Post Contract 定施工合同後

Post Contract 定施工合同後 KCTangNote 註

- 21/2/2023: Revised to active verb style.

- 5/4/2022: "Main objectives" added. Sections after "Additional scope of services" separated.

增加了“主要目標”。“附加服務範圍”之後的部分分開。 - 3/4/2020: Created.

創建。

Generally 概論

- Consultant Quantity Surveyors provide cost management and contract advice services during the post contract stage until the settlement of the Final Account.

顧問工料測量師在合同後階段提供成本管理和合同諮詢服務,直至結算完成。

Main objectives of QS consultancy services 工料測量顧問服務的主要目標

(Added 添加, 5/4/2022)

- Help Client control costs:

幫助客戶控制造價:- Advise on costs in advance

預早報告造價 - Update cost effects of changes promptly

及時更新變更的造價影響 - Suggest cost mitigation proposals

提出降低造價的建議 - Safeguard Client’s interests

維護客戶利益 - Avoid disputes.

避免糾紛。

- Advise on costs in advance

- Be fair and reasonable to Contractor:

對承包商公平合理:- Issue payment valuations promptly

及時出具付款估值 - Agree contract price adjustments regularly during construction

施工期間定期協議合同價格的調整 - Interpret contract terms impartially.

公正地解釋合同條款。

- Issue payment valuations promptly

- Save own costs:

節省自己的成本:- Do it right the first time

第一次就做對 - Use right tools

使用正確的工具 - Use better skills

使用更好的技能 - Establish proper filing system (hardcopy, softcopy and emails)

建立適當的歸檔系統(硬拷貝、軟拷貝和電子郵件) - Establish a proper financial reporting and final accounting system.

建立適當的財務報告和結算制度。

- Do it right the first time

Scope of post contract services of consultant QS firms 工料測量顧問公司的定施工合同後服務範圍

- Attend meetings.

出席會議。 - Prepare contract documents.

準備合同文件。 - Vet insurances, bonds and warranties.

審查保險、擔保和質保。 - Advise on estimated costs of potential changes to the Contract Sum.

就合同價的潛在變更的估計造價提供意見。 - Prepare Financial Reports at regular intervals.

定期準備財務報告。 - Prepare cash flow tables.

準備現金流量表。 - Advise on contract interpretations.

就合同解釋提供意見。 - Value payments.

付款估值。 - Prepare Final Accounts and negotiate with the contractors to agree the Final Accounts.

準備結算並與承包商協商以達成一致。

(revised, 21/2/2023)

Additional scope of services 附加服務範圍

- Handle termination of construction contracts or determination of contractors’ employment.

處理終止施工合同或終止承包商的僱用。 - Prepare for and attend mediation, arbitration or court proceedings.

準備並參加調解、仲裁或法庭訴訟。

Post Contract Meetings

Post Contract Meetings KCTangNote

- 21/2/2023: Revised.

- 5/4/2022: Split from Post Contract.

- 3/4/2020: Created.

Attend meetings

- Principle:

- Be proactive at meetings

- Participate in discussions

- Contribute to the meetings.

-

(added, 21/2/2023)

- Project co-ordination meetings (usually monthly):

- attended by Employer and Consultants without Contractor

- QS usually attends

- for discussing outstanding design, statutory submission status, selection of Nominated Sub-Contractors and Suppliers.

- Design co-ordination meetings (as required):

- attended by Consultants

- QS usually does not attend

- for more detailed co-ordination of drawings prepared by different Consultants.

- Site meetings (usually monthly, more frequently initially):

- attended by Consultants, Contractor and Sub-Contractors

- QS usually attends the relevant part

- for discussing site programme, progress, document issuance and submission status, problems, etc.

- Sub-Contractors’ co-ordination meetings (usually weekly):

- attended by Contractor and Sub-Contractors

- QS does not attend

- for detailed co-ordination of shop drawings, installation drawings, programme, progress, problems, etc.

- Final Account meetings (as required):

- attended by QS and Contractor / Sub-Contractors

- for discussing and agreeing Final Account

- during the course of construction and not necessarily deferred until after completion of the Works.

First progress meeting

首次進度會議

- Meetings:

- Agree subsequent meeting schedule.

以後會議的時間表。

- Agree subsequent meeting schedule.

- Communication:

溝通:- Introduce various parties and their representatives

介紹有關方及其代表 - Establish communication channels.

溝通渠道。

- Introduce various parties and their representatives

- Site:

工地:- Discuss problems upon site takeover

接收工地的問題 - Present and review site layout

現場佈置 - Present and review security system

安保制度 - Present and review construction method statement.

施工組織設計。

- Discuss problems upon site takeover

- Time:

工期:- Fix official Commencement Date and specified Completion Date

正式開工及規定竣工日 - Establish programme submission system

進度計畫送審制度 - Establish progress report submission system

進度報告送審制度 - Establish Sub-Contract tendering programme.

分包定標進度計畫。

- Fix official Commencement Date and specified Completion Date

- Design and Contractors’ submissions:

規劃及設計:- Report on status of Government approvals

政府批文進度 - Establish shop drawings submission system

制配圖紙送審制度 - Establish samples submission system

- Establish records submission system (labour attendance, safety, MPF, etc.).

- Report on status of Government approvals

- Instruction system:

指令制度- Establish instructions and variation quotations system

- Establish authority to instruct and receive instructions.

