Pre-Contract Cost Planning and Control 施工合同前造價計劃和控制

Pre-Contract Cost Planning and Control 施工合同前造價計劃和控制 KCTangNote 註

- 20/1/2026: Rounding formula revised to handle negative numbers.

- 5/3/2023: IPMS revised. Various images updated.

- 18/2/2023: Revised.

修改。 - 8/4/2022: Chinese version partially added. Minor adjustments made.

添加了部分中文版。進行了細微調整。 - 16/3/2022: Re-sequencing and minor corrections made.

進行了重新排序和小幅修正。 - 10/3/2022: Minor adjustments made.

進行了細微調整。 - 7/3/2022: ICMS split out on its own. Cost geometry and most significant cost parameters moved to "Estimating and Pricing".

ICMS 分拆獨立。造價幾何和最重要的造價參數移至"估算和定價"。 - 3/3/2022: Minor adjustments made.

進行了細微調整。 - 1/3/2022: Updated for ICMS 3 and IPMS.

針對 ICMS 3 和 IPMS 進行了更新。 - 23/2/2022: Minor adjustments made.

進行了細微調整。 - 18/3/2021: 9 sections added or revised. Punctuation style revised.

添加或修改了 9 個部分。標點樣式修改。 - 13/3/2020: Usual payment terms added.

添加了通常的付款條件。 - 26/2/2020: Minor adjustments made.

進行了細微調整。 - 20/12/2014: Moved from wiki.

從 wiki 移來。

Pre-contract cost management 施工合同前的造價管理

- Principal cost management tasks during the pre-contract stage:

施工合同前的主要造價管理任務:- Prepare cost estimates or cost plans

編製估算概算或造價計劃 - Prepare cash flow tables

編製現金流量表 - Attend design meetings

參與設計會議 - Monitor the design

監控設計 - Adjust the cost estimates and reconcile

調整估算概算及解釋變化 - Compare alternatives.

比較備選方案。

- Prepare cost estimates or cost plans

- Estimate, plan, update and control.

估計、計劃、更新和控制。

Need for pre-construction cost estimates 為何需要施工前概算

- Know the costs for investment decisions:

知道成本造價以作投資決定:- Calculate land bid price

計算買地投標價 - Calculate acceptable rental

計算可接受的租金 - Evaluate the feasibility of the investment.

評估投資的可行性。

- Calculate land bid price

- Establish a project (development) budget.

確定發展項目的投資預算。 - Obtain funding.

獲取資助。 - Borrow money from the bank.

從銀行借錢。 - Formulate a design brief which defines the scope and standard of the project.

制定設計任務書以說明發展項目的範圍和標準。 - Monitor the design development to control the costs within budget.

監控設計的深化以控制不超出投資預算。 - Estimate fees or review fee percentage.

估算顧問費或覆核顧問費率。

Best time to plan and control the costs 計劃和控制造價的最佳時機

- As early as possible during the development process.

在項目發展階段中越早越好。 - Better chances to make design changes to find a better solution.

較有機會修改設計取得更好的方案。 - To reduce abortive design costs and time.

減少設計返工成本和時間。

Ways to calculate cost estimates 計算造價估算的方法

- Techniques:

- Estimates should be done using expedient methods, approximations and shortcuts to reduce estimating time and costs in order to afford more estimates.

- Methods:

- By unit cost per floor area / length / number estimates

- By measuring the most significant cost parameters

- By measuring elemental quantities

- By measuring approximate quantities

- By pricing the bills of quantities ready for issuance or already issued for tendering.

Estimating mottos 四字真言

-

From big to small.

由大到小。

-

From rough to fine.

從粗到細。

-

Focus on the important.

重點出擊。

-

Make bold assumptions.

大膽假設。

-

Verify carefully.

小心求証。

-

Compare with the unlike.

觸類旁通。

-

Conduct self-checking.

自我覆核。

-

Reconcile with the previous.

瞻前顧後。

-

Empathize with the Client.

設身處地。

(gerunds changed to verbs, 8/4/2022)

Different names of pre-construction cost estimates 概算的不同名稱

- Rough Indication of Costs ("RIC").

大約估算。 - Preliminary Indication of Costs.

初步估算指標。 - Preliminary Cost Estimates.

概算。 - Elemental Cost Estimates.

功能分部概算。 - Cost Plans.

成本計畫。 - Cost Models (An American term).

成本模型 (美式用詞)。 - Pre-tender Estimates.

標底。

Budgets, cost estimates and cost plans

- Budget:

- A budget is the maximum sum a Developer is willing and able to spend on a project.

- Cost estimate:

- A cost estimate is a forecast of the probable ultimate cost based on the current design.

- It is required to be done throughout the pre-construction stages as well as the construction stage until the estimated costs become fixed prices.

- A cost estimate for now, if satisfactory and approved, will become the cost plan for the future design.

- Cost plan:

- A cost plan is a detailed cost framework for controlling future design.

- It sets out the portions of the total budget allocated to different parts of the construction so as to serve as the cost limits to the relevant parts of the construction.

- It may just be based on some interpolation from the cost data of other projects or may be based on some detailed cost estimate specifically prepared for the relevant design.

- It usually refers to the cost plan before the award of the principal contract. After that, the cost plan will be replaced with regular final statements.

- Rough indication of costs ("RIC"):

- It is a kind of cost estimates. It may be just based on unit cost / number or unit cost / floor area or unit cost / other functional unit to be used in the feasibility study or early design stage based on some ideas or sketch designs

- HK ArchSD still calls it "Rough Indication of Costs" when the estimate is still in the early stage though the details may be more than just based on unit cost per floor areas.

- Approximate estimate:

- Approximate estimates should be done using expedient methods, approximations and shortcuts to reduce estimating time and costs in order to afford more estimates.

- This principle should be applied to pre-construction cost estimates or post contract cost estimates.

- Detailed cost estimate:

- It is a more detailed cost estimate prepared when the design is more developed.

- "Detailed" refers to the number of items measured, rather than to the accuracies of the quantities estimated.

- Some consultants call it "Preliminary Cost Estimate", and some call it "Cost Plan".

- It may become the Budgetary Estimate if approved.

- Pre-tender estimate (按工程量清單計算標底):

- A pre-tender estimate is no longer an approximate estimate and is prepared by pricing the bills of quantities ready for issuance or already issued for tendering.

- A logical sequence is like this:

- Rough Indication of Costs => Detailed Cost Estimate => Cost Plan / Budgetary Estimate => Pre-tender Estimate.

(revised, 18/2/2023)

Elemental cost classifications

- Trade by trade classifications:

- Pricing documents for tendering are usually arranged in trade by trade or works section orders or work breakdown structures according to the local standard method of measurement or local practice.

- Elemental cost classifications:

- Instead of following the same order, pre-construction cost estimating in many countries (not all) adopt an elemental cost classification, which divides the costs of a construction project into various parts ("elements") each serving a specific function or common purpose such that the costs of alternatives serving the same function or purpose can be compared, evaluated and selected irrespective of their trades, works sections, design, specification, materials or construction.

- Classifying the costs of a building (or other construction) into elements would facilitate:

- Comparison of the costs of different design options serving the same elemental function

- Comparison with costs of other projects by elements

- Rationalizing the budget allocation between different elements for better use

- Quicker estimating based on elemental quantities which are easier to measure

- Analysis of data for different projects on the same basis and classification.

- Different elemental cost classifications in Hong Kong:

- Different QS practices and ArchSD have different elemental classifications.

- ArchSD adopts the following Project Element Cost Model as described in the Standard Method of Measurement for Building Elements 2020 Edition published by the Architectural Services Department (https://www.archsd.gov.hk/media/publications-publicity/schedule-of-rates/asdsmmbe_2020.pdf):

- Many other places outside Hong Kong also have their own elemental cost classification systems, e.g.:

- UK's Uniclass:

- https://en.wikipedia.org/wiki/Uniclass#The_tables

- https://www.thenbs.com/our-tools/uniclass-2015#classificationtables(browse the Element / Function table)

- UK RICS's NRM 1 ("New Rules of Measurement 1: Order of cost estimating and cost planning for capital building works"):

- USA's Omniclass:

- https://www.csiresources.org/standards/omniclass (incorporating MasterFormat for Work Results and UnitFormat for Elements)

- Australia, Canada, Malaysia, Nigeria, etc.

- UK's Uniclass:

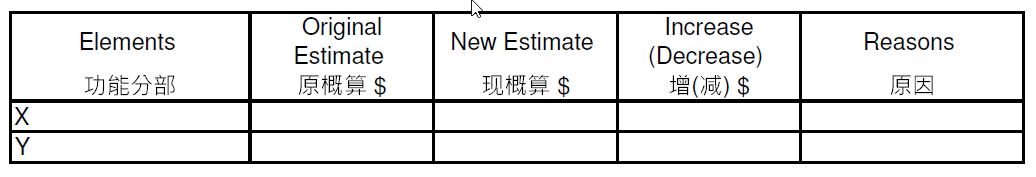

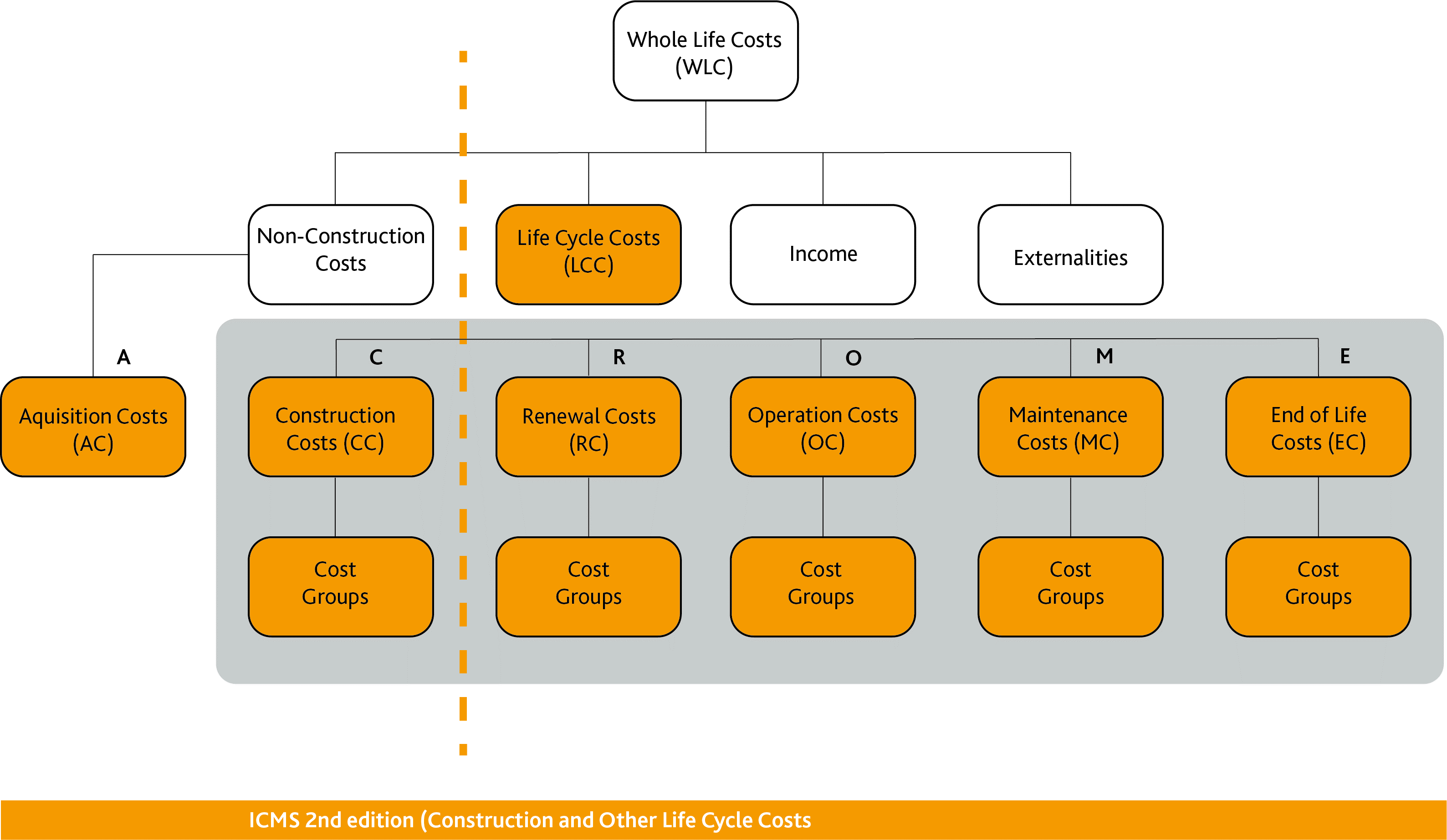

- ICMS:

- International Cost Management Standard (ICMS) (https://icms-coalition.org/the-standard/) is a global classification and reporting standard covering the life cycle costs and carbon emissions of building and civil engineering projects. "elements" is called “Groups” and “Sub-Groups” in ICMS 3 so that they are equally applicable to costs and carbon emissions. The examples shown here are based on that standard. See also International Cost Management Standard.

(revised, 5/3/2023)

Construction floor area and gross floor area in Hong Kong

- Different areas:

- For costing, leasing and sales of buildings and related land, people usually have to refer to unit cost or price per floor area of the buildings as the most important controlling parameter.

- However, there are many types of floor areas being defined for different purposes in Hong Kong or other places outside Hong Kong. An understanding of their possible differences is important.

- CFA:

- Quantity Surveyors measure the construction floor area (CFA) in order to estimate the total construction cost of a building.

- GFA:

- Lands leased by the Government in Hong Kong are subject to limitation on the gross floor areas (lease GFA) of the buildings which may be built on the land. Some of the construction floor area is not accountable for the lease GFA. The Lands Department is responsible for the control. Read the Lands Department's Practice Note on Accountable and Non-Accountable GFA under Lease at https://www.landsd.gov.hk/en/images/doc/1998_1A_text.pdf.

- Building plans have to be submitted to the Buildings Department for approval and consent before construction. The gross floor areas (GFA) are also controlled by the Buildings Regulations. Read the Buildings Department's Practice Note on Calculation of Gross Floor Area and Non-accountable Gross Floor Area at https://www.bd.gov.hk/doc/en/resources/codes-and-references/practice-notes-and-circular-letters/pnap/APP/APP002.pdf.

- The Lands Department's Practice Note says while the Lands Department is usually prepared to follow the Buildings Department's ruling in exemptions from GFA calculations, it reserves its right and absolute discretion to do otherwise in individual cases.

