Rates and Prices

Rates and Prices KCTangNote

- 20/2/2023: Split from "Estimating and Pricing". Incorporating mark-up, margin, wastage, bulkage and shrinkage.

Cost and price

- “Cost” and “Price” are often used interchangeably.

- Between the two parties to a transaction, the price quoted by the Seller / Contractor is the cost to the Buyer / Employer / Client.

- For the same party, Cost + Profit = Price.

- Seller's price = buyer's cost.

Values

- Values can be monetary prices or other benefits.

- Cost can also include non-monetary costs.

Price build-up

- The total price is built up from:

Labour costs (人工費)

+ Material costs (材料費)

+ Plant costs (機械費)

Direct costs (直接費)

+ Site and project overheads (現場及項目管理費)

+ Head office overheads (公司管理費)

Costs (成本)

+ Profit and risks allowance (利潤及風險費)

All-in price before value added tax (稅前綜合價)

+ Value added tax (從價稅)

All-in price (稅後綜合價)

- The value added tax here means a tax chargeable upon the net total price before this tax or the gross total price after this tax. Hong Kong does not implement valued added tax. Hong Kong only charges profit tax on the realisable profit annually.

- Some of the site and project overheads are not directly related to a particular work item but are commonly shared by more than one item. It is normal to price for these site and project overheads as the Preliminaries. The all-in rate for the work item will then only include the balance of the site and project overheads not included in the Preliminaries.

- Profit and overheads are usually allowed for as a percentage of the direct costs. The usual norm for variation is 15%, but it will be very different in competitive tenders. The profit and overheads allowed in the prices for different items can be different.

- Some part of the Works may be sublet to sub-contractors. They will include their own overheads in their prices to the Contractor. They may also share to provide some of the site overheads otherwise provided by the Contractor. Therefore, the mark-up on sub-contractors' prices for profit and overheads should be less than that on direct labour and materials.

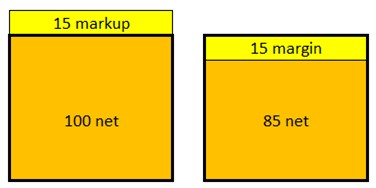

Mark-up and margin

- 100 x (1 + 15%) = 100 + 15 = 115:

- 115 has a mark-up of 15%.

- 85 + 15 = 100:

- 100 has a margin of 15%.

- 15/115 = 13.04%:

- A mark-up of 15% is equal to a margin of 13.04%.

- 15/85 = 17.64%:

- A margin of 15% is equal to a mark-up of 17.64%.

(revised, 18/2/2023)

Cost, price, profit, mark-up and margin

- Simple approach:

- When we face with the above terms, what should be the mathematical formulae to handle them and how can we remember the formulae?

- Instead of using x, y and z to represent the formulae, it would be easier to derive the formulae based on some simple numerical values using 100 as the base.

- cost + profit = price.

- profit markup % = profit / cost x 100%.

- profit margin % = profit / price x 100%.

- Given profit markup and price, how to get the cost?

- A long way:

- Cost + cost * profit markup % = price

- Cost * (1 + profit markup %) = price

- Cost = price / (1 + profit markup %) = price x 100 / (100 + profit based on 100).

- A quicker way:

- If cost = 100 and profit markup = 15%, then profit = 15 and price = 115

- This means, cost = price x 100 / 115

- If cost = 100 and profit markup = 10%, then profit = 10 and price = 110

- This means, cost = price x 100 / 110

- To conclude, if profit markup = P%, then cost = price x 100 / (100 + P).

- If cost = 100 and profit markup = 15%, then profit = 15 and price = 115

% wastage

- If a finished qty of work of 100 requires a material qty of 120. The qty wasted is 20.

- Should the wastage be 20/100 = 20% or 20/120 = 16.67%?

- Both can be correct depending on which is used as the base.

- However, in pricing, when the payment is based on the finished qty, the qty wasted should be borne by the finished qty.

