Note

20/2/2023: Expanded.

Rates and prices

See "Rates and Prices" for basic understanding.

Reading materials

- Read the chapter on Pricing and Tendering of “Quantity Surveyor’s Pocket Book Second Edition” authored by Duncan Cartlidge, which gives examples of how to build up preliminaries prices and unit rates for measured works for tendering.

- Preview the “Code of Estimating Practice Seventh Edition” published by the Chartered Institute of Building at https://books.google.com.hk/books?id=gBJDjH5S61wC&printsec=frontcover&source=gbs_ge_summary_r&cad=0#v=onepage&q&f=false. This book explains what a tenderer should consider at the time of tendering. Site inspection during tendering to understand all conditions on or around the site which may affect the carrying out of the Works should be carefully and thoroughly done, and the implications allowed for in the tender prices and completion times.

General principles

- Both describe the practice in the UK contexts. The wage rates, working rules, tax system, materials and productivity mentioned there may not applicable to Hong Kong, but the methodology and principles can be shared.

- Learn the following concepts:

- Use all-in hourly rates

- Include on-costs (not directly paid to the workers, plant hirers, suppliers and sub-contractors) on the direct costs

- Use labour gang rates

- Include costs of non-productive time (labour and plant) while payment is still needed

- Distinguish between quantities measurable for payments from those quantities consumed (waste, breakage, theft, loss, shrinkage, bulking, unmeasured laps, minor items, etc.) but not measurable for payments and include the costs of those not measurable in the rates for the quantities measurable

- Use representative sample size to calculate the total cost before averaging it to unit cost per quantity so that costs not directly proportional to the quantity can be shared by the unit rates.

- The volume of ground materials becomes bulkier after excavation and this will require bigger transportation means.

- Conversely, bigger volume is required to fill up a space because of compaction and packing.

- Concrete and cement mortar shrink after mixing.

- The cost impact should be taken into consideration.

Estimating from the first principle

- Estimating or building up the unit rates from their constituent costs is called “estimating from the first principle”. This is unlike using a unit rate from other projects.

- Such estimate would need a knowledge of the required constituent quantities of the materials, labour and plant in constructing a work item.

Approximate materials, labour and plant constants (based on Quantity Surveyor’s Pocket Book”)

- Labour constants are not really constants and do vary depending on the site and weather conditions and work complexity. “Labour contents” is more appropriate.

- More decimal places have been given below for the sake of consistency only. It does not mean that the figures are as accurate as to the decimal places given.

|

Item |

Description |

Qty |

Unit |

|---|---|---|---|

|

1 |

Generally |

|

|

|

1.1 |

Labour unloading materials |

1.0 |

Hours/tonne |

|

2 |

Excavation and filling |

|

|

|

|

Bulking |

|

|

|

2.1 |

Sand/gravel |

10% |

|

|

2.2 |

Clay |

25% |

|

|

2.3 |

Chalk |

33% |

|

|

2.4 |

Rock |

50% |

|

|

|

Hand excavation under normal conditions and in medium clay or heavy soil |

|

|

|

2.5 |

Bulk excavation commencing at reduced levels not exceeding 2m deep [“reduced levels” means the levels after oversite excavation to the undersides of hardcore beds of on-grade concrete slabs] |

2.4 |

Hours/m3 |

|

2.6 |

Ditto over 2m not exceeding 4m deep |

2.7 |

Hours/m3 |

|

2.7 |

Foundation excavation commencing at reduced levels not exceeding 2m deep |

4.0 |

Hours/m3 |

|

2.8 |

Bulk excavation in trenches, commencing at reduced levels not exceeding 2m deep |

3.3 |

Hours/m3 |

|

2.9 |

Filling obtained from excavated materials final thickness exceeding 500mm deep |

1.0 |

Hours/m3 |

|

2.10 |

Retaining excavated material on site in temporary spoil heaps distance not exceeding 50 meters |

1.0 |

Hours/m3 |

|

|

Multipliers to the above for excavations other than in medium clay |

|

|

|

2.11 |

Loose sand |

x 0.75 |

|

|

2.12 |

Stiff clay or rock |

x 1.50 |

|

|

2.13 |

Soft rock |

x 3.00 |

|

|

|

Plant productivity |

|

|

|

2.14 |

0.25m3 bucket excavator |

0.2 |

Hours/m3 |

|

3 |

Hardcore filling |

|

|

|

|

Addition to volume to cover compaction and packing |

|

|

|

3.1 |

Hardcore using brick, stone, etc. |

20% |

|

|

|

Alternatively, weight to buy to give compacted volume |

|

|

|

3.2 |

Brick ballast |

1,800 |

kg/m3 |

|

3.3 |

Stone ballast (kg to buy to give compacted volume) |

2,400 |

kg/m3 |

|

|

Labour |

|

|

|

3.4 |

Imported filling as bed over 50mm but not exceeding 500mm deep, 350mm finished thickness |