- Saleable area:

- There are further complications due to the use of saleable area for residential properties. See Cap. 621 Residential Properties (First-hand Sales) Ordinance at https://www.elegislation.gov.hk/hk/cap621.

International Property Measurement Standards (IPMS)

- The International Property Measurement Standards at https://ipmsc.org/standards/ are intended to unify the rules of measurement of various kinds of floor areas for different types of buildings.

- A single harmonised standard covering All Buildings has been published on 15 January 2023 to supersede all previously published standards for individual asset classes.

- IPMS 1 (gross external floor area) and IPMS 2 (gross internal floor area) are referred to by ICMS.

- Read this and appreciate the diagrammatic illustration.

- CFA in Hong Kong is close to IPMS 1 with one exception: accessible rooftop terraces are included in IPMS 1 but not in Hong Kong CFA.

(revised, 18/2/2022, 5/3/2023)

Need for historical cost analyses

- Before talking about the cost estimates, it may be appropriate to talk about cost analyses first.

- Cost analyses are needed to:

- Benchmark new projects

- Provide cost data for new estimates

- Provide cost parameters for new estimates.

(revised, 18/2/2023)

Cost analyses

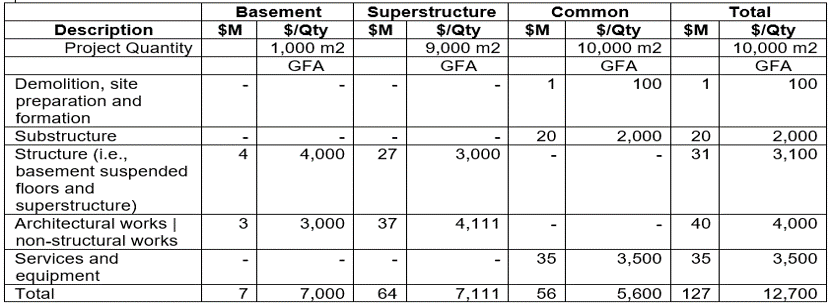

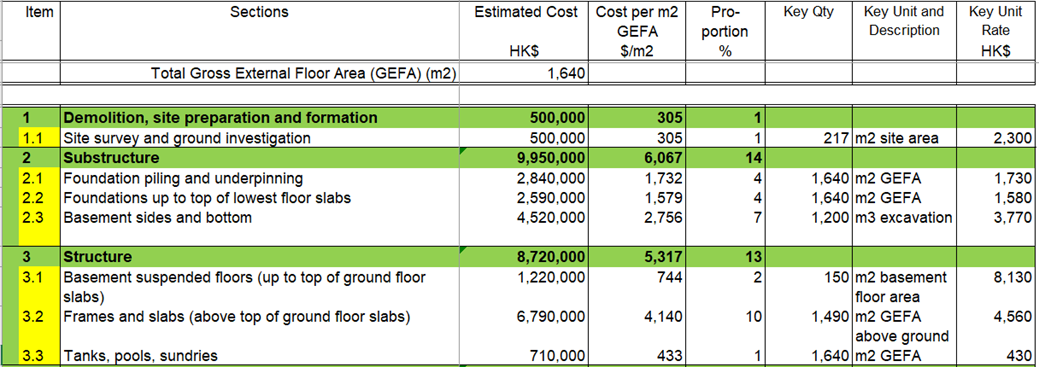

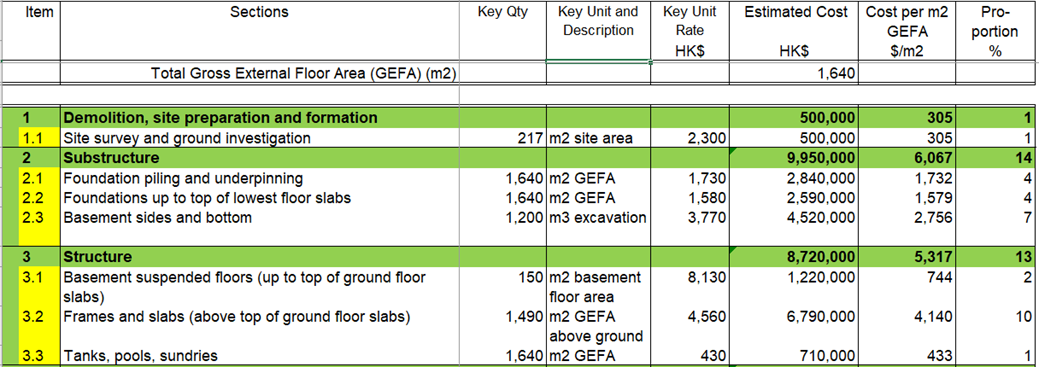

Example adopting ICMS

(image updated, 5/3/2023)

Classify total costs

- A cost analysis analyses the awarded or final prices of a project and re-classify the costs following the same classification used for the cost estimates or cost plans.

- When classified in elemental format, the cost of each element or sub-element is summed up into a single line item.

- The cost is called “elemental cost” in Hong Kong.

Identify elemental quantities

- A single representative quantity is measured for that line item.

- The single quantity is called "elemental quantity" in Hong Kong. “representative” means that the quantity can best represent the cost changes in case of quantity changes.

Get elemental unit rates

- The cost of that cost item is then divided by the elemental quantity to give a single all-inclusive rate.

- The single all-inclusive rate is called "elemental unit rate" in Hong Kong.

- That means:

- elemental cost / elemental quantity = elemental unit rate,

- or

- elemental quantity x elemental unit cost = element cost,

- depending on the order of presenting the columns in table form.

- The elemental unit rates are very useful when the cost of a new project is required to be estimated before any detailed design is available.

Apply the elemental unit rates to new projects

- Elemental quantities can be measured for the new project and priced at elemental unit rates of the reference projects.

- There are not too many items of elemental quantities to be measured. The cost estimating process can therefore be very fast.

- Of course, the elemental unit rates may not be directly applicable to the new project.

- It should at least be adjusted for the changes in the price levels from the times it was applicable to the reference project to the time of the new project, and then for other changed factors.

Get quantity ratios or factors

- A cost analysis should also contains quantity ratios or factors such as:

- elevation area : floor area

- concrete volume per floor area

- formwork area per concrete volume or floor area

- rebar weight per concrete volume or floor area

- etc.

- These quantity ratios can serve as useful references when estimating the costs of new projects.

- Apart from using the data in a cost analysis to estimate the cost of a new project in the absence of detailed design, the data can also be used to benchmark the cost of a new project after a more detailed cost estimate is done to ensure that the new project would not go out of order.

- Hong Kong Government uses this technique to control the costs of new project at the design stage.

- The Architectural Services Department has published a very detailed Project Cost Analysis Form.

Changes in cost and price levels

- Due to changes in the market conditions, the unit rates for exactly the same description of work may change over time.

- The market conditions may include fluctuations in the costs of labour, materials and plant, market competition, and other factors.

- Unit rates applicable in the past would need to be adjusted to the current level.

- Tender price or cost indices are therefore prepared to provide the adjustment factors.

- Their differences should be appreciated.

- Tender price indices and cost indices can fluctuate at different rates because price = cost + profit, and the price may increase less than the cost increase in order to secure projects or may increase more in case the market is full.

(revised, 18/2/2023)

Different methods of approximate cost estimating 計算概算的方法

Different methods

- Unit method (common).

- Superficial method or area method (common).

- Cubic method (seldom used for buildings).

- Storey enclosure method (seldom used now).

- Elemental cost estimates (common):

- Elemental quantity method

- Approximate quantity method.

- Condensed elemental method using the most significant cost parameters.

Pre-tender estimate:

- A pre-tender estimate is no longer an approximate cost estimate and is prepared by pricing the bills of quantities ready for issuance or already issued for tendering.

Unit method (按功能單元個數計算)

- The estimated cost of a building is calculated based on the number of functional units provided by the building x unit cost per functional unit.

- ICMS has suggested the following functional units for buildings: number of occupants | number of bedrooms | number of hospital beds | number of hotel rooms | number of car parking spaces | number of classrooms | number of students | number of passengers | number of boarding gates.

- The unit method is a crude method serving as an early indication of the probable order of cost of the average building of the relevant type.

- It is not useful for forecasting with a high degree of accuracy the costs of newly proposed buildings of the same type because their designs can be very different.

- However, it may be used by clients and in particular government departments to serve as a cost yardstick controlling the budget of newly proposed projects.

- It is still also useful to serve a check that a unit cost per floor area may sound reasonable but, when expressed in unit cost per functional unit, the unit cost can be out of order because of excessive floor area per functional unit.

Superficial method or area method (按樓面積計算)

- The estimated cost of a building is calculated based on the floor area of the building x unit cost per floor area.

- This is the most commonly used method, possibly because the sales and rental prices are also expressed in unit cost per floor area.

- Note however that there are many definitions of "floor area". The same definition should be consistently applied.

Cubic method (seldom used for buildings) (按樓體積計算(現少用))

- The estimated cost of a building is calculated based on the volume of the building x unit cost per volume.

- In theory, the volume can take care of the different storey heights of the building.

- This is not commonly used probably because the floor areas are more readily available, and calculating the volumes would mean a further step to be done.

- The cubic method may be useful for site formation works or civil engineering works involving massive volume of work.

Storey enclosure method (seldom used now) (按樓板及外殼面積加權計算(現少用)

- In essence, the estimated cost of a building is calculated based on the total of the weighted areas of bottom slabs (basement or ground), suspended floor slabs, roof slabs, and walls below and above ground x unit cost per total weighted area.

- Each type of slabs or walls are given different fixed weightings to reflect their relative ratios of costs.

- The calculation is much more complicated than the superficial method or the cubic method.

- With so many varieties of construction components and materials, whether the fixed weightings can truly reflect the relative ratios of costs is doubtful.

- This method is seldom used these days.

- Search the internet for details and examples.

(revised, 18/2/2023)

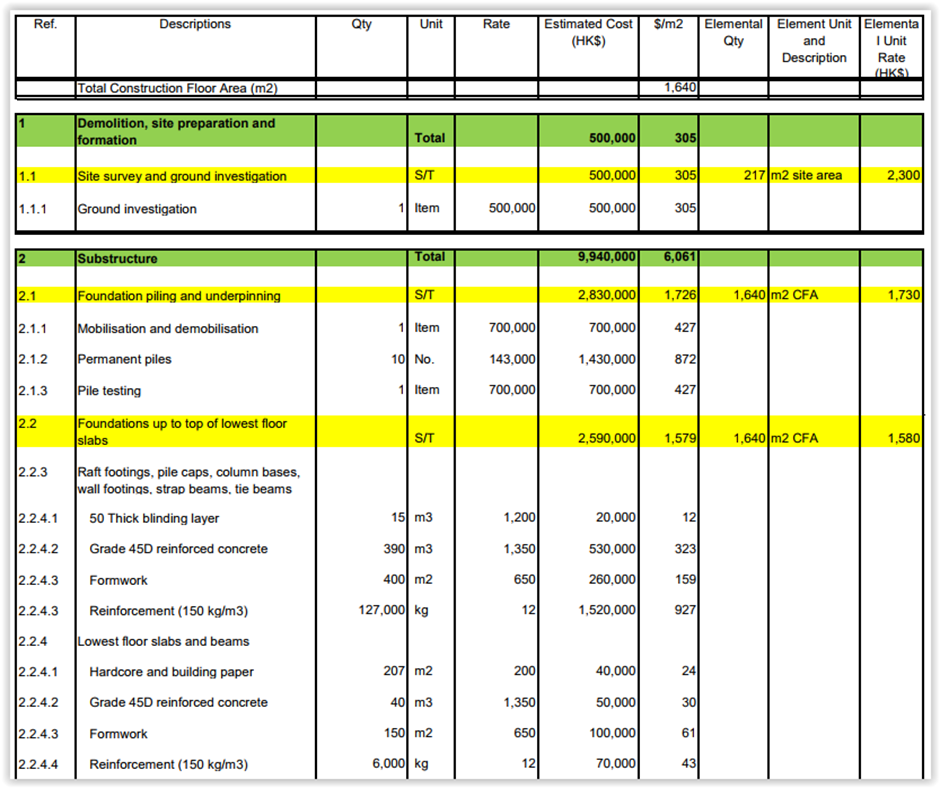

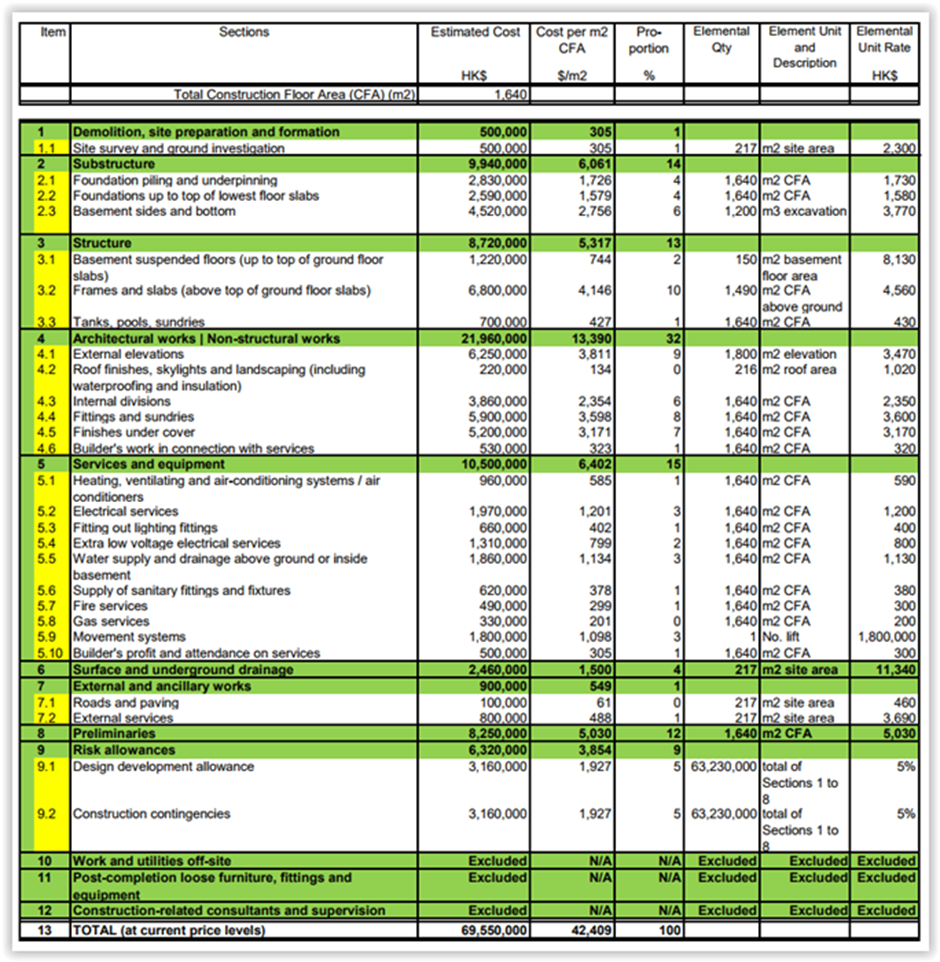

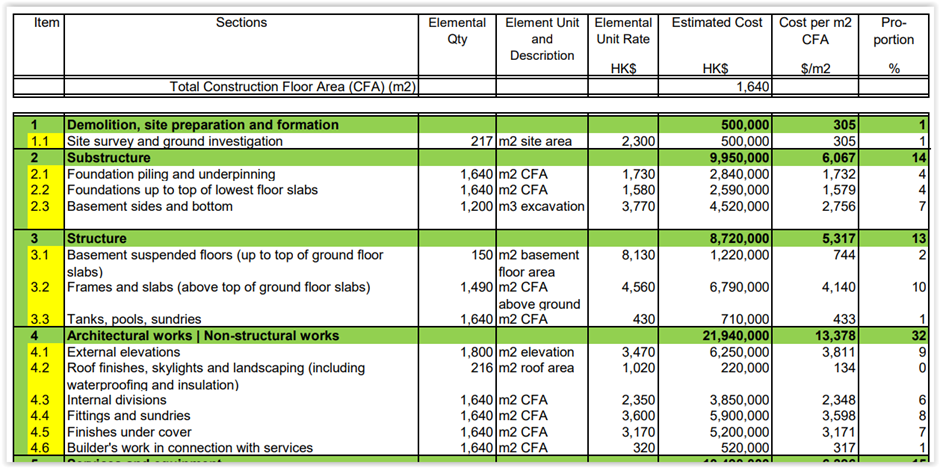

Elemental quantity method (按功能分部工程量計算)

- The building cost is classified into different elements (or Groups or Sub-Groups as used in ICMS as shown under the "Sections" column in the example below which follows ICMS classifications).