- Payments:

付款制度- Establish payment application and certification timeframes and workflow.

- Before or after meeting:

- Agree payment application format

- Agree preliminaries’ payment schedule.

(moved from other page, 21/2/2023)

Contract Documentation

Contract Documentation KCTangNote

- 27/3/2023: Generally revised.

- 20/2/2023: Revised.

- 20/3/2022: Revised.

- 5/4/2022: Split from "Award contract".

- 20/3/2020: Punctuation standardised.

- 7/4/2019: "Originals of Tender Correspondence" added.

Generally

- The contract comes into existence after the mutual agreement of the letter of award or the letter of intent (if having temporary binding effect).

- The post contract stage therefore should start from that time.

- The preparation of the Contract Documents should be done as soon as possible after the mutual agreement of the letter of award, but is often regarded as not of the first priority because the absence of the formal Contract Documents would not affect the contract being in existence.

Prepare formal Contract Documents

製訂合同文件

- Get the counter-signed copy of the letter of award or letter of intent.

- Originals of Tender Correspondence:

- Obtain the originals of the tender correspondence from the recipients and bind them into the original set of the Contract Documents:

- This is a customary practice to bind in the originals. However, sometimes it takes too long to obtain the originals from the recipients because this is not their first priority to attend to this matter, or the recipients would want to retain the originals as original evidence

- Use fair photocopies of the originals for binding into the original set of the Contract Documents:

- Signing of the Contract Documents with such photocopies bound in should be sufficient to signify that the signing parties recognize the fair photocopies represent the true contents of the originals

- Notify the contract parties such intention to use fair photocopies in case they may disagree:

- Some organizations tend to be dogmatic to follow the customary practice.

- Obtain the originals of the tender correspondence from the recipients and bind them into the original set of the Contract Documents:

- Ask the Architect to prepare and bind the Contract Drawings for signing as well.

- Ascertain the number of original and certified true copies required.

- Check for the updated registered addresses.

- Amendments and Special Conditions to the Form of Contract:

- Physically amend the Form by including and initialling overriding clauses to incorporate the amendments and special conditions (seldom adopted)

- Stamp a reminding note against the amended clause to indicate that the clause has been amended elsewhere (quite frequently adopted)

- Do not make any physical amendments or marks at all because the rest of the Contract Documents should have made it clear that there are amendments or special conditions elsewhere in the Contract Documents (quite frequently used).

- Calculate the Date for Completion from the overall duration (Date for Possession or Date for Commencement counted as day 1 - be careful when using words like “after”, “from”, “commencing from”, “commencing on”. NEC does not count the starting date as day 1.).

- Calculate the limit of retention (based on a percentage of the Contract Sum exclusive of prime cost sums for Nominated Sub-Contracts; rounded off; plus the retention funds held in respect of Nominated Sub-Contractors).

- Calculate the amount of surety bond (based a percentage of the Contract Sum; rounded off).

- Check the Tender Documents to see whether to execute as a simple contract or contract under seal and type the signing page accordingly.

- Consider significance of the date of signing (usually not significant because the contract is already in force).

(generally revised, 27/3/2023)

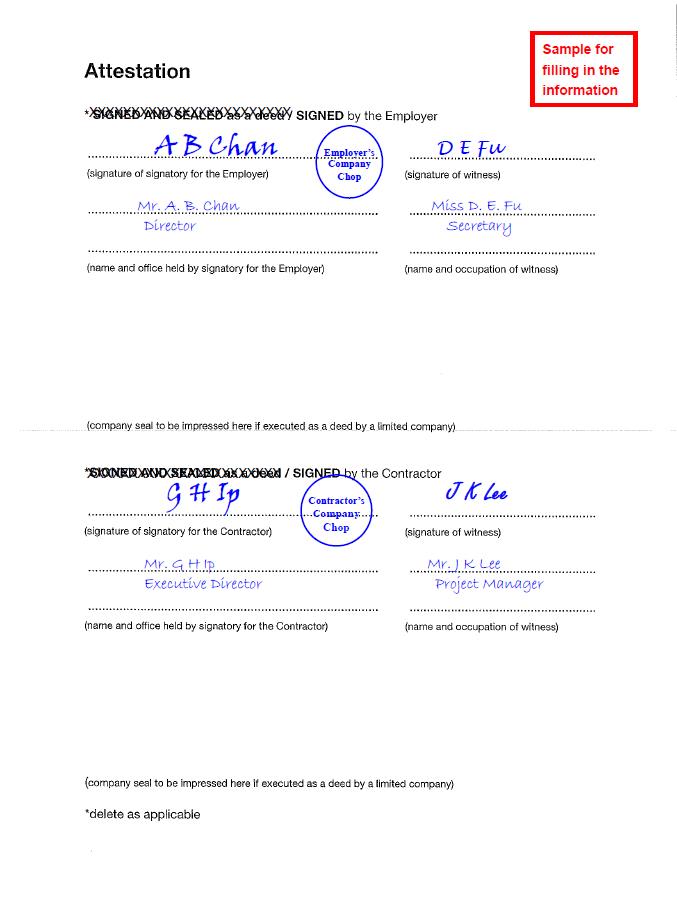

Sign as simple contract

签署合同

- Example of the signing page of the Standard Form of Building Contract 2005/2006 Edition:

Vetting Insurances, Bonds and Warranties

Vetting Insurances, Bonds and Warranties KCTangNote

- 5/4/2022: Split from Post Contract.

