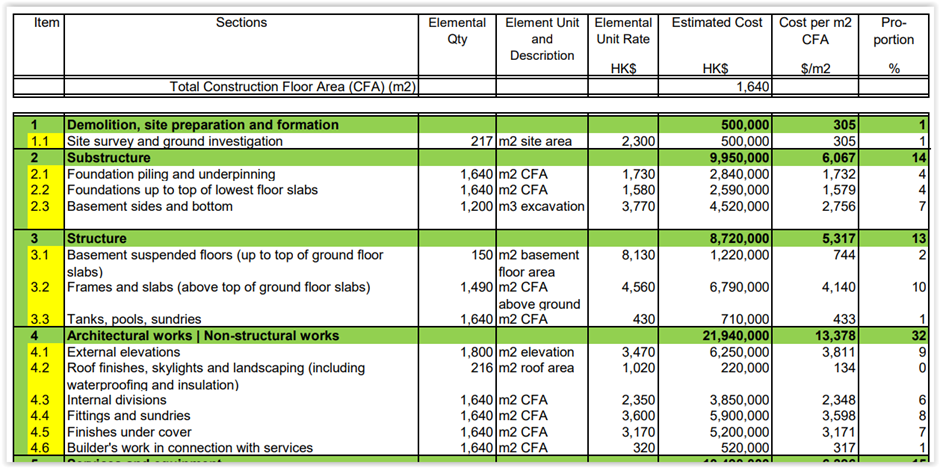

The equivalent cost analysis

- The above format also represents the format of a cost analysis where past cost data are classified and grouped to give the cost of each Cost Group, and the total cost per each Cost Sub-Group is then divided by its most representative quantity (elemental qty with unit and description of what it is) to give the unit cost per Cost Sub-Group.

The equivalent elemental quantity cost estimate

- Where at the very early design stage, instead of being able to measure the approximate quantities, elemental quantities are measured and priced at elemental unit rates.

Codes

- ICMS codes have not been used above since this was an one-off example of use. When the above is put into cost data bank, ICMS codes should be used.

Mapping

- Mapping with local standards is not required unless one wants to re-classify existing systematically classified cost data by electronic means or has to give dual classifications.

- Existing cost data can be re-classified as ICMS with or without the help of mapping links.