- Each element is represented by an appropriate elemental quantity which best represents the elemental cost (i.e., changing proportionally).

- It can be seen from the example below that the elemental quantities generally adopt the values of the most significant cost parameters discussed here and below.

- The estimated cost of a building is calculated based on the total of (elemental quantity x elemental unit rate).

- It takes into account the different forms, provisions and standard of the proposed new building better than the average unit cost per floor area.

- It is therefore a more accurate method than the superficial method.

- However, while the elemental quantities are simple to measure, the elemental unit rates would rely on reliable cost data from other projects or may need careful build-ups.

- This method should only be used at the early stage of design.

- At the time of the elemental quantity cost estimates, there would not be much details to measure approximate quantities and one has to rely on past cost analyses or some estimated quantity factors and ratios to estimate the elemental unit rates.

- The elemental unit rates, quantity factors and ratios should be critically reviewed to see whether they should remain unchanged or adjusted when the design of the building is changed even though the elemental quantities can remain unchanged.

- The price levels of past projects must be adjusted to the present day for use.

(image updated, 5/3/2023)

Approximate quantity method (按分項大約工程量計算)

- The estimated cost of a building is calculated based on the total of (approximate quantity of major item of work x unit rate per quantity of major item of work inclusive of costs of minor items):

- It does not usually show the elemental quantities and elemental unit rates just to save time.

- As the design is more developed, it is possible to measure the work constituting the building more accurately and apply more appropriate unit rates relevant to the materials and standard chosen.

- The quantities are approximate to reduce the time to measure so that a quicker cost estimate can be produced to reflect the updated cost of the design and enable any subsequent measures to control any unexpected costly design.

(image updated, 5/3/2023)

Condensed elemental method using the most significant cost parameters

- Users of the elemental quantity method may find that many elemental quantities are the same for different elements and can in fact be reduced into a few most significant cost parameters:

- Floor area (above ground + below ground)

- Ground area (= roof area)

- Transfer structure area

- External elevation area

- Basement screen wall area or more effectively basement volume of excavation

- Site area

- External area (site area - ground area)

- Number of equipment

- Refrigeration tonnage

- Other elemental quantities.

- The estimated cost of a building is calculated based on the total of (quantity of the above cost parameter x composite unit rate per quantity of cost parameter).

- This can provide a quick and equally reliable cost estimate though not as detailed as the elemental quantity cost estimate.

Contents of cost estimates 概算的內容

- Cover page:

- Estimate Number

- Project Name

- Project Location

- Estimate Date

- List of Contents (if simple enough to list here)

- Consultants’ Names.

- Contents page (for longer list)

-

Grand Summary (in table form):

大匯總:- Total Cost of Each Section of the Project

建設項目每區域的總造價 - Floor Area of Each Section

每區域的樓面面積 - Unit Cost per Floor Area.

每區域的樓面面積的單價。

- Total Cost of Each Section of the Project

-

Descriptions:

編製說明:- Project Name

項目名稱 - Project Location

項目地點 - Scope of the Estimate

估算範圍 - Areas:

面積:- Construction Floor Area / Covered Floor Area

建築面積/有蓋樓面面積 - Ground Area

地面面積 - Site Area

地塊面積 - Lease Gross Floor Area

地契樓面面積 - (Non-)Accountable GFA

可豁面/不豁面地契樓面面積 - Bay Window Area

窗臺面積

- Construction Floor Area / Covered Floor Area

- Basis of the Estimate:

估算依據:- Drawings used

依據的圖紙

- Drawings used

- Price Levels:

價格水準:- Current Prices

現行價格 - Fluctuations from Date of Preparing the Estimate to Tendering

由編製到招標的價格浮動 - Fluctuations from Tendering to Completion of Construction

由招標到竣工的價格浮動

- Current Prices

- Outline Specification of Design and Materials

分部設計及用料大綱 - Finishes Schedule

裝飾表 - Exclusions.

不包項目。

- Project Name

-

Elemental Summary of each Section (in table form):

每區域的功能分部匯總:- Floor Area of the Section

該區域的樓面面積 - Item Reference

項目編碼 - Total Cost of Each Element of the Section

該區域的每功能分部總造價 - Unit Cost per Floor Area

每功能分部的樓面面積單價 - % Proportion of each Element.

每功能分部所占百分比。

- Floor Area of the Section

-

Detailed Build-up (Arranged by Elements or Cost Groups):

具體項目(按功能分部排列):- Item Reference

編碼 - Descriptions

子目說明 - Quantities (rounded off to tens or thousands)

數量(拾位元或百位元整數) - Rates (rounded off to two significant figures)

單價(兩個有效數字) - Extension (rounded off to ten thousands)

合價(萬位元整數) - Elemental Totals

功能分部總價 -

Possible additional information:

可能的附加資料:- Elemental Quantities

功能分部數量 - Unit Costs per Elemental Quantities.

功能分部單價。

- Elemental Quantities

- Item Reference

Adjust published unit costs per floor area

- Some Consultant QS firms publish unit costs per floor area for public information.

- When using these unit costs, care should be exercised to understand the scope of inclusions and exclusions, and their applicability.

- The General Practice Division of the Hong Kong Institute of Surveyors has published a Building Cost Pro-Forma for Private Sector Developments in Hong Kong.pdf.

- This should serve as a useful checklist, but the items and figures suggested there should be verified for individual projects.

Presentation of cost estimates

- Rounding off:

- The quantities, unit rates and costs should be suitably rounded off.

- Word wrapping:

- Text in table cells should be word-wrapped to avoid hiding of text at the end.

- Comparison tables:

- When the cost estimates need to give comparison tables to show different options and the differences between options to help reading and appreciation of the relative costs, instead of showing all the columns of each option together, the columns can be re-arranged in the following sequence to save some space and enable easier reading:

|

Item |

Section |

Elemental Cost |

Difference from Original HK$ |

Cost per m2 CFA |

Remarks |

||||||

|

Original |

Option 1 |

Option 2 |

Option 1 |

Option 2 |

Original |

Option 1 |

Option 2 |

Option 1 |

Option 2 |

||

|

Item |

Section |

Elemental Qty |

Elemental Unit and Description |

Elemental Unit Rate |

Remarks |

|||||

|

Original |

Option 1 |

Option 2 |

Original |

Option 1 |

Option 2 |

Option 1 |

Option 2 |

|||

- When spanning over more than one page, the Item and Section columns and column header rows should be repeated.

- The contents under the Remarks columns can be very flexible, for adjustment methods, calculations, rationale, etc., subject only to space limitation.

- The remarks can be “Assumed no change”, “Original qty x 2”, “Original rate x 1.2”, etc.

- If there is not enough space, and the remarks are repeating, just insert “(a)”, “(b)”, “(c)”, in the Remarks columns, and define them below the table to mean:

- Legend:

- (a) Assumed no change

- (b) Original qty x 2

- (c) Original rate x 1.2 for higher rate due to complexity.

- Instead of showing the quantity and rate adjustments separately, the adjustment can be made directly against the cost, such as:

- Legend:

- (a) Option 1 CFA / Original CFA = 2

- (b) Original cost x 2

- (c) Original cost x 2 x 1.2 for higher rate due to complexity

- (d) Original cost x (new elemental qty / original elemental qty) x (new elemental unit rate / original elemental unit rate).

- Example (d) can in fact save the need to show the columns for elemental qty, unit and unit rates.

- The adjustment calculations can also cover inflationary factors.

Comments on specific ICMS Sub-Groups

Foundation piling

- Scope:

- This Sub-Group includes all foundation piling underneath the building with or without basement.

- Elemental quantity:

- Foundation piling supports the whole building.

- Its costs are more related to the total construction floor area (CFA) of the building including the basement CFA, which should be used as the elemental quantity.

- Elemental unit rate:

- Equals to unit cost per construction floor area based on some similar projects.

- Approximate quantities:

- The costs can be estimated, after consulting the Structural Engineer for a preliminary design, based on:

- Piling plant mobilisation and demobilisation – Item

- Piles – Number with each length/depth stated or total length/depth

- Pile testing – Item.

- It should be noted that the pile depths in ground and the pile core lengths are two different things.

- All ancillary work not measured should be allowed for in the rates.

- The costs can be estimated, after consulting the Structural Engineer for a preliminary design, based on:

Foundations up to top of lowest floor slabs

- Scope:

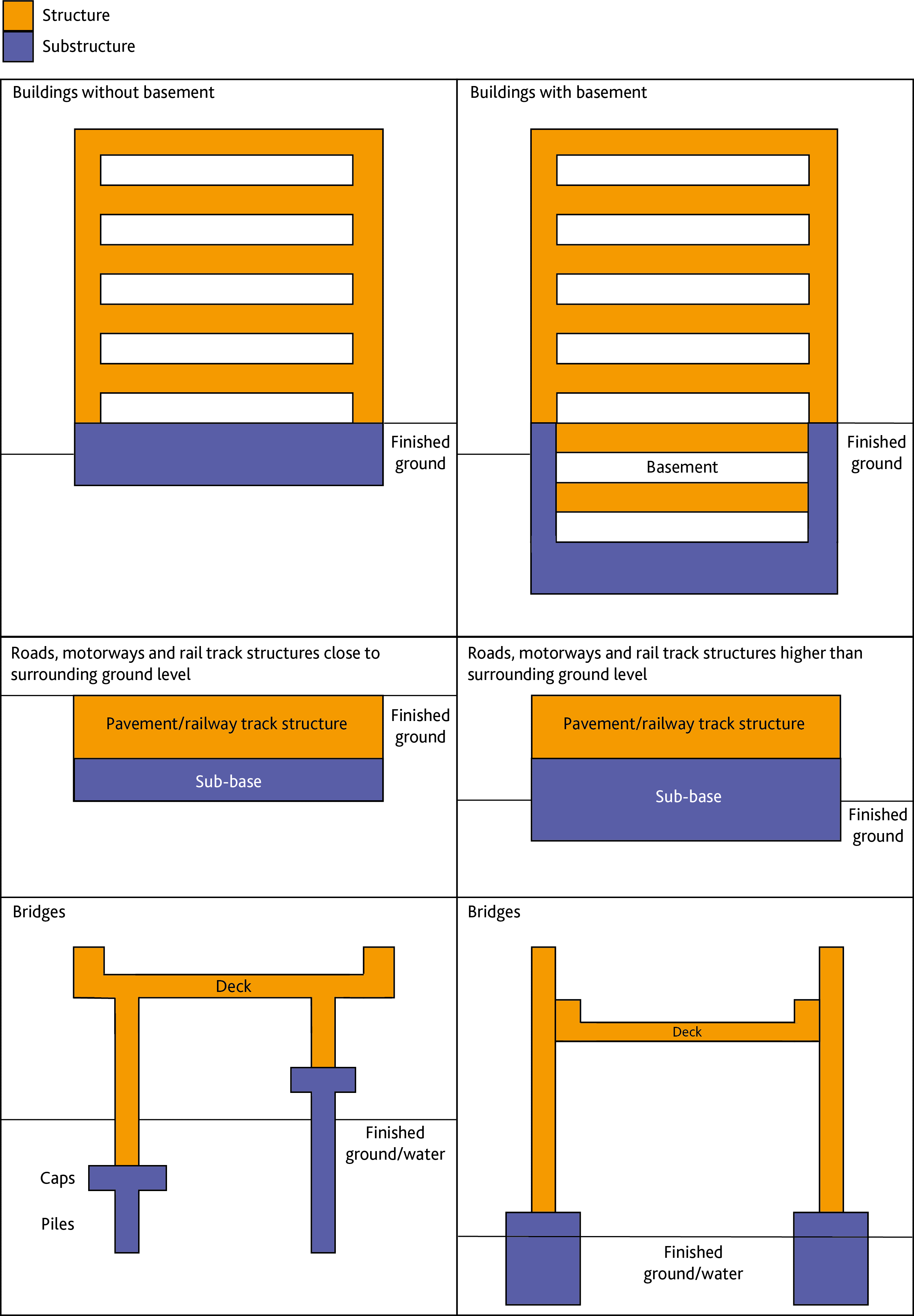

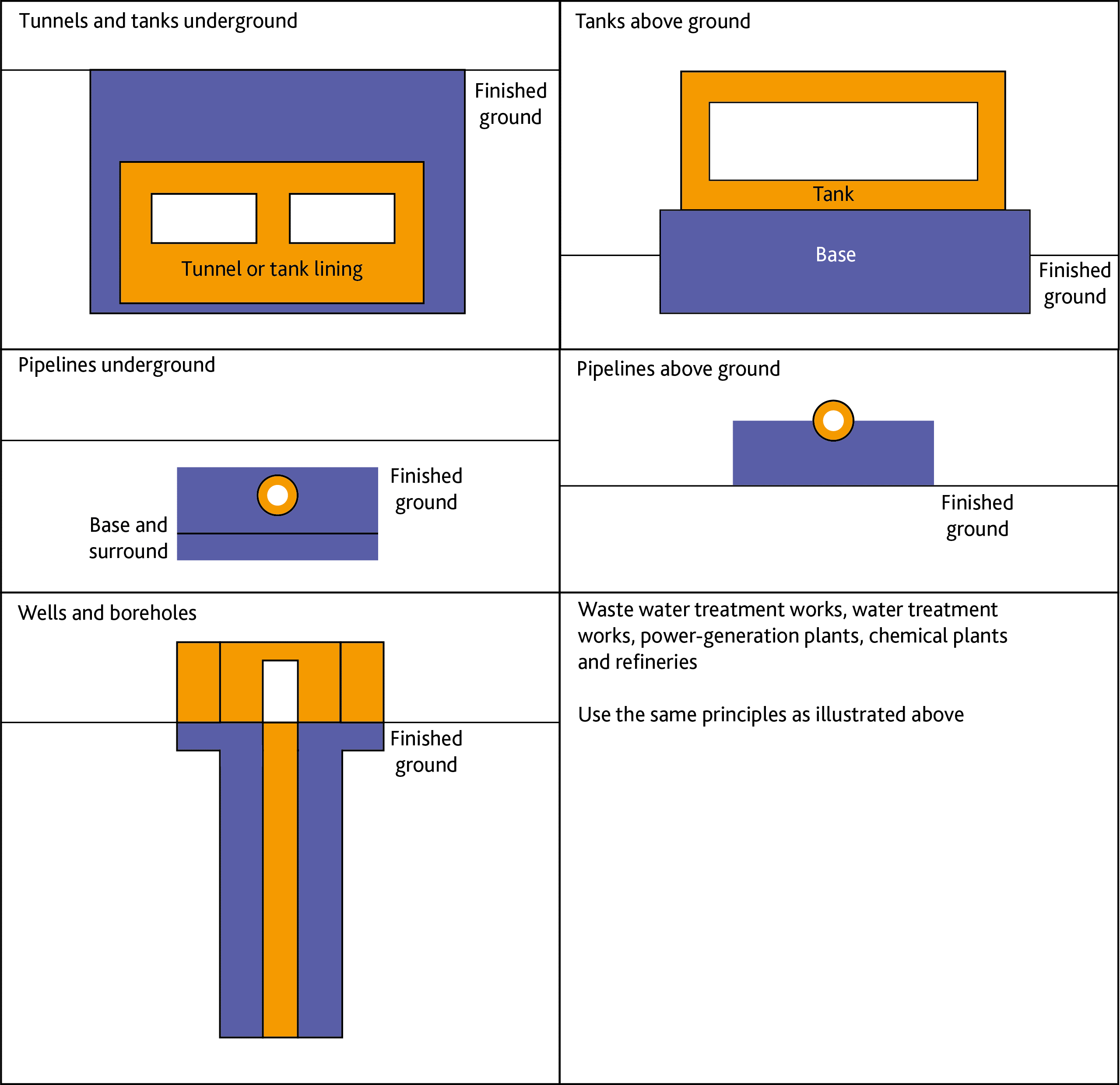

- This Sub-Group includes that shown in blue below (pile caps, footings, substructure columns and walls, and lowest floor slabs and beams) beyond the footprint of the basement, and excludes foundation piling.

- Foundations (excluding piles) underneath the basement are usually integrated with the basement bottom and should therefore be included in the “Basement sides and bottom”.

- Therefore, this Sub-Group's costs are not related to the basement footprint or the basement floor areas.

- Elemental quantity:

- Pile caps, footings and substructure columns and walls, which support the whole building, are more related to the total CFA and building height.

- Lowest floor slabs and beams are more related to the ground area (GA) of the building.

- On the conservative side, the total CFA should be used as the elemental quantity to obtain the elemental unit rate for future references.

- However, when applying this elemental unit rate to a building of significantly different building height and different CFA to GA ratio (approximately equal to the number of floors), the elemental unit rate can be broken into two parts for application.

- For example, from the cost analysis of a reference building:

- The unit rates at (a) and (d) can then be applied to the proposed building, subject to further adjustments for other dissimilarities.

- Similar method can be adopted to split the elemental unit rates into different parts to handle those parts which do not vary in proportion to the elemental quantity.

- Approximate quantities:

- For approximate quantity cost estimates, the costs can be, after consulting the Structural Engineer for a preliminary design, estimated based on:

- Excavation (rates to include disposal) – volume of excavation from commencing level of excavation to bottom of blinding layer with allowance for working spaces beyond the volume of the concrete work

- Lateral supports in the form of planking and strutting for shallow excavation – allowed for in the rates for excavation

- Lateral supports in the form of planking and strutting for deep excavation – as described for “Basement sides and bottom”

- Raft footings, pile caps, column bases, wall footings, strap beams and tie beams – concrete volume, formwork area and reinforcement weight

- Substructure walls and columns – ditto

- Lowest floor slabs and beams – ditto

- Lift pits – number.

- ICMS gives a good checklist of the above.

- All ancillary work not measured should be allowed for in the rates.

- The concrete member sizes can be based on the preliminary design drawings.

- Simplification into approximate average sizes x number can speed up the measurement.

- It may even be quicker to estimate the average thickness per the building footprint from the preliminary design drawings or from some reference projects of similar height or adjusted for the differences in heights.

- Following the same logic, the composite elemental unit rate build-up can be as follows:

- Average concrete thickness / building footprint @ $/m3

- Average formwork area / building footprint @ $/m2

- Average concrete thickness / building footprint x steel ratio kg/m3 concrete @ $/kg

- Average excavation depth / building footprint @ $/m3

- Sum of the above = composite rate / building footprint

- Of course, the concrete thickness and steel ratio should have taken into account the building height.

- For approximate quantity cost estimates, the costs can be, after consulting the Structural Engineer for a preliminary design, estimated based on:

Basement sides and bottom

- Scope:

- This Sub-Group includes that shown in blue below (sides and bottom) of a basement and excavation for the basement, and excludes foundation piling.

- This Sub-Group includes that shown in blue below (sides and bottom) of a basement and excavation for the basement, and excludes foundation piling.

- Elemental quantity:

- This is a difficult Sub-Group for choosing the appropriate elemental unit because:

- part of its costs is related to the volume of the basement (excavation, disposal, and shoring and strutting)

- part related to the basement footprint (basement bottom)

- part related to the side area (basement side and vertical retaining support which can be twice the basement depth).

- The volume of the basement should be the best choice for use as the elemental quantity.

- The basement floor area may also be a reflection of the volume.

- However, it would be better to estimate the costs from a number of approximate quantities rather than a single elemental quantity.

- This is a difficult Sub-Group for choosing the appropriate elemental unit because:

- Approximate quantities:

- For approximate quantity cost estimates, the costs can be, after consulting the Structural Engineer for a preliminary design, estimated based on:

- Excavation (rates to include disposal) – volume of excavation from commencing level of excavation to bottom of blinding layer with allowance for working spaces beyond the volume of the concrete work

- Vertical lateral support – area of excavated surfaces retained (from commencing level of excavation to bottom of blinding layer) x 2 or more to account for the embedded depth below the blinding layer

- Horizontal or raking shoring to lateral support - area of excavated surfaces retained (suitable for raking shoring) or volume of excavation (suitable for flying shoring, i.e. horizontal shoring spanning across the whole site with intermediate vertical posts to support), unless more detailed measurement is used

- Bottom slabs and blinding (including all foundations underneath but excluding piles) – concrete volume, formwork area and reinforcement weight

- Basement sides – area

- Vertical waterproof tanking, drainage blanket, drains and skin wall – area of tanking

- Horizontal waterproof tanking, drainage blanket, drains and topping slab – area of tanking

- Insulation – area

- Lift pits, sump pits, sleeves – number of lift pits and sump pits.

- ICMS gives a good checklist of the above.

- All ancillary work not measured should be allowed for in the rates.

- The concrete member sizes can be based on the average thicknesses from the preliminary design drawings or from some reference projects of similar height or adjusted for the differences in heights.

- Simpler cost build-up can take the following form:

- Volume of excavation – composite rates to cover excavation, disposal, and horizontal or raking shoring per m3 of excavation

- Area of basement bottom – composite rates to cover all horizontal elements, with different ratios per basement bottom area to account for different elements

- Area of basement sides – composite rates to cover all vertical elements, with different ratios per basement side area to account for different elements

- Lump sum – to cover other standalone elements.

- For approximate quantity cost estimates, the costs can be, after consulting the Structural Engineer for a preliminary design, estimated based on:

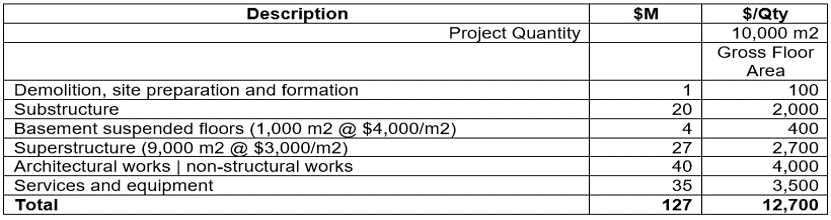

Basement suspended floors (up to top of ground floor slabs)

- Scope:

- This Sub-Group includes all structural walls and columns, beams, slabs and staircases inside the basement, but excludes basement sides and bottom.

- Elemental quantity:

- The elemental quantity should be the CFA of the basement.

- Elemental unit rate build-up (per basement CFA):

- Similar to that for the "Frames and slabs".

Frames and slabs (above top of ground floor slabs)

- Scope

- This Sub-Group includes all structural walls and columns, beams, slabs and staircases above the top of ground floor slabs.

- Elemental quantity

- The elemental quantity should be the CFA above ground, not the total CFA including the basement CFA.

- Elemental unit rate build-up (per CFA above ground):

| Concrete | m3 concrete / m2 floor area | @ $/m3 |

| Formwork | m2 formwork / m2 floor area | @ $/m2 |

| Reinforcement |

kg reinforcement / m3 concrete x m3 concrete / m2 floor area or kg reinforcement / m2 floor area |

@ $/kg |

- The quantity ratios are usually based on some similar projects or by sampling based on a typical bay.

Roof beams and slabs for Buildings under "Structure"

- Scope:

- Roofs can occur at the top of buildings or at lower floors. Any suspended floor without cover above is considered as a roof.

- “roof beams and slabs” for Buildings should also include such roofs at the top or at lower floors.

- In principle, the roof area on plan at various levels should be equal to the projected building footprint area on plan.

-

-

- Elemental quantity:

- The elemental quantity should be the roof area if roof beams and slabs are separately estimated.

- Otherwise, it should be part of the total CFA including the basement CFA.

External elevations

- Scope:

- This Sub-Group includes all external walls including applied finishes, cladding, curtain walls, windows, doors, shop fronts and shutters on the external elevations, but excludes external structural walls.

- Elemental quantity:

- The elemental quantity should be the external elevation area.

-

ICMS defines it as "total area of external wall finishes, facade cladding and curtain walls, windows, doors, shop fronts, roller shutters, fire shutters, etc. on the external elevations including all surfaces of

external railings, parapets and features, but ignoring the presence of canopies".

- Elemental unit rate build-up (per elevation area):

| Aluminium windows | a% elevation area | @ $/m2 |

| Finishes on structural walls, columns and beams | b% elevation area | @ $/m2 |

| External non-structural walls and finishes | c% elevation area | @ $/m2 |

| Roller shutters | d% elevation area | @ $/m2 |

- a%+b%+c%+d% = 100% elevation area.

- The percentages are approximate proportions of the total external elevation area of a sampled section of the elevation.

Roof finishes, skylights and landscaping (including waterproofing and insulation)

- Scope:

- This Sub-Group include those to such roofs at the top or at lower floors.

- Elemental quantity:

- Roof area

- Element unit rate build-up:

- Similar to other Sub-Groups.

Internal divisions

- Scope:

- This Sub-Group includes all kinds of divisions including internal windows, doors and shutters.

- Elemental quantity:

- The elemental quantity can be the total CFA including the basement CFA.

- Element unit rate build-up (per CFA):

| Internal non-structural concrete walls | m2 walls / m2 floor area | @ $/m2 |

| Internal brick walls | m2 walls / m2 floor area | @ $/m2 |

| Doors | No. of doors / m2 floor area | @ $/No. |

| etc. |

- The quantity factors are based on a similar project or approximate wall areas per construction floor area of a sampled floor, which layout may be just an educated guess.

- The wall areas have door openings deducted.

- The elemental quantity can also be the total wall areas without deducting door openings

-

The elemental unit rate build-up will then be (per total wall area):

| Internal non-structural concrete walls | a% of wall area | @ $/m2 |

| Internal brick walls | b% of wall area | @ $/m2 |

| Extra for doors | No. of doors / m2 wall area | @ $/No.# |

| etc. |

- a% + b% = 100%.

- # = after deducting cost of wall.

- The percentages are approximate proportions of the total wall area of a sampled floor, which layout may be just an educated guess.

Fittings and sundries

- Scope

- This Sub-Group basically includes all the metal work and joinery, and interior landscaping.

- Elemental quantity

- The elemental quantity can be the total CFA including the basement CFA, or the relevant functional quantity.

- Elemental unit rate:

- Generally based on similar projects.

Finishes under cover

- Scope

- This Sub-Group includes all floor and ceiling finishes and false ceilings whether internal or external, and internal wall finishes and cladding.

- Elemental quantity

- The elemental quantity can be the total CFA including the basement CFA.

- Elemental unit rate build-up of floor finishes (internal and external) (per CFA):

| Floor finish A | a% of floor area / CFA | @ $/m2 |

| Floor finish B | b% of floor area / CFA | @ $/m2 |

| Floor finish C | c% of floor area / CFA | @ $/m2 |

| Add 10% for skirting |

- a%+b%+c% = an estimated percentage of floor area / CFA after deducting voids, and wall and column base areas, i.e. less than 100% of CFA.

-

Elemental unit rate build-up of internal wall finishes and cladding (per CFA):

| Wall finish A | a% of wall area / CFA | @ $/m2 |

| Wall finish B | b% of wall area / CFA | @ $/m2 |

| Wall finish C | c% of wall area / CFA | @ $/m2 |

- The quantity factors are based on a similar project or approximate internal wall finishes areas per CFA of a sampled floor, which layout may be just an educated guess.