- 3/4/2020: Created.

Generally

Vet insurances, bonds and warranties

- QS vets draft insurances and bonds submitted by the Contractors and Nominated Sub-Contractors and Suppliers to ensure that the terms and conditions are in compliance with the contract requirements.

- Usual types:

- Contractors' all risks and third party liability insurances – required to be submitted before any work on site

- Employees’ Compensation Insurance – required to be submitted before any work on site

- Surety bond – usually required before the first payment otherwise cash security of equal amount will be retained

- Materials and workmanship warranty (roofing, kitchen and bathroom waterproofing layers, windows, curtain wall) – usually towards Substantial / Practical Completion.

- Form of Warranty related to Nominated Sub-Contractors and Suppliers should have been dealt with not later than the award of the contracts.

- Usual problems encountered:

- Drafts not exactly following the pro-forma given in the Tender Documents (pro-forma usually given for bonds and warranties)

- Drafts not complying with contract requirements

- Incorrect date of the letter of acceptance or letter of intent inserted (used when Contract Documents may not have been signed at that time)

- Incorrect names and addresses of Project, Employer and Contractor inserted

- Incorrect descriptions of parties to be included as the joint-insured

- Incorrect descriptions to cover all tiers of sub-contractors

- Amounts of excesses too high

- Period of insurance (construction and defects liability / maintenance) not sufficient

- Fixed expiry date in the form of calendar date instead of a floating expiry date pegged to the Substantial Completion Date or Date of Defects Rectification Certificate / Certificate of Completion of Making Good Defects.

- Late submission of drafts with protracted rounds of comments and re-submissions

- Late submission of formally executed documents.

Cost Monitoring and Management

Cost Monitoring and Management KCTangNote

- 5/4/2022: Split from Post Contract.

- 3/4/2020: Created.

Advise on estimated costs of potential changes to the Contract Sum

- Design changes may be proposed during the course of construction.

- The Employer may like to know the estimated costs before approving to make the design changes.

- QS estimates the costs based on the Architect’s or Engineer’s design.

- The design may not be complete for estimating at the earliest time for quick decision making.

- Whether the design is complete or not, approximate estimating using approximate quantities and composite rates should be adopted to shorten the time to do the estimate.

- It is possible that the design may eventually not be adopted or may be further modified.

- It will be a waste of time if the estimate is prepared in great details like valuing a variation formally but is not really so accurate that at the end of day the estimate cannot be used as the formal valuation.

- Buffer for agreement with the Contractor should be allowed.

- AI pre-approval forms may need to be signed before an Architect’s instruction is authorized to be issued for the proposed changes.

- The Contractor may also raise claims, which require QS to report to the Employer the probable costs of those claims.

Prepare Financial Reports at regular intervals

- QS needs to prepare Financial Reports at regular intervals (usually monthly) to report on the latest situation of all the possible adjustments to the Contract Sum.

- The reports serve as a register of instructions issued, potential variations, claims received, etc.

- The reports should have columns to show the latest of each of the following:

- amounts estimated by QS – with buffer for budgetary purposes; not known to the Contractor; can be viewed as the maximum payable

- changes since the last report

- amounts claimed by the Contractor

- amounts assessed by QS – formal amount notified to the Contractor; can be viewed as the minimum payable

- difference from amounts claimed

- e.g.:

- The reports should also show the status of the items, such as:

- tentative based on claim

- estimated (some measurement)

- no cost effects

- assessed (detailed)

- agreed

- original

- e.g:

Prepare cash flow tables

- QS may be required to prepare cash flow tables regularly or ad-hoc to indicate the likely amounts of payments required to be made by the Employer so that he may prepare for funding.

- Care should be made to adjust for the difference between the time of progress and the time of actual payment.

- A comparison between the cash flow graph prepared based on the baseline master programme and the latest actual flow graph can be a good visual indication of whether the progress is ahead or behind the programme (measured by the value of the Works).

Contract Advice

Contract Advice KCTangNote

- 21/2/2023: Created.

Advise on contract interpretations

- As QS is the party responsible for preparing the contractual and financial parts of the Tender Documents, QS is very often requested by the Employer and other Consultants to advise on the contractual validity of claims raised by the Contractor.

- The next and probably the most important question is on the cost implications.

- While the Special Conditions of Contract and Preliminaries may be prepared using the QS’s company standard with some modifications with little thoughts on the interpretations, post contract advice would demand a good understanding of the meaning of the clauses in the Form of Contract, Special Conditions of Contract and Preliminaries.

- On top of a thorough understanding of the standard forms of contract, the common law rights and remedies are also very important matters to be understood.

- A QS may be handling different types of contracts at the same time, therefore, his/her knowledge should be broad enough to cover all types encountered.

- In the worst case where determination of the employment of the Contractor or termination of contract is to be considered, proper procedures must be implemented to ensure that a proper determination or termination would not end up into a breach of contract. QS advice on the detailed procedures would be important.

- In case dispute resolution procedures like mediation, arbitration or court proceedings are involved, the case will then usually be passed to the lawyers to handle with QS to assist on the technical and financial aspects only.

Contractors' Cost Monitoring and Management 承包方造價的跟蹤管理

Contractors' Cost Monitoring and Management 承包方造價的跟蹤管理 KCTangNote

21/2/2023: Sections from "Site takeover" merged into here.

30/3/2020: Revised. English version added.