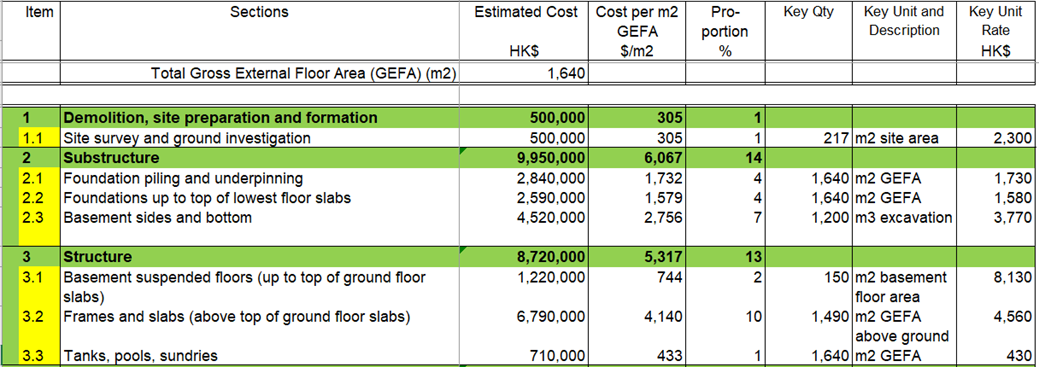

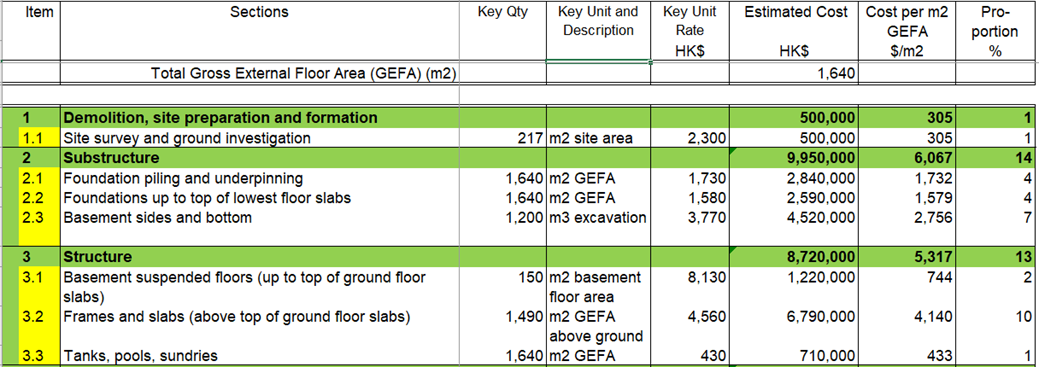

Proposal to Develop Key Quantities and Key Units by K C Tang on 13 April 2023

(Section added, 28/10/2025)

-

ICMS 3 provides Project Attributes and Values tables requiring the input of Project Quantities in the form of areas or lengths and in the form of functional units. It also provides reporting templates showing how the reported costs can be expressed as unit costs per those Project Quantities. These Project Quantities are useful for estimating, comparing or benchmarking based on unit costs per Project Quantities at the high levels like Level 1 – Projects or Sub-Projects, or Level 2 Categories.

-

However, when the costs at or below Level 3 - Cost Group are estimated, compared or benchmarked, the unit costs per Project Quantities may not be the most representative unit costs, e.g., external elevations being more related to the elevation areas and therefore unit cost / elevation area; roof finishes being more related to the ground area (projected footprint area) and therefore unit cost / ground area.

-

Traditional elemental cost estimating calls IMCS Cost Groups and Sub-Groups as “elements” and measures “element(al) quantities” at the element(al) totals levels. The unit rates are called “element(al) unit rates”.

-

When carrying out approximate cost estimates, the element(al) quantities (not yet the detailed quantities of various items of work) of the proposed project can be measured, and the element(al) unit rates derived from past cost analyses can be applied to the quantities to obtain quick approximate cost estimates. This is particularly useful when the design is still at the very preliminary outline stage. See examples on the next page.

-

The element(al) unit rates can continue to be used for benchmarking and monitoring the development of the design when more detailed cost estimates are possible.

-

It is therefore suggested that ICMS 3 should adopt similar practice, but may call them “Key Quantities” and “Key Units and Descriptions” whereby the Key Quantities at Levels 1 and 2 would be the Project Quantities while those at Levels 3 and below may be the Project Quantities or some other more representative quantities. In principle, the choice should be that Key Quantities x Rates / Key Unit best represent the total cost of the relevant Group or Sub-Group.

-

There can be more than one choice of Key Quantities for the Groups and Sub-Groups. Therefore, these Key Quantities would be put forward as suggestions (discretionary) only. Quantities for estimating are always approximate. It is therefore also suggested that ICMS needs not go into great details to define the measurement units. A simple description for each Key Unit should be enough.

-

A pdf file showing a preliminary attempt to define the Key Units for the ACROME Categories has been done (not fully for O and E) for comments and further development if the idea is accepted. Download: ICMS_3_Key_Quantity_Unit_Proposal_(20230413a).pdf

Examples:

Cost analysis to obtain Key Unit Rates:

Applying the Key Unit Rates to obtain a new cost report:

Further Reading

(Section added, 28/10/2025)

See Mapping with HK ArchSD Standard.

See Pre-Contract Cost Planning and Control.

See Life Cycle Costing with ICMS.

See Whole Life Carbon Assessment for the Built Environment, 2nd Edition, 2023 by RICS.