1.5 |

Hours/m3 |

|

3.5 |

Ditto exceeding 500mm deep |

1.0 |

Hours/m3 |

|

3.6 |

Surface treatments compacting filling (SMM7 only) |

0.2 |

Hours/m2 |

|

3.7 |

Surface treatments compacting sloping surfaces (SMM7 only) |

0.4 |

Hours/m2 |

|

3.8 |

Blinding bed, not exceeding 50mm thick, level to falls, cross falls or cambers, 40mm finished thickness |

0.5 |

Hours/m3 |

|

|

Plant productivity |

|

|

|

3.9 |

Medium-sized mechanical shovel spreading and levelling hardcore |

15 |

m3/hour |

|

3.10 |

Roller consolidating hardcore in 150mm layers |

15 |

m3/hour |

|

4 |

Concrete |

|

|

|

|

Weight to buy to give volume before shrinkage |

|

|

|

4.1 |

Cement in bag |

1.28 |

tonnes/m3 |

|

4.2 |

Cement in bulk |

1.28-1.44 |

tonnes/m3 |

|

4.3 |

Sharp sand (fine aggregate) |

1.60 |

tonnes/m3 |

|

4.4 |

Gravel (coarse aggregate) |

1.40 |

tonnes/m3 |

|

|

Addition to volume to cover shrinkage |

|

|

|

4.5 |

Concrete |

40% |

|

|

|

Waste |

|

|

|

4.6 |

Concrete placing |

5% |

|

|

|

Labour |

|

|

|

4.7 |

Labourer hand mixing concrete |

4.0 |

Hours/m3 |

|

|

Mechanical mixing, transporting up to 25 meters, placing and compacting, plain in situ concrete |

|

|

|

4.8 |

Concrete in trench filling |

2.0 |

Hours/m3 |

|

4.9 |

Horizontal work exceeding 300mm thick in structures |

1.5 |

Hours/m3 |

|

4.10 |

Sloping work not exceeding 15 degrees and exceeding 350mm thick in structures |

3.0 |

Hours/m3 |

|

|

Mechanical mixing, transporting up to 25 meters, placing and compacting, reinforced in situ concrete, packing around reinforcement and into formwork |

|

|

|

4.11 |

Concrete in trench filling |

4.0 |

Hours/m3 |

|

4.12 |

Sloping work not exceeding 15 degrees and exceeding 350mm thick in structures |

4.5 |

Hours/m3 |

|

4.13 |

Vertical work exceeding 300mm thick in structures (walls) |

6.0 |

Hours/m3 |

|

4.14 |

Vertical work exceeding 300mm thick in structures (columns) |

8.0 |

Hours/m3 |

|

|

Hand loaded concrete mixers, concrete output |

|

|

|

4.15 |

100 litre mixer |

1.2 |

m3/hour |

|

4.16 |

150 litre mixer |

1.8 |

m3/hour |

|

4.17 |

175 litre mixer |

2.1 |

m3/hour |

|

4.18 |

200 litre mixer |

2.4 |

m3/hour |

|

|

Mechanical feed concrete mixers, concrete output |

|

|

|

4.19 |

250 litre mixer |

4.0 |

m3/hour |

|

4.20 |

300 litre mixer |

7.2 |

m3/hour |

|

4.21 |

400 litre mixer |

9.6 |

m3/hour |

|

4.22 |

500 litre mixer |

12.0 |

m3/hour |

|

5 |

Reinforcement |

|

|

|

|

Waste |

|

|

|

5.1 |

Bar reinforcement – for binding wire and rolling margins |

5% |

|

|

5.2 |

Fabric reinforcement – for waste and laps |

12.5-15% |

|

|

|

--- |

|

|

|

5.3 |

Labour unloading reinforcement |

4.0 |

Hours/tonne |

|

|

Labour cutting, bending and fixing reinforcement |

|

|

|

5.4 |

10mm diameter bars |

4.0 |

Hours/50kg |

|

5.5 |

10-16mm bars |

3.0 |

Hours/50kg |

|

5.6 |

over 16mm bars |

2.75 |

Hours/50kg |

|

5.7 |

Fabric reinforcement |

30 |

m2/hour |

|

6 |

Formwork |

|

|

|

|

Skilled labour fixing metal formwork |

|

|

|

6.1 |

Soffits of horizontal work not exceeding 300mm thick, propping not exceeding 3m high |