24/12/2014: Moved from wiki.

Main principles

主要原則

(not in any particular order, but probably: more important and easier to do given first)

- Reduce waste:

減少損耗:-

At source

在源頭

- Recycle.

循環再用。

-

- Reduce rubbish:

減少垃圾:-

At source

在源頭

- Recycle.

循環再用。

-

- Reduce abortive work:

減少返工:- Confirm material and workmanship samples and acceptance standards

確定材料及工藝的樣板及驗收標準 - Do it right at the first time

第一次就做對 - Reduce defects

減少缺陷 - Chase acceptance inspections and approvals.

追驗收檢查。

- Confirm material and workmanship samples and acceptance standards

- Reduce wasted time:

減少浪費時間:- Reduce idling time

減少窩工 - Prepare, follow, monitor and update programmes

編訂、依從、監控和更新進度計劃表 - Track and record progress and reasons for deviations

跟踪記錄進度及偏離的理由 - Increase advance planning and co-ordination

多加事前協調 - Chase comments and approvals.

追審核意見和批准。

- Reduce idling time

- Reduce exposure to delay damages:

減少誤期賠償的可能性:- Prevent delay

避免誤期 - Notify delay

通知誤期 - Claim extension of time.

要求延長時間。

- Prevent delay

- Reduce accidents.

減少意外。 - Reduce complaints.

減少投訴。 - Ensure subcontractors and suppliers perform as committed.

確保分包商和供應商履行承諾。 - Increase productivity.

增加生產力。 - Get what should be entitled.

爭取應得的。 - Reduce what should not be lost.

減少不應失的。 - Get incentives and bonus:

獲得獎勵和獎金:- Perform better than contract requirements

表現優於合同規定 - Innovate.

創新。

- Perform better than contract requirements

- Establish a proper financial accounting and costing system:

建立完善的財務會計預算制度:- Know clearly the profit and loss situation of individual projects

要清楚知道個別工程的損益情況 - Keep clear records of actual expenditures and incomes

要有清楚的實際支出及收入記錄 - Establish a proper budgetary and final accounting system

建立完善的預決算制度 - Forecast the final expenditures and incomes of the whole project, and monitor and control the development.

要對整個工程的最終支出及收入作出預測,及進行跟蹤管理。

- Know clearly the profit and loss situation of individual projects

- Pay attention to causes which may increase costs, and take proper records.

對任何會使工程成本會增加的原因多加留意,並作出適當的記錄。 - Pay attention to opportunities which may increase incomes, take proper records, and raise requests for compensation at appropriate times.

對任何會使工程收入增加的機會多加留意,並作出適當的記錄,及適時提出爭取要求。 - Be mindful of oral communications without record:

小心口講無憑:- During construction, it is common for Contractors to follow Employers' or Architects' oral instructions and carry out work at additional cost, but they can at the end lose the chances to get paid because of insufficient records

施工過程中,承包方往往依照發包方或建築師的口頭指令,而多做了增加成本的工作,但到頭來因記錄不全而喪失了獲得補償的機會 - Similarly, Contractors lose chances to get paid for work which should have entitled them to payment because they have not kept proper records

同樣地承包方往往就可以使工程收入增加的事件,未有進行適當的記錄而喪失了獲得補償的機會 - Therefore, record keeping is of paramount importance

因此,記錄很重要 - Employing a dedicated person to keep records is worthwhile.

花錢請專人進行記錄是值得的。

- During construction, it is common for Contractors to follow Employers' or Architects' oral instructions and carry out work at additional cost, but they can at the end lose the chances to get paid because of insufficient records

- Pay attention to time limits:

注意期限:- In Hong Kong and overseas contracts, it is usual to set time bars to claims for extension of time or financial compensation. Missing the time limits will lose the right to claim. Therefore, do not overlook.

香港及國外的合同,往往就工期延長的申請及費用索償,設定了期限。過期提交會喪失了獲考慮的機會,因此不要掉以輕心。

- In Hong Kong and overseas contracts, it is usual to set time bars to claims for extension of time or financial compensation. Missing the time limits will lose the right to claim. Therefore, do not overlook.

Site takeover

工地接收

- Mainly avoid existing but not obvious on-site problems that will have a bad impact in the future.

主要避免有現存但不明顯的現場問題將來會產生壞影響。 - Note and record the conditions of the existing buildings on site.

注意及記錄現場建築物的現狀。 - Note and record the conditions of neighbouring buildings.

注意及記錄鄰近建築物的現狀。 - Record the handover of setting out benchmarks and site boundary lines.

記錄測量基準點、紅線的交收。 - Carry out site level and topographical survey.

進行地平測量。 - Implement settlement monitoring.

實施沉降監測。

Fixing of Sub-Contractors and Suppliers

確定分包商及供應商

- Clarify the scope of the Sub-Contracts and Supply Contracts.

明確分包及供應內容。 - Agree the prices.

商定價格。

Management of Drawings

圖紙管理

- Aim at reducing abortive work and strengthening the basis for additional payments.

目標為減少返工、加強追加工程款的依據。 - Distinguish between:

區分:- Tender Drawings

招標圖 - Contract Drawings

合同圖 - Variation drawings (issued under instructions)

變更圖(按指令發出) - Statutory submission drawings

政府送審圖 - Shop drawings

制配圖 - Fabrication drawings

預製圖 - Working drawings / construction drawings

施工圖 - Installation drawings

安裝圖 - Builder’s work drawings

土建圖 - Combined services drawings

機電綜合圖 - Record drawings of idling and abortive work

窩工返工記錄圖 - As-built drawings.