- Note the approximate formula: internal wall finishes = internal wall area x 2 + external wall area.

- False ceiling voids and unfinished lift shafts would affect this formula.

-

Elemental unit rate build-up of ceiling finishes and false ceilings (internal and external) (per CFA):

| Ceiling finish A | a% of ceiling area / CFA | @ $/m2 |

| Ceiling finish B | b% of ceiling area / CFA | @ $/m2 |

| Ceiling finish C | c% of ceiling area / CFA | @ $/m2 |

- a%+b%+c% = an estimated percentage of the ceiling area / CFA after deducting voids, and wall and column areas, but adding beam sides, i.e. more than 100% of CFA.

Services and equipment

- The costs of services and equipment are generally estimated based on $/CFA for each sub-system.

- If part of the building is not served by a sub-system, the CFA used may be only the area served.

- In the case of toilets and kitchens, the estimate may be based on the number of toilets and kitchens.

- For a more detailed cost analysis or cost estimate, the costs can be broken down into the following portions:

- Costs related to main equipment (chillers, cooling towers, air handling units, transformers, boilers, etc.)

- Costs related to terminal service outlets (air grilles, diffusers, lighting points, power points, sprinklers, speakers, cameras, sanitary fittings, etc.)

- Costs related vertical up-feed and down-feed

- Costs related to horizontal distribution

- Costs related to isolated locations (e.g. toilets, kitchens, plant rooms, etc.).

Movement systems

- While using the CFA as the elemental quantity for movement systems cannot be treated as wrong particularly when the CFA is big and there are many lifts and escalators, the cost should better be estimated based on cost per number of lift or escalator.

Elemental quantities based on % of other costs

- It would be more appropriate to use % of other costs (base costs) as the elemental quantities to allow for preliminaries and risk allowances as the base costs may change when the CFAs remain the same.

Steel ratios

- The steel ratios of structural walls and columns should be bigger than those for beams and slabs.

Unit cost / CFA of taller buildings

- The $/CFA of foundations, substructure and structure should be higher for taller buildings because of increased loading on the lower floors and increased wind load.

- The $/CFA of services and equipment should be higher for taller buildings because of longer running lengths of vertical pipes and cables, and increased lift speeds and capacities.

- Refuge floor would need to be added.

- Taller buildings take longer times to complete, causing higher unit rates and higher preliminaries costs. While it is usual to use the same % for preliminaries for different projects, when carrying out comparative cost studies for buildings with very different construction periods, the % should reflect the differences. Instead of adjusting all the unit rates, it may as well be simpler to adjust only the preliminaries to also cover the higher unit rates.

Composite rates for approximate quantities 組合單價的測算

Composite items

- The approximate quantity method measures major work items as composite items so as to reduce the need and time to break down the work items into components for detailed measurement.

- Examples are:

- lump sum allowances for mobilisation and demobilisation of major construction plant

- m or No. piles of specific cross-sectional size

- m3 excavation including disposal (backfill or remove from site)

- m2 or m concrete members including formwork and reinforcement

- m2 brick or block work including lintols

- m2 cladding or curtain walls or window walls or windows including glazing

- m or No. extra over m2 or m for special features

- No. doors including frames, architraves, fixings, glazing, painting, fire rating, etc.

- No. of major metal or joinery fittings

- m2 roof finishes including surface layer, protective screed, waterproofing layer, levelling screed, insulation, etc.

- m2 rendering including surface treatment

- m2 plastering including painting

- m2 tiling including screeding

- No. of vertical stacks of water supply or disposal pipes including all pipe fittings and ancillaries

- No. of kitchens or bath rooms or other serviced rooms including all sanitary fittings and branches

- No. of sanitary fittings including all accessories

- No. of terminal M&E fittings including conduits or wiring or cables

- No. of main M&E equipment

- m conduits or wiring or cables

- m2 ducts

- lump sum allowances for sundries

- lump sum for or No. of costly tests

- Different sizes or types may be separated or grouped together depending on their cost significance.

- Average sizes may be stated or varying sizes deemed.

Composite rates

- Building up of composite rates would be required for such composite items.

- Buffers should be allowed in the approximate quantities and composite rates to cover the costs of unmeasured minor items.

Using BIM

- When preliminary BIM models are used to generate quantities for preparing cost estimates, the quantities would not reflect the work items not modelled. Extra allowances in the approximate quantities or the composite rates should be made to cover the costs of unmodelled but necessary items.

Build-up of composite rates using properly set out dimension tables

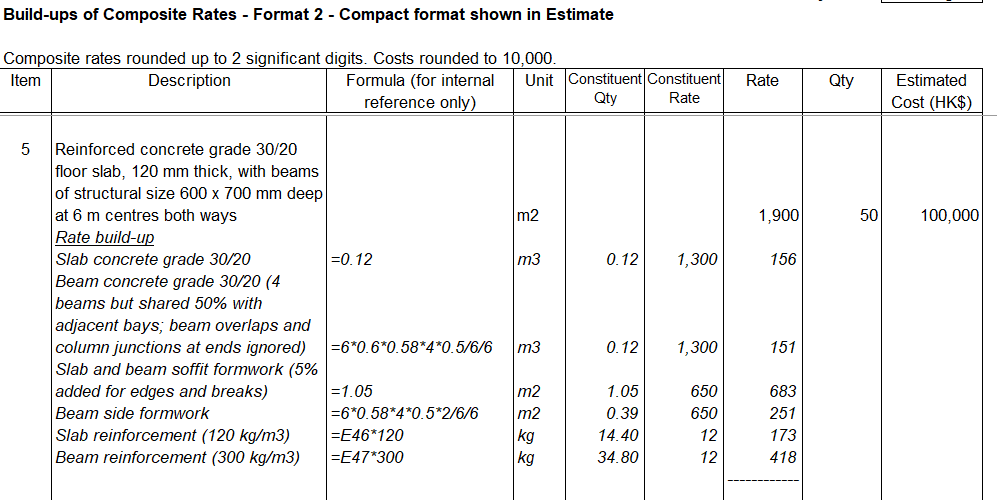

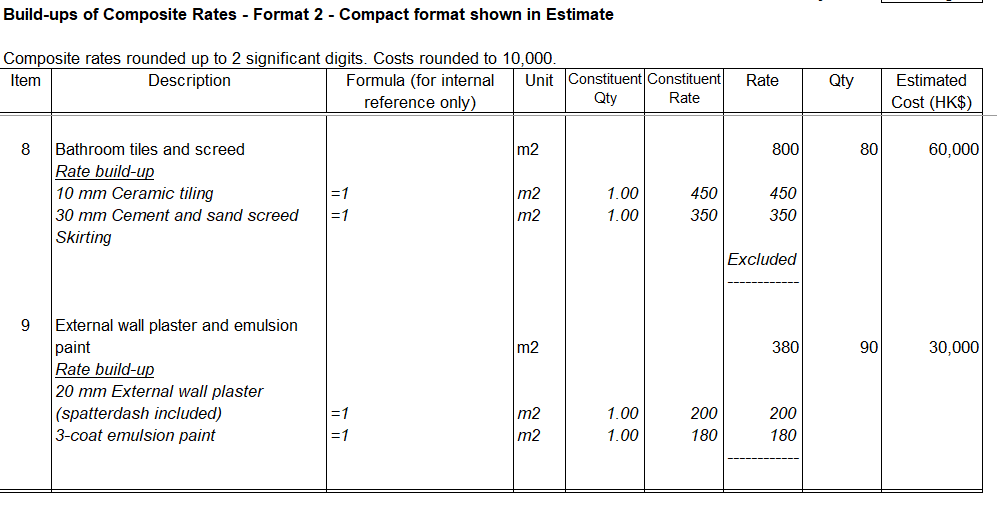

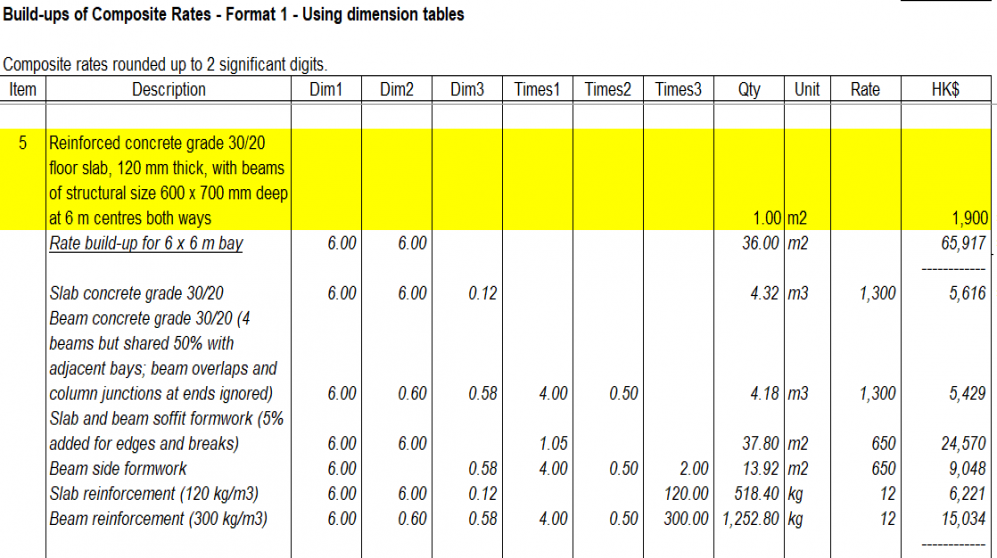

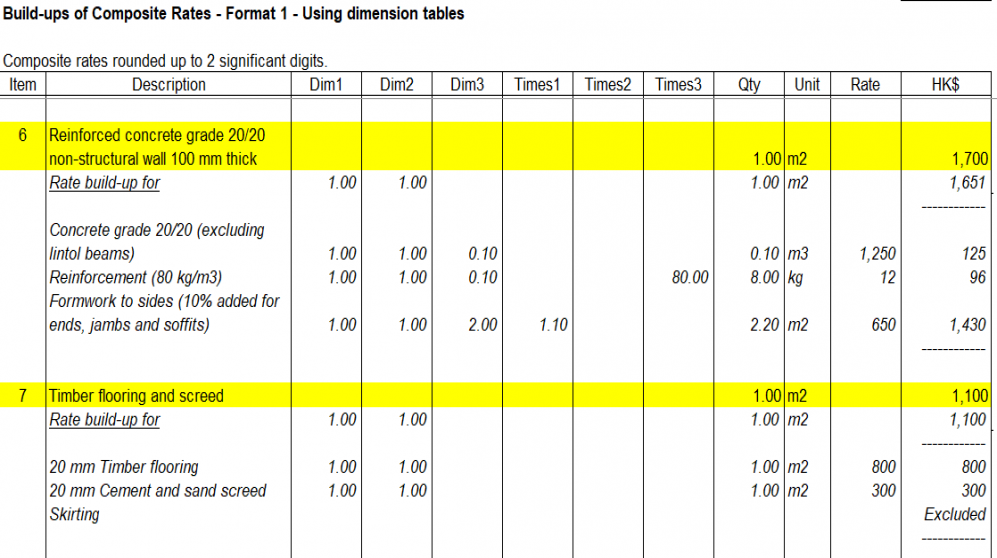

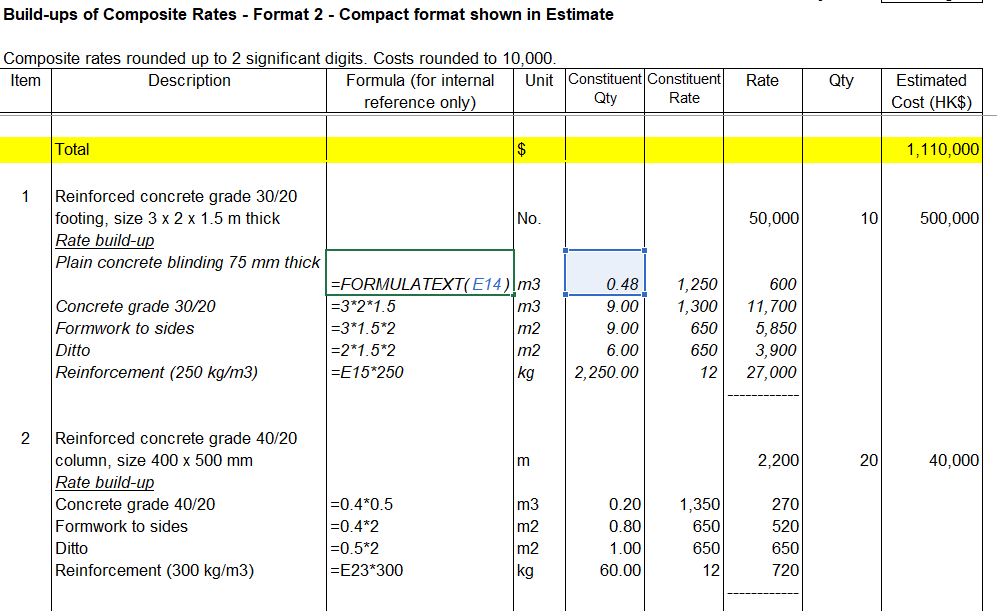

- The following gives examples of composite items and build-ups of composite rates.

- Example 1:

- Note that in Hong Kong, beam concrete and formwork are measured those parts below slab soffit. Beam reinforcement includes those at the intersection of slab and beam.

- Example 2:

-

- Note that a typical bay of 6 x 6 m is measured to average out the beam quantities.

- Note also that the four beams around each typical bay are shared with adjacent slabs, and their quantities are therefore halved.

-

- Example 3:

-

-

- Example 4:

(first image added, 18/2/2023)

Handling empty cells instead of entering “1”

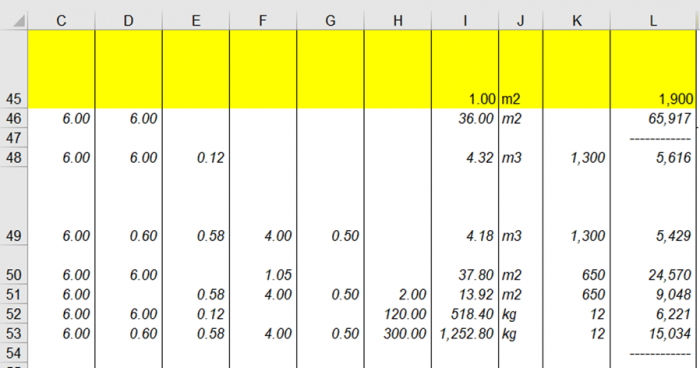

- Note that 36.00 at cell I46 uses the formula: "=PRODUCT(C48:H48)" which can treat empty cells within the range of C48:H48 as 1 without the need for entering 1.