1.8 |

Hours/m2 |

|

6.2 |

Soffits of sloping work, sloping one way |

2.5 |

Hours/m2 |

|

6.3 |

Vertical surfaces of walls |

2.0 |

Hours/m2 |

|

6.4 |

Edges of horizontal work not exceeding 500mm |

0.2 |

Hours/m |

|

|

Skilled labour fixing stripping formwork |

|

|

|

6.5 |

Soffits of horizontal work not exceeding 300mm thick, propping not exceeding 3m high |

1.0 |

Hours/m2 |

|

6.6 |

Soffits of sloping work, sloping one way |

1.2 |

Hours/m2 |

|

6.7 |

Vertical surfaces of walls |

1.0 |

Hours/m2 |

|

6.8 |

Edges of horizontal work not exceeding 500mm |

0.1 |

Hours/m |

|

7 |

Precast concrete units |

|

|

|

|

Waste |

|

|

|

7.1 |

Lintels, sills, copings and plank floors – for damaged or broken units |

2.5% |

|

|

|

1 Bricklayer + 1 labourer |

|

|

|

7.2 |

Hoisting and fixing a 225 x 150mm lintel up to 3 metres above ground |

0.3 |

Hours/m |

|

8 |

Cement mortar |

|

|

|

|

Weight to buy to give volume before shrinkage |

|

|

|

8.1 |

Cement |

1.40 |

tonnes/m3 |

|

8.2 |

Sand |

1.60 |

tonnes/m3 |

|

8.3 |

Hydrated lime |

0.60 |

tonnes/m3 |

|

|

Addition to volume to cover shrinkage |

|

|

|

8.4 |

Cement mortar |

25% |

|

|

|

Waste |

|

|

|

8.5 |

Cement mortar |

5% |

|

|

|

Labour |

|

|

|

8.6 |

Labourer mixing mortar |

4.0 |

Hours/m3 |

|

|

Mortar mixers, mortar output |

|

|

|

8.7 |

100 litre mixer |

0.25 |

Hours/m3 |

|

9 |

Brickwork |

|

|

|

|

Number of 215 x 102.5 x 65 mm bricks with 10 mm mortar joints per m2 wall one brick thick |