竣工圖。

- Tender Drawings

- Submit or request as appropriate.

按責任發出或要求。 - Record issuance and receipt of new and revised drawings.

記錄發出和接收的新的和修訂的圖紙。 - Always use the latest drawings.

永遠要使用新版的圖紙。 - Do not throw away superseded drawings.

用過的舊版圖紙不能拋掉。

Design briefing/co-ordination meetings

設計交底會/協調會

- Between Employer and Consultants.

發包方及顧問之間。 - Between Consultants, Contractors and Sub-Contractors.

顧問、總包及分包之間。 - Between Main Contractor and Sub-Contractors.

總包及分包之間。 - Explaining, co-ordinating, commenting and approving drawings.

解釋、協調、評論和批准圖紙。

Site management

現場管理

- Site:

工地:- Site security

現場安保 - Accident records

事故記錄 - Effecting insurances.

保險的落實。

- Site security

- Planning and design:

規劃及設計:- Design co-ordination meetings

設計交底會 - Progress of submission of shop drawings

制配圖紙送審進度 - Progress of statutory approvals

政府批文進度 - Progress of selection of sub-contractors

分包定標進度 - Report on variation instructions.

變更指令報告。

- Design co-ordination meetings

- Materials:

材料:- Monitoring of material ordering progress

監控訂料進度 - Recording of incoming and outgoing of materials

記錄進料領料情況 - Control of wastes

控制損耗 - Regular removal of rubbish

定期清理垃圾 - Checking for unnecessary waste

檢查有沒有不必要之浪費 - Monitoring of residual value.

監控殘料餘值。

- Monitoring of material ordering progress

- Construction:

施工:- Coordination of working sequence

協調工序先後 - Coordination of the use of temporary facilities

協調臨時設施的使用 - Assurance to use latest drawings

確定用新版的圖紙 - Assurance to use materials and workmanship according to approved samples

確定用批核樣板的材料及工藝 - Quality issues

品質問題 - Quality inspection records and status

質檢記錄及情況 - Record of abortive and idling work

返工窩工記錄 - Handling of inclement weather.

惡劣天氣的處理。

- Coordination of working sequence

- Progress:

進度:- Regular progress meetings

定期的進度會議 - Weekly reports

每週報告 - Daily reports

每日報告 - Progress photos

進度照片 - Manpower status and records

人手情況及報告 - Progress reports

施工進度 - Delay records.

工期延誤報告。

- Regular progress meetings

不外乎

- 开源

- 节流(转移风险)

开源

- 多拿工程亦算是公司开源的主要内容

- 但拿到工程后,开源的方法则有限而艰巨

- 不外乎靠变更及索赔来增加收入

- 亦可以征费的方式对分包方收取各种费用,例如:

- 清理垃圾费

- 垂直运输使用费

- 分包管理费

- 对分包方征费未必完全按照合同的规定,有些近乎买怕费

节流

- 重点应是节流

- 更重要的是不要亏本拿工程

- 亏本拿工程之后能翻身的主要靠幸运之神眷顾

- 节流的措施可从投标阶段做起,直至保修完成

Payment Valuations

Payment Valuations KCTangNote

21/2/2023: Revised. Section sequence re-ordered.

11/1/2021: Typo corrected.

3/4/2020: Revised.

24/12/2014: Moved from wiki.

Intro

- Quantity Surveyors value the amounts of payments to Contractors periodically. Payments are to facilitate Contractors’ cash flow. Payment valuations can only be an approximation and should not take unduly long time to do just to improve the accuracy of minor significance to the effect of unduly deferring the payments to Contractors.

Terms of payment

- There can be broadly two types of payment terms:

- Progress payments which are made at regular intervals, usually monthly, based on valuation of value of actual work done and materials delivered, with provisions for retention

- Stage payments which are made not at regular intervals, but are made when certain stage of construction has been achieved, e.g. upon concreting of the floor at mid-height of the building, upon concreting of the roof, upon submission for Occupation Permit, etc.

- The progress payment method is the usual method used and will be described in detail first. Discussion of stage payments will be given at the end.

- The terms “milestone payments”, “regular milestone payments” and “time-related milestone payments” are also used. It should be noted that these terms are not terms with established definitions in the industry but are used here for identification purposes only.

- The terms of payment and payment processes must follow the specific terms and conditions of the Contract.

- This paper is based on the Standard Forms of Building Contract 2005/2006 versions. Some terms used in the pre-2005 versions have also been mentioned.

- Government General Conditions of Contract follow similar principle, though the retention percentages and limits of retention are smaller than those adopted by the private sector. The form signed by the Quantity Surveyor is called a payment certificate rather than a payment valuation.

Advance payments and deposit payments

Meaning

-

Advance payment or deposit payment is a portion of the Contract Sum to be paid upon the award of the Contract as a security for the Contract and to facilitate the Contractor to procure materials and to cover his early expenses.

- Both terms usually mean the same thing for everyday use. However, there can be some important difference between deposit payments and advance payments in some contracts. For some sales contracts, deposit is a consideration for securing the formal execution or further performance of the contract. If the buyer fails to proceed, the deposit he paid would be forfeited. If the seller fails to proceed, he has to refund the deposit in double. Advance payments do not have such implied meaning. However, the actual meaning of the two terms would depend on the terms of the individual agreements or contracts.