- In the above example, the addition to cover the qty wasted is 20/100 = 20%, so the wastage should be 20%.

- If a 3 x 6 finished board requires a 4 x 8 uncut board, the wastage to be allowed is (4 x 8) / (3 x 6) - 1 = 32/18 - 1 = 77.78%.

- To conclude, the wastage to be allowed

= qty wasted / finished qty

= (qty used - finished qty) / finished qty

= (qty used / finished qty) - 1. - The denominator is the payable qty (finished qty).

% bulkage (excavation)

- How to allow for the extra volume to work on if payment is based on the volume before bulking?

- Bulkage or bulking factor = volume after bulking / volume before bulking.

- Volume after bulking = volume before bulking x bulkage.

- The addition to cover the extra volume is volume before bulking x bulkage. This should be simple.

% shrinkage (concrete, mortar, plaster, screed) or % compaction (soil backfilling)

- How to allow for shrinkage if payment is based on the quantity after shrinkage?

- If shrinkage = 20%, for each 100 qty, qty shrunk = 20, qty left = 80.

- The addition to cover the qty shrunk = 20/80 = 25%.

- If shrinkage = 30%, for each 100 qty, qty shrunk = 30, qty left = 70.

- The addition to cover the qty shrunk = 30/70 = 42.86%.

- If shrinkage = S%, then the addition factor = S/(100-S).

- The denominator is the payable qty (qty left).

All-in rates and unit of quantity

- All-in rate = all-in price / quantity.

- Not all the costs are directly proportional to the quantity of the work, it can be a combination of:

- Variable costs

- Fixed costs.

- Cost = f(weight) + f(volume) + f(area) + f(length) + f(number) + f(quality) + f(quality) + f(time) + f(others).

- When the total price of a work item is required to be broken down into quantity and rate, the unit of the quantity to be used should be one which represents the most cost significant variable.

- If there are more than one cost significant variable, then the work item should be broken down into more than one sub-item.

- It is usual and easier to estimate the cost of a bigger sample quantity of a work item first and divide the cost by the quantity to obtain the unit rate so that:

- Those costs not directly related to the quantity of the work item can be shared

- Wastage, laps, etc. which are not measured in the quantity can be allowed for.

(revised, 18/2/2023)

Rate build-up

- Labour costs:

- Daily rates to include for:

- daily basic wage

- travelling and meal allowances

- allowances for hand tools and personal accessories

- allowances for holidays with pay

- mandatory provident fund (MPF) contribution

- year end bonus

- incentive payments

- levies and insurances if not priced separately

- etc.

- Time to consider:

- taking from stores, hoisting, lowering

- placing, fixing

- non-productive travelling and recess time

- etc.

- Daily rates to include for:

- Material costs:

- Rates to include for:

- ex-factory costs, package

- export transportation, transit insurance

- customs clearance and duties

- demurrage, off-site storage

- local delivery

- off-loading, returning package

- etc.

- Quantities to consider:

- basic quantities

- breakage, damage, theft

- wastage (cutting, conversion)

- unmeasured laps

- bulkage, consolidation, shrinkage

- etc.

- Rates to include for:

- Plant costs (called "Equipment costs" in civil engineering contracts):

- Rates to include:

- Use of plant (not purchasing of plant)

- Mobilization, relocation and demobilization costs, if not measured separately

- Fuels and consumables

- Maintenance and repair.

- Time to consider:

- Time used

- Unavoidable idling time

- Mobilization, relocation and demobilization time, if not measured separately.

- Rates to include:

- Site and project overheads

- Expenses on site or off-site specifically due to the project, not specifically related to any particular group of work but are commonly shared.

- Head Office Overheads

- Expenses in running the head office, shared between different concurrent projects.

- Profit

- The expected profit with allowance for risks.

- Tax if charged based on total price (not in Hong Kong which implements profits tax on the realisable profit annually, not value added tax on turnover).

- Rates build-up applicable to measured work as well as preliminaries.

Tender pricing

See Tender Pricing for more details.