|

|

|

9.1 |

Stretcher bond |

60 |

No./m2 |

|

9.2 |

Header bond |

120 |

No./m2 |

|

9.3 |

English bond |

90 |

No./m2 |

|

9.4 |

Flemish bond |

80 |

No./m2 |

|

|

Volume of mortar |

|

|

|

9.5 |

Half-brick walls |

0.03 |

m3/m2 |

|

|

Waste |

|

|

|

9.6 |

Bricks – cutting and waste |

7.5-12.5% |

|

|

9.7 |

Damp-proof courses not exceeding 300mm wide – waste and laps |

5% |

|

|

|

1 Bricklayer + 0.5 labourer |

|

|

|

9.8 |

Laying bricks |

60 |

No./hour |

|

9.9 |

Forming cavity 50mm wide including building in wall ties at 5/m2 |

0.10 |

Hours/m2 |

|

9.10 |

Laying 1 layer pitch polymer damp-proof course not exceeding 300mm wide |

0.10 |

Hours/m |

|

9.11 |

Extra over walls for closing cavities with brickwork at opening perimeters |

0.35 |

Hours/m |

|

9.12 |

Bonding half-brick walls to existing |

1.10 |

Hours/m |

|

9.13 |

Bedding and pointing frames |

0.05 |

Hours/m |

|

9.14 |

Holes for pipes 50mm diameter in existing half-brick wall |

0.25 |

Hours/No. |

|

9.15 |

Ditto over 110mm diameter in existing half-brick wall |

0.30 |

Hours/No. |

|

9.16 |

Ditto over 150mm diameter in existing half-brick wall |

0.55 |

Hours/No. |

|

10 |

Blockwork |

|

|

|

|

Waste |

|

|

|

10.1 |

440 x 215 x 100 mm concrete blocks – cutting and waste |

5-10% |

|

|

|

Labour |

|

|

|

10.2 |

Gang laying lightweight concrete blockwalls |

0.50 |

Hours/m2 |

|

11 |

Asphalt work |

|

|

|

|

25 kg/block asphalt roofing covering capacity |

|

|

|

11.1 |

First 12mm thickness |

35 |

m2/1000kg |

|

11.2 |

Additional 3mm thickness |

150 |

m2/1000kg |

|

|

Waste |

|

|

|

11.3 |

Asphalt roofing |

2.5% |

|

|

|

1 Craftsman + 1 labourer laying |

|

|

|

11.4 |

19mm two-coat asphalt roofing |

0.15 |

Hours/m2 |

|

11.5 |

Skirtings, fascias and aprons 150-225mm girth (including internal angle fillet and labours |