- Advance payments in the following discussions include deposit payments.

Advance payments not preferred by Employers

- Normal progress payments do not provide for advance payments.

- Advance payment is an over-payment from the point of view of the Employer, and the over-payment would possibly exist until the end of the Contract, depending on the terms of recovering the advance payments in subsequent payments.

Situation where advance payments are adopted

- Advance payments are usually required by suppliers or contractors for sales contracts, lift and escalator contracts, fitting out contracts, minor contracts of short duration, contracts in Mainland China.

- Advance payments are also appropriate for contracts which involve substantial up-front expenditure before materials are delivered to site.

Terms of payment with advance payment

- Terms of payment in the form of “10% advance payment upon commencement, 85% progress payment, 2.5% retention to be released upon Substantial / Practical Completion and 2.5% retention to be released at the end of the Defects Liability Period” is quite common for less formal contracts. This means that after payment of the 10% advance payment, 85% of the value of work done and materials delivered is to be paid during the course of the Works.

- If the Contract Sum changes, the above terms are not clear whether the already paid amounts will need to be adjusted.

- Expressing in cumulative percentages such as 10%, 95%, 97.5% and 100% may resolve the problem.

Recovery of advance payments relative to progress payments

- If the advance payment is in the form of a lump sum, how and when the advance payment is to be recovered should be stated.

- Advance payment is not expected to be subject to retention. The normal way to calculate retention should be adjusted.

- A way to present the payment valuation is as follos:

- Advance payments made up-front are recovered from subsequent payments. Recovery of the advance payments in subsequent payments is pro-rata to the progress value of work done and materials delivered.

- In this example, the recovery is based on:

- (Original advance payment / Original Contract Sum) x gross amount of progress payment = 10% x gross amount of progress payment.

- If the Contract Sum is increased during the course of the Works, the recovery of deposit will be quicker. However, if the Contract Sum is reduced during the course of the Works, the recovery will be slower and it will leave a portion unrecovered upon Substantial / Practical Completion. It is advisable that the formula should be revised to relate to the Estimated Final Contract Sum instead of the Original Contract Sum as follows:

- Original advance payment x (Gross amount of progress payment / Estimated Final Contract Sum) = Original advance payment x percentage of work done and materials on site.

- No matter which of the above calculations are used, only until the contract works are fully completed will the advance payment be fully recovered. That is why advance payment creates over-payment until Substantial / Practical Completion or beyond.

Faster recovery of advance payments

- To avoid leaving the advance payments there for too long, other methods to ensure quicker recovery of advance payments can be used, subject to agreement by both contract parties.

- A method which would not be welcome by contractors would be full recovery in the second Interim Certificate.

- Other more moderate methods are:

- Rate of recovery of advance payments being faster than the progress of work – for example advance payment made equal to 10% of the Contract Sum to be recovered at 20% of the gross amount of progress payment

- Recovery by instalments at specified number of Interim Certificates, e.g. at the 3rd, 5th and 7th payments

- Recovery by instalments at Interim Certificates issued after specified days, e.g. x, y, z months after commencement of the Works.

- The last two methods described above are not dependent on the progress of work, it has the advantage of forcing the Contractor not to be late in progress, otherwise he may receive less cash inflow due.

Bonds

- Advance payments or deposits are a kind of over-payment before they are fully recovered. If the Contractor or Supplier disappears or repudiates the Contract after receipt of advance payments or deposits, the Employer will have no redress unless measures like the following are implemented:

- The amount of surety bond to be increased to cover the advance payments or deposit payments and the surety bond to be obtained before payment

- Advance payment bond to be provided by the Contractor or Supplier as security.

Stage payments

Meaning

- Under a “stage payment” method, the Works are broken down into a number of stages of completion each with a value which will be paid on completion of the relevant stage of the Works. Unlike the normal progress payment method where work done and materials on site are valued and paid for at regular intervals, stage payments are not made at regular intervals but are made only when a certain stage of the Works is completed.

- For some contracts when the various stages of completion of the Works are defined by means of milestones, the stage payment method is called “milestone payment” method.

- An example of stage or milestone payment would be:

- The value assigned to each stage or milestone should preferably be equal to the value of the work required to achieve the stage or milestone, but they can also be made different purposely.

Use of stage or milestone payments

- Stage payment method is usually for sales contracts, lift and escalator contracts, fitting out contracts, contracts for single block speculative residential building, minor contracts, civil engineering contracts.

- Stage payment method would be appropriate for contracts which can have easily defined stages of completion of the Works, for contracts which are of simple nature, for contracts which the Architect would not like to spend time to value the quantities of work and materials delivered on regular basis.

- Stage or milestone payments are simple to operate if not subjected to Employers’ changes or Contractors’ abuse.

- Stage or milestone payments are not suitable for complex projects which are prone to design and programme changes.

- Substantial design and programme changes may render the original terms of payments not workable and require revisions which may be too frequent and laborious that the original intent to save work in carrying out normal valuation based on work done and materials delivery is no longer realized.

Problems with stage or milestone payments

- The definitions of stages (or milestones) should be broad and simple enough to enable easy judgment as to their achievement by visual inspection without requiring detailed valuation.

- If the definitions of the stages are too rigid, literal interpretation of the definitions may result in non-achievement of the stages and hence non-payment. A definition of “100% completion”, if interpreted literally, would always lead to argument.