- However, if the individual cell values within the range of C48:H48 contain more than 2 decimal places, the PRODUCT() function using the hidden values will not give the same result as the displayed value. To ensure proper match, a formula based on the displayed values should be used. Such accuracy would be required for Bills of Quantities and Final Account and should not be needed for Cost Estimates.

(added, 5/3/2023)

Using dash lines to bound ranges

- Note that 65,917 at cell L46 uses the formula "=SUM(L47:L54)" which covers the range from the upper dash line to the lower dash line. Those dash lines embrace the rows of constituent items between them and ensure that the formula will not be corrupted due to addition or deletion of rows.

(added, 5/3/2023)

Round unit rates to 2 significant digits

- Note that 1,900 = 65,917/36.00 = 1,831.03 has been rounded up to two significant digits as 1,900.

The formula used is "=IF(INT(L46/I46)>0,ROUNDUP(L46/I46,2-LEN(INT(L46/I46))),ROUNDUP(L46/I46,2))".- The formula used is "=IF(ABS(L46/I46)>1, ROUNDUP(L46/I46, 2-INT(LOG10(ABS(L46/I46)))-1), ROUNDUP(L46/I46, 2))".

- L46/I46 is the quotient. Let's call it "Q".

The formula will become "=IF(INT(Q)>0,ROUNDUP(Q,2-LEN(INT(Q))),ROUNDUP(Q,2))".- The formula will become "=IF(ABS(Q)>1, ROUNDUP(Q, 2-INT(LOG10(ABS(Q)))-1), ROUNDUP(Q, 2))".

It can be read as: if integer of Q > 0, then round it to 2 significant digits, else round up Q to 2 decimal places).- It can be read as: if absolute number of Q > 1, then give 2 significant digits, else give 2 decimal places, always round up (away from zero)).

Q = 1831.03, INT(Q) > 0.- Q = 1831.03 or -1831.03, ABS(Q) > 1.

2 - LEN(INT(Q)) = 2 - 4 = -2.- 2 - INT(LOG10(ABS(Q))) - 1 = 2 - 3 - 1 = -2.

- ROUNDUP(1831.03, -2) = 1900.

- If Q = 0.1234 or -0.1234, then ROUNDUP(Q, 2) = 0.13 or -0.13.

- The unit rates used in Cost Estimates are approximate rates.

- It would not make sense to show them in many digits and with decimal places to make them look like very accurate.

- 2 significant digits should be sufficient.

- Estimates should include buffers.

- Rounding up is appropriate.

(added, 5/3/2023)

(formula revised to handle negative numbers, 20/1/2026)

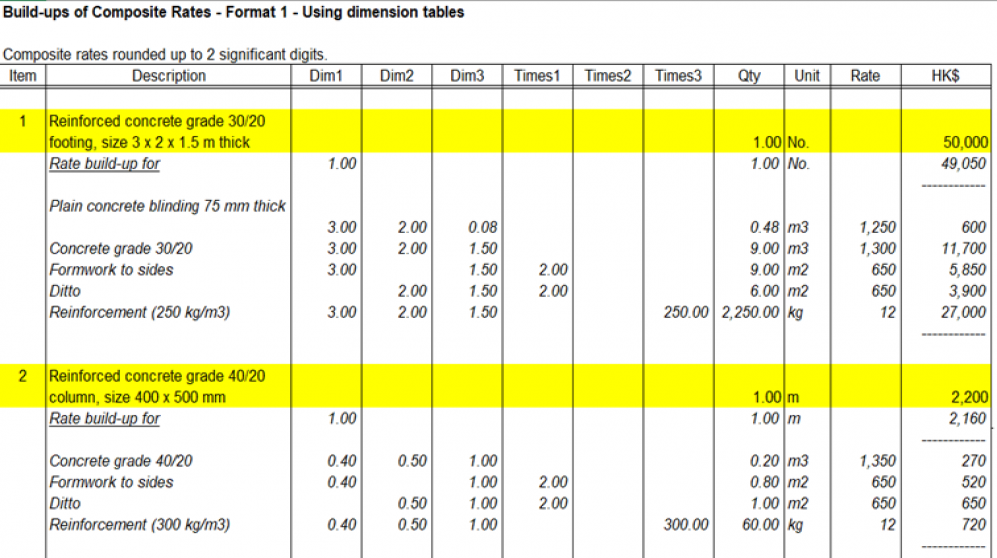

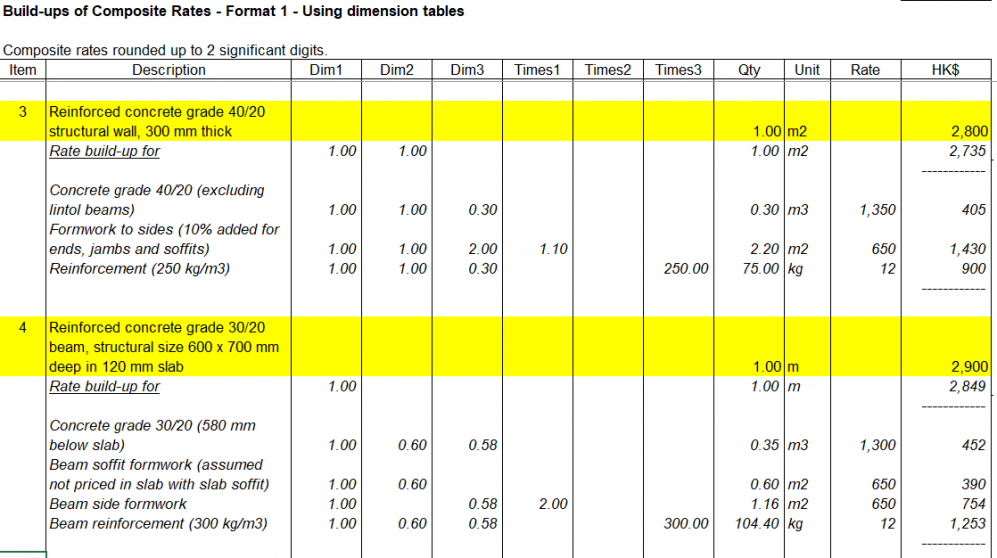

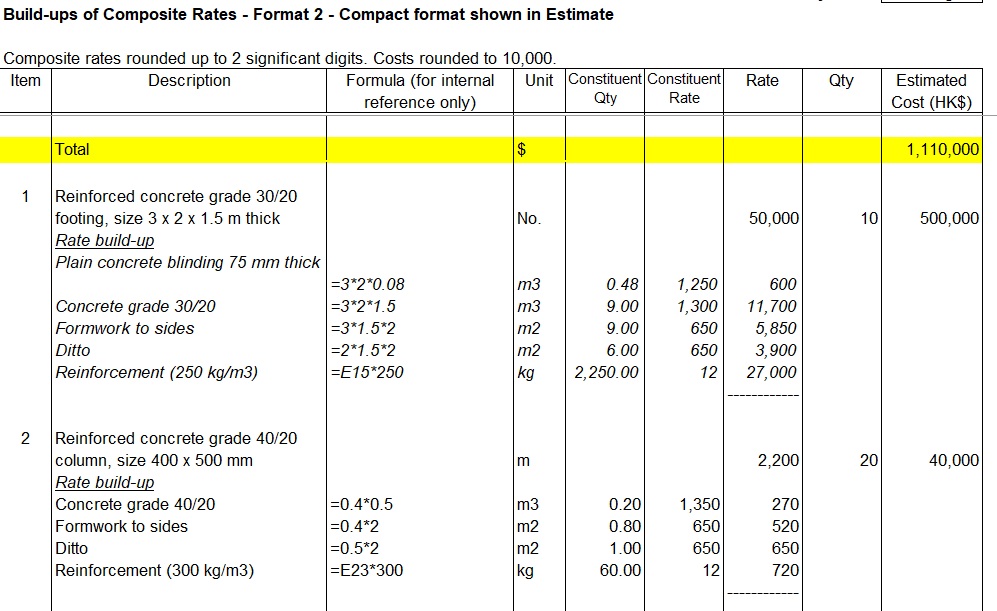

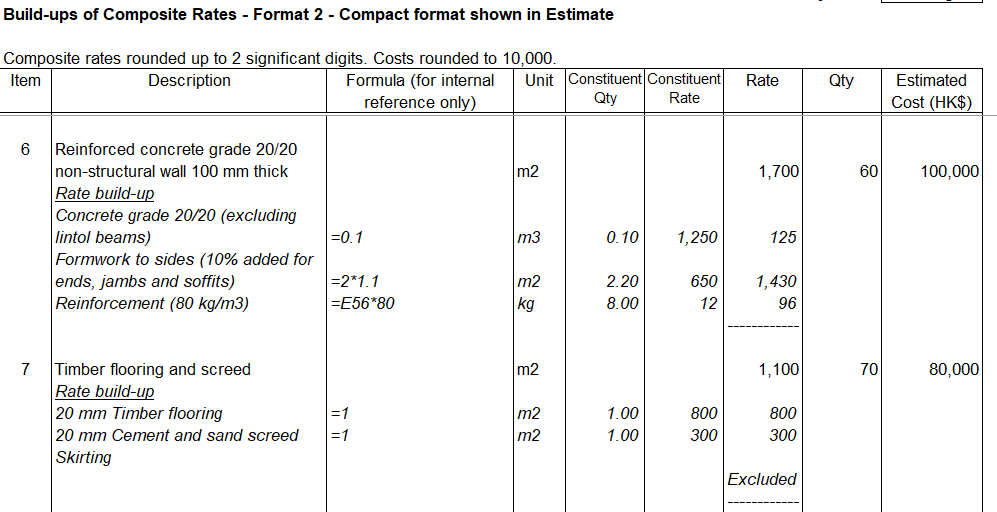

Build-up of composite rates using compact format for showing in the Cost Estimate

- The following shows another method to present the composite rate calculations in the Cost Estimate.

- Example 5:

- Note that the reinforcement refers to the concrete quantities already calculated at cells E15 and E23 above.

- Example 6:

- Note that the function FORMULATEXT() is used to display the formula of the quantity of 0.48 above for checking. The cell entry must be preceded with "=" for it to be recognised as a formula.

- Using this function will eliminate the need to type the formula separately as an explanation in addition to entering the formula in the calculation cell and risking mismatch errors.

- The formula column can be hidden or deleted when issuing the Cost Estimate.

- Note also that the estimated costs have been rounded to the nearest 10,000, using the formula "=ROUND(Rate*Qty, -4)".

- This would give the image that the figure is an approximate estimate rather than an accurate figure.

- Example 7:

- Example 8:

- Example 9:

- Example 10:

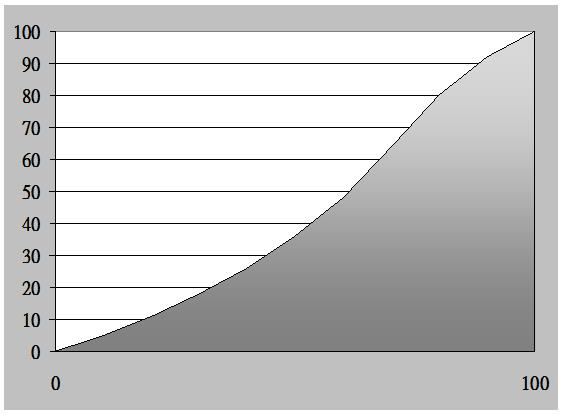

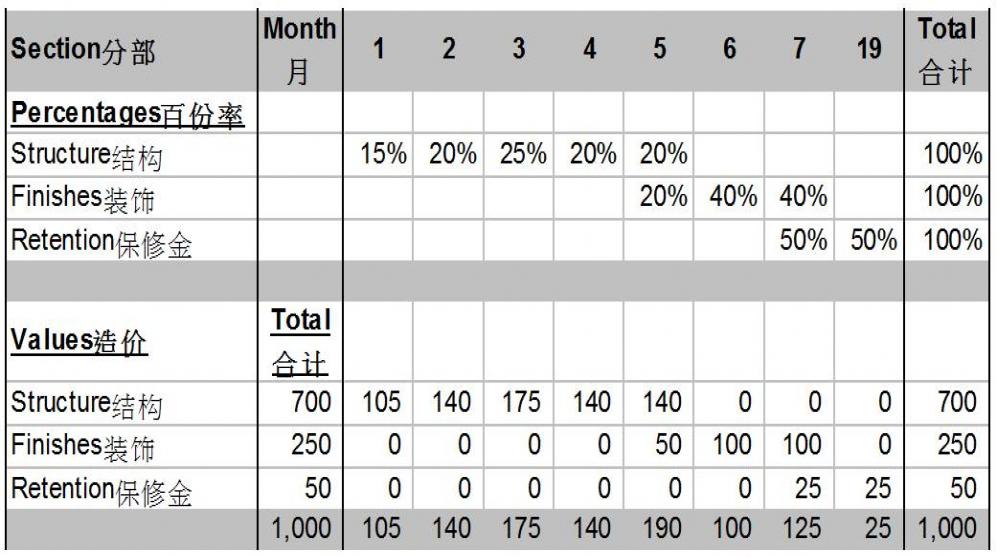

Prepare cash flow tables 編製現金流量表

Use S-curve 用S線圖

- Divide the horizontal axis into parts equal to the number of months of construction.

將水平軸按施工的月份數目分段 - For each month, interpolate from the curve the cumulative payment percentage on the vertical axis.

利用曲線找出每個月在垂直軸相對的累計進度百份率 - Find the monthly payment percentages from the cumulative percentages.

用累計進度百份率計出每月進度百份率 - Apply the monthly payment percentages to the total cost to obtain the monthly payment values.

每月進度百份率乘總造價得出每月進度款。

Use Bar Chart Programmes 用條形進度計畫表

- Follow the bar chart programme, assign the monthly payment percentages for each activity bar.

跟從條形進度計企劃表,對每條活動配以每月進度百份率 - Apply the monthly payment percentages to the total cost of each activity bar to obtain the monthly payment values.

將每月進度百份率乘該條活動的造價得出每月進度款 - Ensure that the total of each activity bar is correct.

確保每條活動的合計無誤。

For both methods

- Separate stage payments.

要把分期付款及大型採購分列 - Separate Retention.

要把保修金分列 - Watch out time lag between work carried out, payment certification and honouring of payment.