0.60 |

Hours/m2 |

|

12 |

Felt roofing |

|

|

|

|

Waste |

|

|

|

12.1 |

Felt roofing – waste and laps |

15% |

|

|

13 |

Tile roofing |

|

|

|

|

Waste |

|

|

|

13.1 |

Nails |

5% |

|

|

13.2 |

Tile roofing |

10% |

|

|

|

1 Tiler + 1 labourer laying tile roofing |

|

|

|

13.3 |

60mm lap, 63No., 0.09kg tile nails, 10.08m battens, 0.11kg batten nails |

0.67 |

Hours/m2 |

|

13.4 |

75mm lap, 68No., 0.10kg tile nails, 10.88m battens, 0.12kg batten nails |

0.73 |

Hours/m2 |

|

13.5 |

90mm lap, 74No., 0.11kg tile nails, 11.84m battens, 0.13kg batten nails |

0.79 |

Hours/m2 |

|

13.6 |

100mm lap, 78No., 0.12kg tile nails, 12.48m battens, 0.14kg batten nails |

0.83 |

Hours/m2 |

|

|

1 Tiler + 0.5 labourer |

|

|

|

13.7 |

Fixing tile battens, including unloading |

2.50 |

Hours/100m |

|

14 |

Carpentry/carcassing |

|

|

|

|

Waste |

|

|

|

14.1 |

Carpentry/carcassing |

7% |

|

|

|

Carpenter/joiner fixing |

|

|

|

14.2 |

Plates, sleepers |

0.10 |

Hours/m |

|

14.3 |

Partitions |

0.15 |

Hours/m |

|

14.4 |

Floor joists |

0.18 |

Hours/m |

|

14.5 |

Upper floor joists |

0.20 |

Hours/m |

|

14.6 |

Strutting between 200mm joists |

0.35 |

Hours/m |

|

15 |

General joinery: first fixing |

|

|

|

|

Waste |

|

|

|

15.1 |

General joinery: first fixing |

7% |

|

|

15.2 |

Chipboard flooring |

10% |

|

|

|

Carpenter fixing |

|

|

|

15.3 |

Gutter boarding |

1.0 |

Hours/m |

|

15.4 |

19mm fascias |

1.0 |

Hours/m |

|

15.5 |

Barge boards |

0.4 |

Hours/m |

|

15.6 |

Chipboard flooring |

0.5 |

Hours/m2 |

|

16 |

Unframed joinery: second fixing |

|

|

|

|

Waste |

|

|

|

16.1 |

Unframed joinery: second fixings |

7% |

|

|

|

Joiner fixing |

|

|

|

16.2 |

Architraves (19 x 50mm) |

0.10 |

Hours/m |

|

16.3 |

Skirtings (19 x 75mm) |

0.15 |

Hours/m |

|

16.4 |

Window boards |

0.30 |

Hours/m |

|

16.5 |

Allow 0.05kg nails per m |

|

|

|

17 |

Doors, shutters and hatches and associated ironmongery |

|

|

|

|

Joiner fixing and hanging on standard hinges |

|

|

|

17.1 |

Standard doors |

1.4 |

Hours/No. |

|

17.2 |

Solid core doors |

2.0 |

Hours/No. |

|

17.3 |

Door lining sets 1050 x 1200mm |

3.0 |

Hours/No. |

|

17.4 |

Standard casements |

1.1 |

Hours/No. |

|

17.5 |

Staircases – straight flight |

5.0 |

Hours/No. |

|

18 |

Finishes |

|

|

|

|

Covering capacity |

|

|

|

18.1 |

11mm browning plaster (undercoat) |

135-155 |

m2/tonne |

|

18.2 |

11mm tough coat plaster (undercoat) |

135-150 |

m2/tonne |

|

18.3 |

11mm hardwall plaster (undercoat) |

115-130 |

m2/tonne |

|

18.4 |

2mm board finishing plaster |

410-430 |

m2/tonne |

|

18.5 |

2mm finishing plaster |

410-430 |

m2/tonne |

|

18.6 |

13mm universal one coat plaster |

85-95 |

m2/tonne |

|

|

Consumption |

|

|

|

18.7 |

1mm thick tile adhesive including grout |

2 |

litre/m2 |

|

|

Waste |

|

|

|

18.8 |

Plaster |

10% |

|

|

18.9 |

Tiles |

10% |

|

|

18.10 |

Tile adhesive and grout |

5% |

|

|

|

1 Plasterer + 1 labourer |

|

|

|

18.11 |

1 base coat |

0.20 |

Hours/m2 |

|

18.12 |

1 finishing coat |

0.25 |

Hours/m2 |

|

18.13 |

Ceilings – add |

25% |

|

|

18.14 |

Floor screeds |

0.30 |

Hours/m2 |

|

18.15 |

Wall tiles |

0.60 |

Hours/m2 |

|

19 |

Glazing |

|

|

|

|

Consumption |

|

|

|

19.1 |

Glazing compound per metre of bedding |

0.2 |

kg/m |

|

|

Waste |

|

|

|

19.2 |

Glass cutting |

10% |

|

|

19.3 |

Glass fixing |

10% |

|

|

19.4 |

Glazing compound and glazing beads |

5% |

|

|

|

Labour |

|

|

|

19.5 |

Glazing |

15 |

m2/hour |

|

20 |

Plumbing |

|

|

|

|

Craftsman installing rainwater installations |

|

|

|

20.1 |

110mm plastic rainwater pipes |

0.50 |

Hours/3m |

|

20.2 |

65mm plastic rainwater pipes |

0.50 |

Hours/3m |

|

20.3 |

Fittings |

0.10 |

Hours each |

|

|

Craftsman installing waster installations |

|

|

|

20.4 |

32mm plastic wastes |

0.30 |

Hours/3m |

|

20.5 |

110mm plastic soil pipes |

0.35 |

Hours/3m |

|

20.6 |

Fittings |

0.15 |

Hours each |

|

|

Craftsman installing hot and cold water installations |

|

|

|

20.7 |

15mm light gauge copper tube with capillary joints fixed with pipe clips @ 1m centres |

0.20 |

Hours/m |

|

20.8 |

28mm ditto |

0.25 |

Hours/m |

|

20.9 |

Fittings |

0.40 |

Hours each |

|

20.10 |

Pipe ancillaries |

0.80 |

Hours each |

|

|

Craftsman installing sanitary fittings |

|

|

|

20.11 |

Lavatory basins including wastes and pair taps |

2.50 |

Hours/unit |

|

20.12 |

Baths including wastes and pair taps |

2.80 |

Hours/unit |

|

20.13 |

Close-coupled WCs |

2.25 |

Hours/unit |

|

20.14 |

Show trays with wastes, traps, mixers and shower fittings |

6.00 |

Hours/unit |

|

21 |

Painting |

|

|

|

|

Coverage |

|

|

|

21.1 |

1st coat emulsion paint |

15 |

m2/litre |

|

21.2 |

2nd coat emulsion paint |

8 |

m2/litre |

|

|

Skilled labour |

|

|

|

21.3 |

Knotting and stopping |

4.5 |

Hours/100m2 |

|

21.4 |

Priming |

11.0 |

Hours/100m2 |

|

21.5 |

Painting undercoat |

14.0 |

Hours/100m2 |

|

21.6 |

Painting gloss coat |

18.0 |

Hours/100m2 |

|

21.7 |

Painting emulsion paint |

8.0 |

Hours/100m2 |

|

21.8 |

Preparation of surfaces (rubbing down between coats, etc.) |

4.0 |

Hours/100m2 |

|

22 |

Wallpaper |

|

|

|

|

Skilled labour |

|

|

|

22.1 |

Stripping off old paper to walls |

1.0 |

Hours/10m2 |

|

22.2 |

Applying size on walls |

0.5 |

Hours/10m2 |

|

22.3 |

Hanging lightweight paper on walls |

2.0 |

Hours/10m2 |

|

22.4 |

Hanging heavyweight paper on walls |

2.5 |

Hours/10m2 |

|

22.5 |

Hanging on ceiling – add |

50% |

|

|

23 |

Manholes and inspection chambers |

|

|

|

|

Labour |

|

|

|

23.1 |

Based on other trades – add for working in confined spaces |

25% |

|

Mainland, China

- National standard price books:

- China has published national standard price books giving unit rates for all common items for all kinds of construction works.