- If the definitions of the stages are too complex thus requiring detailed calculations, the original intent to have a simple payment valuation method is defeated.

- On the other hand, if the definitions are too loose, the Contractor may take advantage to do work just enough to match the definitions while the value assigned for the stage may in fact have already allowed for a greater extent of work.

Regular milestone payments

- A variance of the stage payment or milestone payment method is to break down the Works into greater number of more detailed stages or milestones and to value the Works at regular intervals. By the regular valuation date, the various stages or milestones are checked to see if they are achieved. The corresponding amounts of those stages or milestones achieved will be included in the current payment certificate. No payment will be made in respect of those not achieved. An example of such milestone payment calculation is as follows:

- The time factor is made a factor in making payments.

Use of regular milestone payments

- The advantage of the regular milestone payment method is that valuation is made at regular intervals, such that the Contractor can receive money regularly though smaller in amount as compared to non-regular stage payment method.

Problems with regular milestone payments

- To enable regular milestone payments to work, the Works have to be broken done into greater number of milestones. Some degree of concurrency would be created. A case may be encountered where the Contractor may be so unlucky that substantial number of milestones are only 95% achieved and therefore he cannot be entitled to payment though the Works if viewed as a whole may be 40% complete.

- Furthermore, the milestones are usually defined with reference to a programme planned before tendering. The programmed activities planned before tendering without the Contractor’s input may not be realistic when compared to the Contractor’s intended sequence of work after contract award. If there is any further critical variation to the Works or serious disruption to the original programme and logic such that the definitions of the activities can no longer be achievable or can only be achieved until the very late stage of the Works, payments will be seriously deferred. The milestone payment schedule needs to be revised to be realistic or workable. The task of making such revision may be similar to that required to do a normal progress valuation. If the milestone payment schedule needs to be constantly revised to be realistic, it may be better to use normal progress method.

Time-related milestone payments

- A more stringent form of time-related milestone payments is to relate the milestone to a specific calendar day or a specific period after commencement. Failure to achieve the milestone by the prescribed date or within the prescribed period will lead to no payment and payment will have to wait till a subsequent qualifying milestone. An example would be like this:

- If Milestone B cannot be achieved by 1/6/2002, no payment will be made. If Milestone C is achieved by 1/9/2002, payment will be made for Milestones B and C, otherwise, depending on the detailed terms of the milestone payment method, no payment will be made for both or payment will be made for Milestone B only.

Use of time-related milestone payments

- Time-related milestone payments put strong emphasis on achievement in relation to time and greater commitment from contractors towards time.

- Time-related milestone payment method is suitable for time critical projects.

Possible solutions to alleviate problems

- To alleviate some of the problems with stage or milestone payments mentioned above, the following measures may be adopted:

- Use realistic definitions for stages or milestones with margin for interpretation

- Minimize concurrent activities when devising the stages or milestones

- Minimize post contract changes

- Include a condition to the effect that in case the cumulative total of stage payments deviates from the value based on work done and materials delivery by a certain percentage then payments will be based on the latter. (Valuation needs not be done every time but would be done only when it is suspected that the deviation is great.)

- Re-agree the terms when it is considered necessary to better represent the latest situation.

Payment processes

- The usual processes for payment are:

- Contractor’s Payment Application → QS’s Valuation → Architect’s Certification → Contractor’s Presentation → Employer’s Honouring.

- A more detailed description is as follows:

- the Contractor, Nominated Sub-Contractors and Nominated Suppliers supply materials and, where applicable, carry out work

- the Contractor, Nominated Sub-Contractors and Nominated Suppliers calculate the values of materials supplied and work done by them

- the Nominated Sub-Contractors and Nominated Suppliers submit their payment applications to the Contractor, with copies to the Architect, the Quantity Surveyor, the M&E Consultant (where applicable), and the Employer (usually)

- the Contractor submits his payment application (incorporating applications from the Nominated Sub-Contractors and Nominated Suppliers) to the Architect, with copies to the Employer, the Quantity Surveyor, the M&E Consultant (where applicable)

- the Quantity Surveyor visits the Site, inspects and records the extent of unfixed materials and work done on site, in the presence of the Contractor’s representative (usually site quantity surveyor) and, if considered necessary, representatives from the Nominated Sub-Contractors and Nominated Suppliers

- the Quantity Surveyor calculates the values of unfixed materials and work done on site

- the M&E Consultant similarly visits the Site, values M&E works, and issues his payment valuation to the Quantity Surveyor

- the Quantity Surveyor issues his draft payment valuation incorporating the M&E Consultant’s valuations) to the Contractor to seek his agreement, with copies to the Employer, the Architect and the M&E Consultant for their information and, if they so desire, comments

- the Quantity Surveyor issues his formal payment valuation (incorporating the M&E Consultant’s valuation) to the Architect, with copies to the Employer, M&E Consultant, and the Contractor

- the Quantity Surveyor issues advice individually to Nominated Sub-Contractors and Suppliers to inform them the amounts of payment included in the main payment valuation

- the Architect issues his payment certificates certifying the amounts payable to the Contractor, Nominated Sub-Contractors and Nominated Suppliers

- the Contractor presents the payment certificate to the Employer for payment

- the Employer pays the Contractor.

Time

Dates

- “Date of Application” means the date of the Contractor’s payment application.

- “Date on Site” means the date when the QS visits the Site to carry out valuation.