注意施工、批款及付款的時間差。 -

Payment terms:

- Usual payment terms for construction contracts in Hong Kong:

- no advance payment;

- monthly payments for materials delivered to site and work done subject to 10% retention on the gross total up to a maximum equal to 5% of the original Contract Sum;

- half of the retention to be released upon Practical Completion / Substantial Completion (*); and

- the balance to be released upon the issue of the Defects Rectification Certificate / Certificate of Completion of Making Good Defects / Maintenance Certificate (*) after rectification of defects found during the Defects Liability Period / Maintenance Period (*) usually of 12 months.

- (*) = Different terms used by different standard forms of contract.

- Possible payment terms for lift and escalator contracts / sub-contracts:

- 10% upon award;

- 20% when ready for shipment;

- 30% on delivery to site;

- 25% on issue of Use Permit by the EMSD;

- 10% on Practical Completion / Substantial Completion; and

- balance upon the issue of the Defects Rectification Certificate (as above).

- Suppliers:

- Usually require deposits or advance payments which can be moderately up to 30% or sometimes up to 50%.

- Lower tiers sub-contractors:

- Require shorter payment periods and no retention.

- Usual payment terms for construction contracts in Hong Kong:

Reconciliation 概算變化的解釋

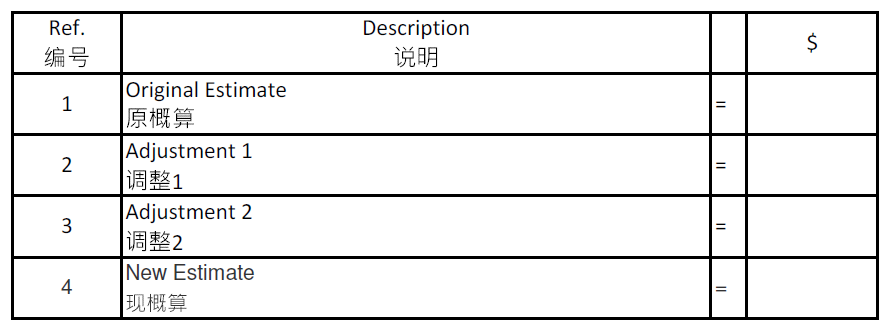

- Presented vertically:

垂直列出:

- Presented side by side:

並排表示:

- A legend of “(a)”, “(b)”, “(c)”, etc. can be used for stating common reasons, similar to the legends suggested for “comparison tables” under “Presentation of Cost Estimates” above.

Pre-tender Estimates 標底

- Method:

- By pricing the Bills of Quantities before formal issue of tender documents or before return of tenders.

在發出招標檔前或在回標前利用工程量清單套取單價計價。

- By pricing the Bills of Quantities before formal issue of tender documents or before return of tenders.

- Purposes:

- For checking whether the cost so priced is within the previous estimate and the Budget

以檢查得出的總價是否仍在前概算或投資預算之內 - For making design changes and issuing tender addendum to keep the costs within the Budget

作出設計修改並發出招標檔變更通知以便維持造價在投資預算之內 - For checking against tenders returned for reasonableness

用作評核回標價的合理性。

- For checking whether the cost so priced is within the previous estimate and the Budget

International Cost Management Standard

International Cost Management Standard KCTangNote

- 28/10/2025: Whole life carbon assessment mapping figure added. Examples of Different Kinds of Cost Estimates, Key Quantities and Key Units, and Further Reading added

- 15/3/2022: Expanded.

- 7/3/2022: Split from Pre-Contract Cost Planning and Control.

Intro

- International Cost Management Standard (ICMS) (https://icms-coalition.org/the-standard/), formally called "International Construction Measurement Standards", is intended to provide global consistency in presenting construction life cycle costs and carbon emissions.

Aims

- Provide global consistency in classifying, defining, measuring, recording, analysing and presenting entire construction life cycle costs and carbon emissions at a project, regional, state, national or international level.

- Allow costs and carbon emissions to be managed and potentially reduced.

- Allow:

- construction life cycle costs and carbon emissions to be consistently and transparently benchmarked (comparative benchmarking)

- the causes of differences in life cycle costs and carbon emissions between projects to be identified (option appraisal)

- properly informed decisions on the design and location of construction projects to be made at the best value for money (investment decision-making) and

- data to be used with confidence for construction project financing and investment, decision-making, and related purposes (certainty).

Characteristics

- Global: co-existing with the locals.

- High level.

- For the first time, building works, civil engineering works and carbon emissions are now also covered by the same classification at the high level.

- Same for costs and carbon emissions.

Timeline

- 17 June 2015: Formation of ICMS Coalition – a non-governmental, not-for-profit professional coalition.

- November 2015: Standards Setting Committee starting to work.

- July 2017: Release of the 1st Edition covering capital construction costs of building and civil engineering works,

- August 2019: Release of the 2nd Edition extended to cover other life cycle costs and more civil engineering project types at the PAQS Congress in Malaysia.

- November 2021: Release of the 3rd Edition extended to cover carbon emissions and more civil engineering project types. Change of names to International Cost Management Standard and Standard Setting Committee.

Evolution of cost classification

- "elements" in the traditional QS sense was called "Cost Groups" and "Cost Sub-Groups" in ICMS 1 and 2.

- With the addition of carbon emissions in ICMS 3, it is now called "Groups" and "Sub-Groups" to make them common for costs and carbon emissions.

Hierarchical framework

- Simple

- This framework is simpler than that commonly used in Hong Kong, which is for building works only.

- Shared groups

- Construction, Renewal and Maintenance all share the same Groups.

- Composite and prefabricated work

- It is covered.

- Development budget

-

For new developments, the total of the Acquisition Costs and Construction Costs represents the capital cost of development or development budgetary cost.

-

Codes

- Code: 01.2.03.030

- Meaning: Buildings: Construction: Structure: Frames and slabs (above top of ground floor slabs).

| Level 1 | Project Type | 01. | Buildings |

| Level 2 | Category | 2. | Construction |

| Level 3 | Group | 03. | Structure |

| Level 4 | Sub-Group | 030 | Frame and Slabs |

Relationship between ICMS, LCC and WLC

- 'Occupancy Costs' are considered as part of the 'Non-Construction Costs'.

- Compatible with ISO 15686-5:2017 Buildings and constructed assets – Service life planning – Part 5: Life-cycle costing.

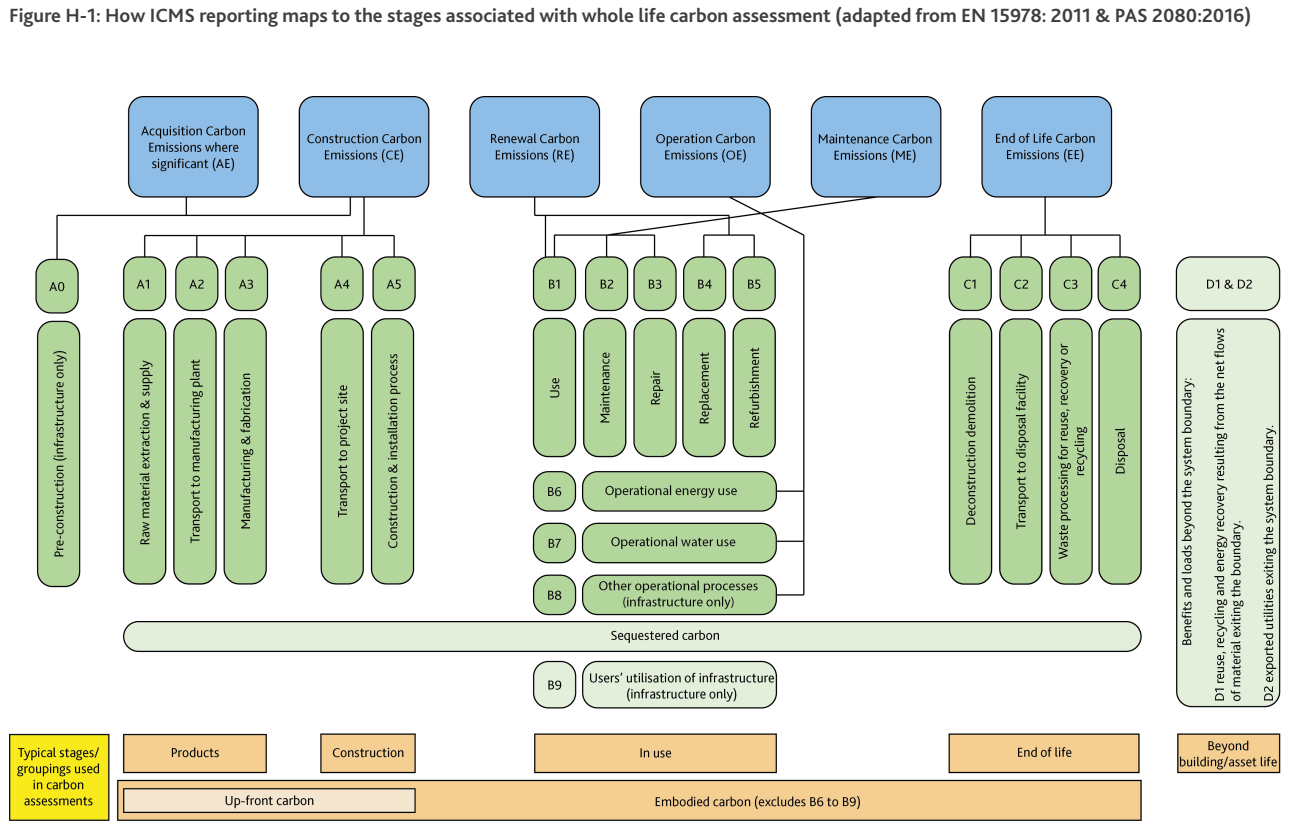

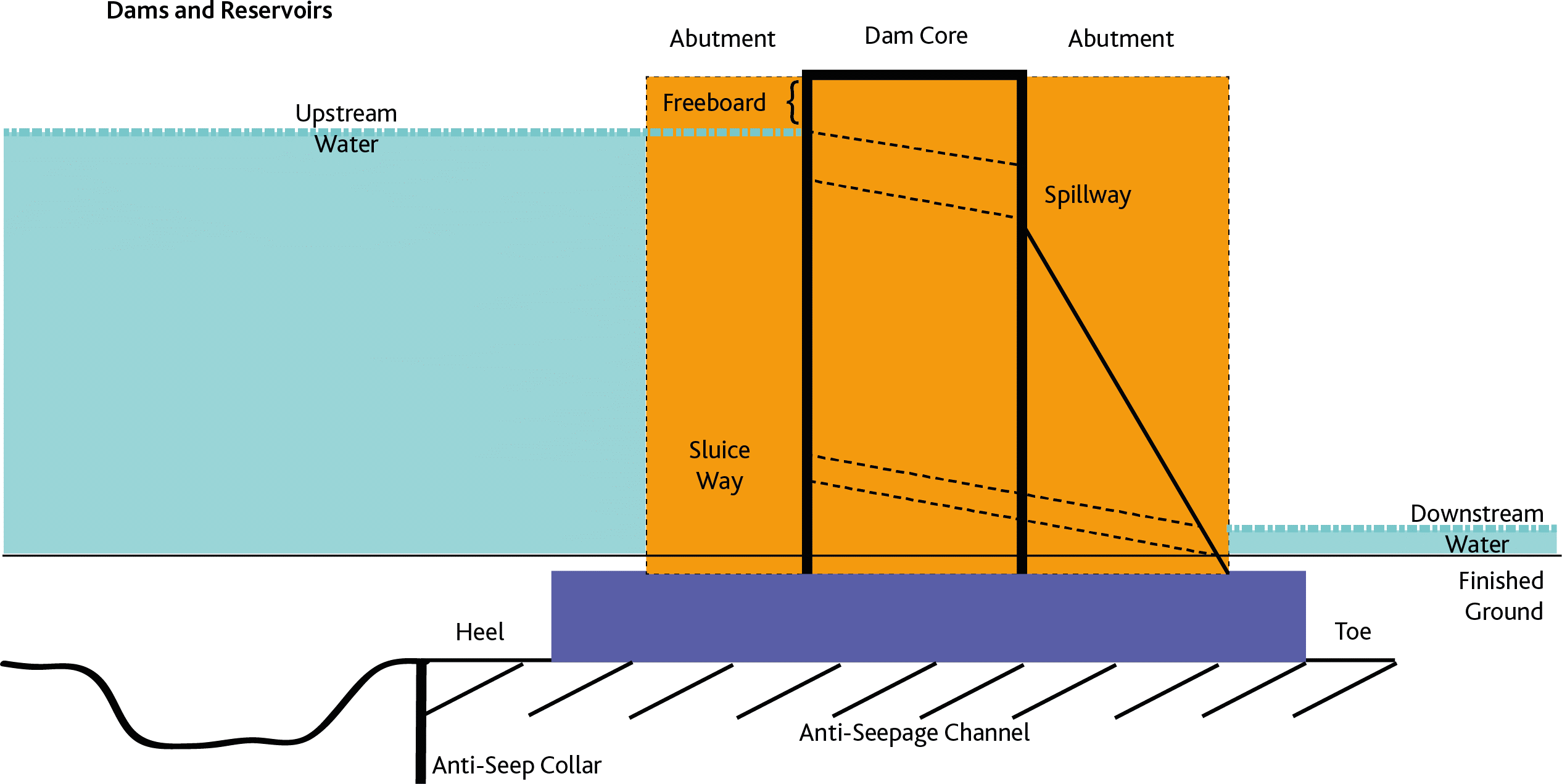

Carbon reporting framework

- The reporting structures for costs and carbon emissions are identical.

- Mapping to EN 15678: 2011 & PAS 2080:2026:

(Figure added, 29/10/2025)

Groups and Sub-Groups

Acquisition Groups and Sub-Groups

-

Carbon emissions are reported for Acquisition only if they are significant.

-

2-digit code for Groups and 3-digit code for Sub-Groups.

| Code | Description | |

| Group (Level 3) | ||

| Sub-Group (Level 4) | ||

| 1. | Acquisition Costs (AC) | Acquisition Carbon Emissions (AE) (each Sub-Group includes Risk Allowances | |

| 01. | Site acquisition | |

| 01.010 | Costs and premium required to procure site | |

| 01.020 | Compensation to existing occupiers | |

| 01.030 | Demolition, removal and modification of existing properties by way of payment to existing owners instead of carrying out physical work | |

| 01.040 | Contributions for the preservation of heritage, culture and environment | |

| 01.050 | Related fees to agents, lawyers, and the like | |

| 01.060 | Related taxes and statutory charges | |

| 02. | Administrative, finance, legal and marketing expenses | |

| 02.010 | Client’s general office overheads | |

| 02.020 | Client’s project-specific administrative expenses: | |

| • in-house project management and design team | ||

| • supporting project staff | ||

| • project office venue, furniture and equipment if not included in Constructor’s preliminaries | site overheads | ||

| • stores and workshops | ||

| • safety and insurances | ||

| • staff training | ||

| • accommodation and travelling expenses for in-house team and external parties | ||

| 02.030 | Interest and finance costs | |

| 02.040 | Legal expenses | |

| 02.050 | Accounting expenses | |

| 02.060 | Sales, leasing, marketing, advertising and promotional expenses | |

| 02.070 | Taxes and statutory charges related to sales and lease | |

| 02.080 | License and permit charges for operation and use | |

Construction | Renewal | Maintenance Groups and Sub-Groups: Buildings

-

Carbon emissions are reported at the Sub-Group level by exception.