- It has also published materials, labour and plant contents (“quotas”) for building up the unit rates.

- As they are national standards, provinces and cities use them as the base to publish local price books and quotas to cater for local conditions.

- The unit rates are direct costs.

- Further additions are required to cover indirect costs, overheads, profits, taxes and charges, which usually use part or whole of the direct costs as the base for percentage mark-ups.

- Old practice:

- In the old days, the price books and quotas were rigidly applied.

- The mark-up factors were regulated by the central or local governments.

- As the unit costs of materials, labour and plant might vary, local supervisory authorities published as and when necessary cost adjustment factors to be applied on the relevant general materials, labour and plant costs.

- Uncommon materials’ costs might be adjusted individually.

- The central or local governments or local supervisory authorities also adjusted the mark-up factors as and when necessary.

- Instead of adjusting the unit rates individually, the relevant costs were extracted and summed up to serve as the bases for adjustments.

- This was a tedious process if done manually when software was not available.

- The same system and method were applied to tender pricing.

- This means that the unit rates were not all-in rates. In order to calculate the cost effect of changing 1 unit quantity of work item, one would need to make many adjustments to the unit rate to get the total cost.

- Using the same fixed sets of unit rates, quotas, mark-up factors and adjustment factors mean that all tenderers’ unit rates should be the same, and this would mean no competition.

- The unit rates would not truly reflect the productivity of individual contractor.

- This was more like an accounting system when the contractors were all state-owned and appointed by the local supervisory authorities to individual projects without the need for competitive tendering.

- Later practice:

- Later, China promoted competition, and allowed the tenderers to compete the price levels, but still required them to follow the quotas per unit quantity, i.e., separating the constituent quantities and costs making up the unit rates.

- However, if a tenderer genuinely estimates the unit cost but is bound to use the same constituent quantities, he has to adjust the constituted unit costs to compensate.

- This would mean both the constituent quantities and unit costs would not be genuine.

- Nowadays, to ensure competition based on the tenderers’ own productivity, China has given greater flexibility for the tenderers to estimate their unit rates without strictly following the price books and quotas.

- However, the standard price books, quotas and pricing system still have great influence and guiding effects.

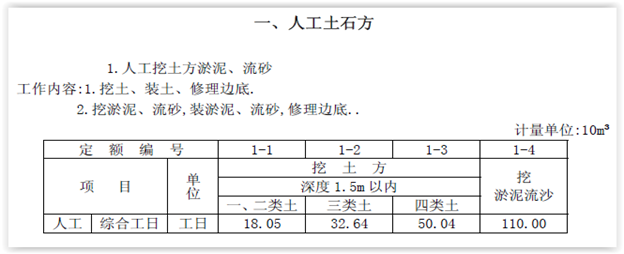

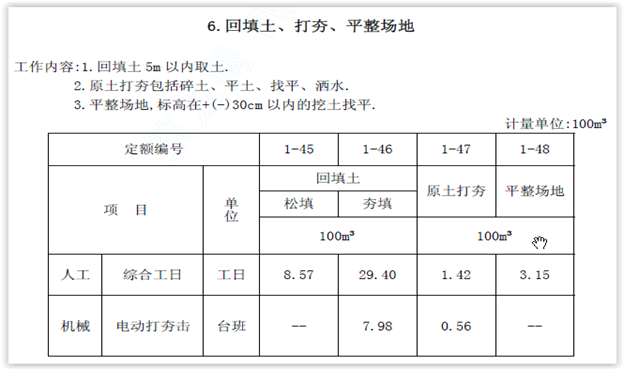

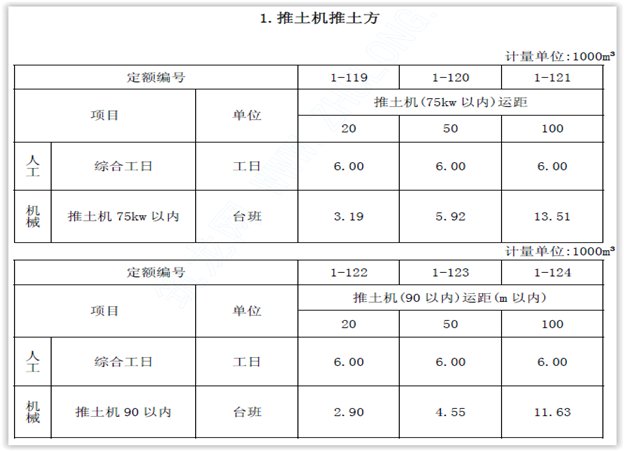

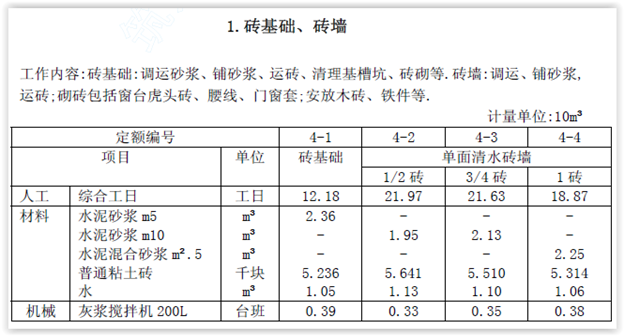

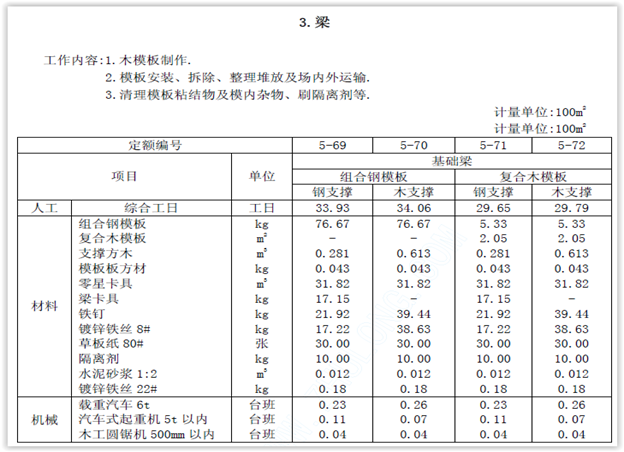

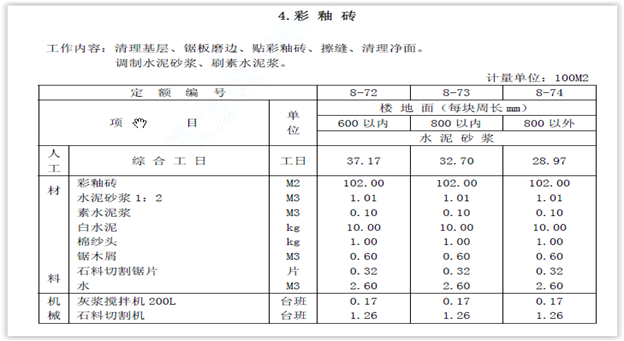

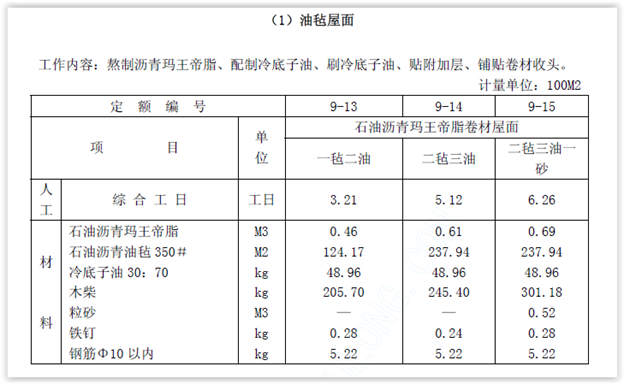

Example constants for building up unit rates in mainland, China

Source: National Standard Basic Constants (Quotas) for Builder’s Works (GJD-101-95).

Hong Kong

- Hong Kong does not have a publicly published set of materials, labour and plant contents, while contractors may have their in-house data.

- However, whether most of them have such data is doubtful, because contractors would usually rely on and require their sub-contractors to quote unit rates per work or supply quantity, even for labour-only sub-contracting.

- Only the lowest tier of sub-contractors (usually labour-only sub-contractors) may need to estimate the labour contents.