-

2-digit code for Groups and 3-digit code for Sub-Groups.

| Code | Description | |

| Group (Level 3) | ||

| Sub-Group (Level 4) | ||

| 2. | Construction Costs (CC) | Construction Carbon Emissions (CE) | |

| 3. | Renewal Costs (RC) | Renewal Carbon Emissions (RE) | |

| 5. | Maintenance Costs (MC) | Maintenance Carbon Emissions (ME | |

| (CC | CE, RC | RE, and MC | ME share the same Groups below, so far as applicable. Those separated by ‘ | ’ in [ ] are respective alternative terms.) | ||

| 01. | Demolition, site preparation and formation | |

| 01.010 | Site survey and ground investigation | |

| 01.020 | Environmental treatment | |

| 01.030 | Sampling of hazardous or useful materials or conditions | |

| 01.040 | Temporary fencing | |

| 01.050 | Demolition of existing buildings and support to adjacent structures | |

| 01.060 | Site surface clearance (clearing, grubbing, topsoil stripping, tree felling, minor earthwork, removal) | |

| 01.070 | Tree transplant | |

| 01.080 | Site formation and slope treatment | |

| 01.090 | Temporary surface drainage and dewatering | |

| 01.100 | Temporary protection, diversion and relocation of public utilities | |

| 01.110 | Erosion control | |

| 02. | Substructure | |

| 02.010 | Foundation piling and underpinning: | |

| • mobilisation and demobilisation | ||

| • trial piles and caisson | ||

| • permanent piles and caisson | ||

| • pile and caisson testing | ||

| • underpinning | ||

| 02.020 | Foundations up to top of lowest floor slabs: | |

| • excavation and disposal | ||

| • lateral supports | ||

| • raft footings, pile caps, column bases, wall footings, strap beams, tie beams | ||

| • substructure walls and columns | ||

| • lowest floor slabs and beams (excluding and beyond basement bottom slabs) | ||

| • lift pits | ||

| • composite or prefabricated work | ||

| 02.030 | Basement sides and bottom: | |

| • excavation and disposal | ||

| • lateral supports | ||

| • bottom slabs and blinding | ||

| • sides | ||

| • vertical waterproof tanking, drainage blanket, drains and skin wall | ||

| • horizontal waterproof tanking, drainage blanket, drains and topping slab | ||

| • insulation | ||

| • lift pits, sump pits, sleeves | ||

| • composite or prefabricated work | ||

| 03. | Structure | |

| 03.010 | Structural removal and alterations | |

| 03.020 | Basement suspended floors (up to top of ground floor slabs): | |

| • structural walls and columns | ||

| • beams and slabs | ||

| • staircases | ||

| 03.030 | Frames and slabs (above top of ground floor slabs): | |

| • structural walls and columns | ||

| • upper floor beams and slabs | ||

| • roof beams and slabs | ||

| • staircases | ||

| • fireproofing to steel structure | ||

| 03.040 | Tanks, pools, sundries | |

| 03.050 | Composite or prefabricated work | |

| 04. | Architectural works | Non-structural works | |

| 04.010 | Non-structural removal and alterations | |

| 04.020 | External elevations: | |

| • non-structural external walls and features | ||

| • external wall finishes except cladding | ||

| • facade cladding and curtain walls | ||

| • external windows | ||

| • external doors | ||

| • external shop fronts | ||

| • roller shutters and fire shutters | ||

| 04.030 | Roof finishes, skylights and landscaping (including waterproofing and insulation): | |

| • roof finishes | ||

| • skylights | ||

| • other roof features | ||

| • roof landscaping (hard and soft) | ||

| 04.040 | Internal divisions: | |

| • non-structural internal walls and partitions | ||

| • shop fronts | ||

| • toilet cubicles | ||

| • moveable partitions | ||

| • cold rooms | ||

| • internal doors | ||

| • internal windows | ||

| • roller shutters and fire shutters | ||

| • sundry concrete work | ||

| 04.050 | Fittings and sundries: | |

| • balustrades, railings and handrails | ||

| • staircases and catwalk not forming part of the structure, cat ladders | ||

| • cabinets, cupboards, shelves, counters, benches, notice boards, blackboards | ||

| • exit signs, directory signs | ||

| • window and door dressings | ||

| • decorative features | ||

| • interior landscaping | ||

| • access panels, fire service cabinets | ||

| • sundries | ||

| 04.060 | Finishes under cover: | |

| • floor finishes (internal and external) | ||

| • internal wall finishes and cladding | ||

| • ceiling finishes and false ceilings (internal or external) | ||

| 04.070 | Builder’s work in connection with services: | |

| • plinth, bases | ||

| • fire-proofing enclosure | ||

| • hoisting beams, lift pit separation screens, lift shaft separator beams | ||

| • suspended manholes | ||

| • cable trenches, trench covers | ||

| • sleeves, openings and the like not allowed for in ‘Fittings and sundries’ | ||

| 04.080 | Composite or prefabricated work | |

| 05. | Services and equipment | |

| 05.010 | Heating, ventilating and air-conditioning systems/air conditioners: | |

| • seawater system | ||

| • cooling water system | ||

| • chilled water system | ||

| • heating water system | ||

| • steam and condensate system | ||

| • fuel oil system | ||

| • water treatment | ||

| • air handling and distribution system | ||

| • condensate drain system | ||

| • unitary air-conditioning system | ||

| • mechanical ventilation system | ||

| • kitchen ventilation system | ||

| • fume and smoke extraction system | ||

| • anaesthetic gas-extraction system | ||

| • window and split-type air conditioners | ||

| • air-curtains | ||

| • fans | ||

| • related electrical and control systems | ||

| • submissions, testing and commissioning | ||

| 05.020 | Electrical services: | |

| • high-voltage transformers and switchboards | ||

| • incoming mains, low-voltage transformers and switchboards | ||

| • mains and submains | ||

| • standby system | ||

| • lighting and power | ||

| • uninterruptible power supply | ||

| • electric underfloor heating | ||

| • local electrical heating units | ||

| • earthing/lightning protection and bonding | ||

| • submissions, testing and commissioning | ||

| 05.030 | Fitting out lighting fittings | |

| 05.040 | Extra low voltage electrical services: | |

| • information and communications technology system | ||

| • staff paging/location | ||

| • public address system | ||

| • building automation | ||

| • security and alarm | ||

| • close circuit television | ||

| • communal aerial broadcast distribution and the like | ||

| • submissions, testing and commissioning | ||

| 05.050 | Water supply and drainage above ground or inside basement: | |

| • cold water supply | ||

| • hot water supply | ||

| • flushing water supply | ||

| • grey water supply | ||

| • cleansing water supply | ||

| • irrigation water supply | ||

| • rainwater disposal | ||

| • soil and waste disposal | ||

| • planter drainage disposal | ||

| • kitchen drainage disposal | ||

| • related electrical and control systems | ||

| • submissions, testing and commissioning | ||

| 05.060 | Supply of sanitary fittings and fixtures (installation included in ‘Water supply and above ground drainage’ unless not separable from costs of ‘Fittings and sundries’) | |

| 05.070 | Disposal systems: | |

| • refuse | ||

| • laboratory waste | ||

| • industrial waste | ||

| • incinerator | ||

| • submissions, testing and commissioning | ||

| 05.080 | Fire services: | |

| • fire hydrant and hose reel system | ||

| • wet risers | ||

| • sprinkler system | ||

| • deluge system | ||

| • gaseous extinguishing system | ||

| • foam extinguishing system | ||

| • audio/visual advisory system | ||

| • automatic fire alarm and detection system | ||

| • portable hand-operated appliances and sundries | ||

| • related electrical and control systems | ||

| • submissions, testing and commissioning | ||

| 05.090 | Gas services: | |

| • coal gas | ||

| • natural gas | ||

| • liquid petroleum gas | ||

| • medical gas/laboratory gas | ||

| • industrial gas/compressed air/instrument air | ||

| • vacuum | ||

| • steam | ||

| • submissions, testing and commissioning | ||

| 05.100 | Movement systems: | |

| • lifts | elevators | ||

| • platform lifts | ||

| • escalators | ||

| • travellators | moving walkways | ||

| • conveyors | ||

| • submissions, testing and commissioning | ||

| 05.110 | Gondolas | |

| 05.120 | Turntables | |

| 05.130 | Generators | |

| 05.140 | Energy-saving features | |

| 05.150 | Water and wastewater treatment equipment | |

| 05.160 | Fountains, pools and filtration plant | |

| 05.170 | Powered building signage | |

| 05.175 | Audio/visual entertainment system | |

| 05.180 | Kitchen equipment | |

| 05.190 | Cold room equipment | |

| 05.200 | Laboratory equipment | |

| 05.210 | Medical equipment | |

| 05.220 | Hotel equipment | |

| 05.230 | Car park or entrances access control | |

| 05.240 | Domestic appliances | |

| 05.250 | Other specialist services | |

| 05.260 | Builder’s profit and attendance on services | |

| 06. | Surface and underground drainage | |

| 06.010 | Surface water drainage | |

| 06.020 | Storm water drainage | |

| 06.030 | Foul and wastewater drainage | |

| 06.040 | Drainage disconnections and connections | |

| 06.050 | CCTV inspection of existing or new drains | |

| 06.060 | Buried Process Pipe | |

| 07. | External and ancillary works | |

| 07.010 | Permanent retaining structures | |

| 07.020 | Site enclosures and divisions | |

| 07.030 | Ancillary structures | |

| 07.040 | Roads and paving | |

| 07.050 | Landscaping (hard and soft) | |

| 07.060 | Fittings and equipment | |

| 07.070 | External services: | |

| • water supply | ||

| • gas supply | ||

| • power supply | ||

| • communications supply | ||

| • external lighting | ||

| • utility disconnections and connections | ||

| 08. | Preliminaries | Constructors’ site overheads | general requirements | |

| 08.010 | Construction management including site management staff and support labour | |

| 08.020 | Temporary access roads and storage areas, traffic management and diversion (at the Constructors’ discretion) | |

| 08.030 | Temporary site fencing and securities | |

| 08.040 | Commonly shared construction plant | |

| 08.050 | Commonly shared scaffolding | |

| 08.060 | Other temporary facilities and services | |

| 08.070 | Technology and communications: telephone, broadband, hardware, software | |

| 08.080 | Constructor’s submissions, reports and as-built documentation | |

| 08.090 | Quality monitoring, recording and inspections | |

| 08.100 | Safety, health and environmental management | |

| 08.110 | Insurances, bonds, guarantees and warranties | |

| 08.120 | Constructor’s statutory fees and charges | |

| 08.130 | Testing and commissioning | |

| 08.140 | Extras for extreme climatic or working conditions (if priced separately according to local pricing practice) | |

| 09. | Risk Allowances | |

| 09.010 | Design development allowance | |

| 09.020 | Construction contingencies | |

| 09.030 | Price Level Adjustments: | |

| • until tendering | ||

| • during construction | ||

| 09.040 | Exchange rate fluctuation adjustments | |

| 10. | Taxes and Levies | |

| 10.010 | Paid by the Constructor | |

| 10.020 | Paid by the Client in relation to the construction contract payments | |

| 11. | Work and utilities off-site (including related risk allowances, taxes and levies) | |

| 11.010 | Connections to, diversion of and capacity enhancement of public utility mains or sources off-site up to mains connections on-site: | |

| • electricity | ||

| • transformers | ||

| • water | ||

| • sewer | ||

| • gas | ||

| • telecommunications | ||

| 11.020 | Public access roads and footpaths | |

| 12. | Production and loose furniture, fittings and equipment (including related risk allowances, taxes and levies) | |

| 12.010 | Loose production, process and operating furniture, fittings and equipment not normally provided before completion of construction | |

| 12.020 | Fixed production, process and operating furniture, fittings and equipment installed before completion of construction | |

| • production (including process and operating) equipment (including furniture and fittings) | ||

| • related instrument and control systems | ||

| • related safety and environmental control systems | ||

| • related storage and transfer systems | ||

| • services and equipment as described in Group 05 but dedicated to serve production equipment | ||

| • surface and underground drainage as described in Group 06 but dedicated to serve production equipment | ||

| • testing and commissioning | ||

| • licences and certifications to start production | ||

| • risks allowances | ||

| • taxes and levies | ||

| 13. | Construction-related consultants and supervision (including related risk allowances, taxes and levies) | |

| 13.010 | Consultants’ fees and reimbursable: | |

| • architects (architectural, landscape, interior design, technical, etc.) | ||

| • engineers (geotechnical, civil, structural, mechanical, electrical and plumbing, technical, etc.) | ||

| • project managers | ||

| • surveyors (quantity surveying, land surveying, building surveying, cost engineering, etc.) | ||

| • specialist consultants (environmental, traffic, acoustic, facade, BIM, etc.) | ||

| • value management studies | ||

| 13.020 | Charges and levies payable to statutory bodies or their appointed agencies (in connection with planning, design, tender and contract approvals, supervision and acceptance inspections) | |

| 13.030 | Site supervision charges (including their accommodation and travels) | |

| 13.040 | Payments to testing authorities or laboratories | |

Construction | Renewal | Maintenance Groups and Sub-Groups - Civil Engineering Works

-

Carbon emissions are reported by exception at the Sub-Group level.

-

2-digit code for Groups and 3-digit code for Sub-Groups.

| Code | Description | |

| Group (Level 3) | ||

| Sub-Group (Level 4) | ||

| 2. | Construction (CC | CE) | |

| 3. | Renewal (RC | RE) | |

| 5. | Maintenance (MC | ME) | |

| (CC | CE, RC | RE, and MC | ME share the same Groups below, so far as applicable. Those separated by ‘|’ in [ ] are alternative terms for respective Groups) | ||

| 01. | Demolition, site preparation and formation | |

| 01.010 | Site survey and ground investigation | |