- They may as well quote based on past project unit rates with adjustments.

- In case of labour-only sub-contracting, the contractors would need to estimate the materials and plant contents.

- In this connection, correct estimate of the materials’ waste factors is very important, and should not rely simply on the published waste factors applicable outside Hong Kong.

- When preparing the final accounts, it may be required to find out the labour contents allowed for in the unit rates.

- The way to do it is to subtract the more certain material costs from the all-in unit rates first and dividing the remainder by the daily wage rate to obtain the mandays required.

- The mark-ups for profit and overheads and the plant costs should also be dealt with in the calculation.

Direct costs

- The costs of materials, labour and plant directly incurred due to the carrying out of a specific work item is called “direct costs”.

- “Direct” means that if the quantity of the work item is changed, the costs will also change sensitively.

Indirect or overhead costs

- There are indirect costs which are costs of supporting work or services which are not directly related to or do not sensitively change relative to the quantities of a specific type of work items but are commonly required and shared by more than one type of work items. They are called “overheads”.

- There are two kinds of overheads. One is called “head office overheads”. The other is called “site overheads” or "project overheads”.

Head office overheads and profit

- Head office overheads are the costs of running the contractor’s company whether a particular project is undertaken or not.

- However, all projects on hand must contribute to support the head office overheads. Since head office overheads are continually incurred, timely contribution is important. If the contribution from a particular project has become low or slow, the company will suffer. If the cause of the loss is something for which the Employer is responsible under the construction contract, this will be a matter for claims.

- A contractor’s annual profit and loss account statement may show the following:

- Turnover (prices received from projects)

- Less Cost of sales

- Gross profit

- Add Other income

- Less Administrative expenses

- Profit before tax

- Less Profits tax

- Profit after tax.

- The administrative expenses may include:

- Head office staff salary

- Director's remuneration

- Mandatory Provident Fund

- Audit fee

- Bad debt

- Bank charges

- Cleaning

- Computers, accessories and software

- Currency revaluation difference

- Depreciation

- Entertainment

- Insurances

- Loss on disposal of fixed assets

- Postage and courier

- Printing and stationery

- Professional fees and charges

- Rents and rates

- Repair & maintenance

- Staff welfare

- Sundry expenses

- Telephone and fax

- Travelling expenses

- Water and electricity.

- The profit is whatever left over after subtracting the costs and expenses from the prices.

- The profit and overheads allowed for in tenders are usually calculated as percentage mark-ups on the direct costs (i.e., cost of sales).

- If the account is healthy, to maintain the same level of contribution to profit and overheads:

- The percentage mark-up for gross profit (i.e., including overheads) would be

- = Gross profit / Cost of Sales

- The percentage mark-up for head office overheads would be

- = Administrative expenses / Cost of sales x 100%

- The percentage mark-up for net profit (i.e., excluding overheads) would be

- = Gross profit percentage – head office overheads percentage.

- The percentage mark-up for gross profit (i.e., including overheads) would be

Site or project overheads

- Site overheads or project overheads are the costs which are incurred on top of the regularly incurred head office overheads when a project is undertaken, and are those costs of commonly shared work or services not priced as part of the direct costs of the permanent work items.

- Project staff do not necessarily station on the site all the time.

- Site/project overheads may be priced as a percentage mark-up on the direct costs, but major costs would usually be priced in the Preliminaries Bill or Specification Preliminaries Section.

- See headings of preliminaries items.

- Preliminaries items should also be priced based on direct costs plus profit and head office overheads.

工程承包造价的组成

- 按资源划分:

- 人工费

- + 材料费

- + 机械使用费

- = 直接费

- + 管理费

- = 成本

- + 利润

- = 税前造价

- + 按造价计取的税金

- = 税后造价(综合单价)

- 按计价文件划分:

- 开办经营费(措施费)

- + 工程量x综合单价

- + 指定项目(分包及供货)暂定价

- + 分包管理配合费

- + 暂定款

- + 施工不可预见费

- + 点工单价表

- = 承包总价

管理费分为

- 企业(公司)管理费:

- 香港一般是按其他的工程成本计取费率,并摊在所有单价内

- 项目管理费:

- 可以专项的计在开办经营费内,或按其他工程的成本计取费率摊在单价内

利润

- 香港一般是按其他的工程成本计取费率,并摊在所有单价内

税金

- 香港工程未有营业税、销售税等增值税种,只有利得税