- “Date of Valuation” means the cut-off date to calculate work done and materials on site. This is usually the same as the Date on site.

- "Date of Issuing Valuation" / "Date of Recommendation":

- Traditionally, the QS’s valuation is called a payment recommendation.

- “Date of Issuing Valuation” or “Date of Recommendation” means the date of the QS’s letter issuing the valuation for payment. This can only be later than the Date of Valuation.

- “Date of Certificate” means the date of the Architect’s Interim Certificate.

Frequency of Interim Certificates

- The Contract should state the time interval between successive payment certificates. This is usually one month.

- “Period of Interim Certificates” is used to mean such time interval.

- The 2005/2006 versions of the Standard Forms of Building Contract specify that the first Interim Certificate should not be issued later than 42 days after the Commencement Date of the Contract.

- The 2005/2006 versions also specify that the payment application should be submitted not later than 14 days before the due date for Interim Certificate, and the payment valuation should be submitted not later than 7 days before the due date for Interim Certificate. The exact date of the valuation has not been expressly stated. It should be a day between the 14 days and the 7 days.

Period for payment of certificates / Period for Honouring Certificates

- The Contract should state the grace period to pay after the issue of a payment certificate.

- This period is called “period for payment certificate” in the 2005/2006 versions of the Standard Forms of Building Contract. The default period is 14 calendar days from the date of the certificate.

- This period is called “Period for Honouring Certificates” in the pre-2005 Standard Forms of Building Contract. The default is 14 calendar days after the presentation by the Contractor of the certificate to the Employer. This is longer.

- The Contractor usually would issue an invoice for the same amount when requesting payment or presenting the Certificate.

- Some developers would require a period long than 14 days.

Payment to Nominated Sub-Contractors and Suppliers

- The Contract should state the period to pay the Nominated Sub-Contractors and Suppliers.

- The Standard Forms of Building Contract require this to be within 14 days of receipt by the Contractor of the relevant payment from the Employer.

Pay-when-paid

- Payment to Nominated Sub-Contractors and Suppliers is a “pay-when-paid” arrangement. The Contractor would not pay if he has not received the same money from the Employer.

- Argument would arise if due to deductions as a result of certain defaults of the Contractor, the total amount certified as due to the Contractor is less than that certified as due to Nominated Sub-Contractors and Suppliers, but the Contractor denies that the defaults are his, then the Contractor would declare that he has not received sufficient payment in respect of the Nominated Sub-Contracts and Supply Contracts and therefore he would not pay in full. The situation would become messier if the defaults in question relate to delays and disruptions where the Nominated Sub-Contractors and Suppliers are implicated as well.

- The 2005/2006 versions of the Standard Forms of Building Contract intend to remedy the problem by using the expression “within 14 days of the Contractor receiving payment or the accounting of payment from the Employer, as the case may be” meaning that once the relevant payment has been accounted for, this should be paid, notwithstanding that this has been set-off by other deductions from the payment to the Contractor.

- Some countries forbid pay-when-paid arrangement, meaning that the Contractor has to pay irrespective of his receipt of payment.

Valuation

Valuation format

- The simplest form of a payment valuation can be as follows:

- This shows that each BQ item is valued against the quantity of work done.

- In actual practice, to calculate the quantity of each item at each payment application and valuation will take a lot of time and is an impracticable task. People actually estimate the percentage done first by quick alternative approximations and apply the percentage to the original quantity to get the quantity done.

- The number of items is also too many to handle. The same percentage done may be applied to different items which in fact should have slight variances.

- Therefore, instead of calculating each quantity done individually, it is more practicable to value based on a group of related items or items under the same heading, and estimate the percentage done based on the whole group.

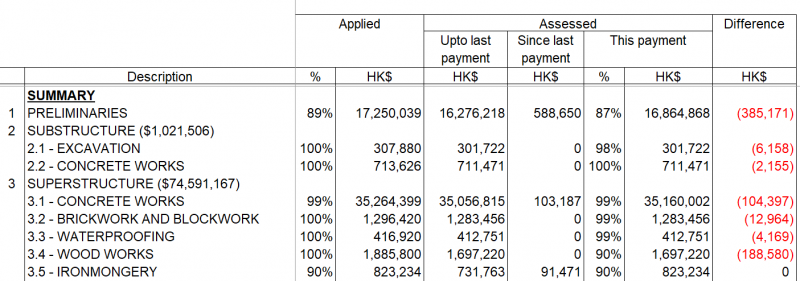

- A valuation detail with items grouped may look like this:

- A valuation summary may look like this:

-

-

- A valuation statement may look like this:

-

-

First payment format and procedure

- Set up payment valuation pro-forma.

- Pro-forma to be converted from BQ.

- Change the BQ file into a file format capable of doing calculations, such as EXCEL, if not already in such file format.

- If QS software is used for BQ and payment valuation, facilitate the Contractor to use the same software.

- Group BQ items into suitable groups (e.g. under sub-headings) to reduce the items to be valued.

- Valuation to be based on percentages rather than based on absolute quantities.

- Valuation to be based on gross value to-date rather than nett value since last payment.

- Discuss with the Contractor to agree format and procedure.

- Agree with the Contractor the principle and calculation methods for paying preliminaries.

- Running totals to be kept for material delivery.

- A.I. as authority for paying variations.

Payment for preliminaries

- Preliminaries prices should be broken down into initial costs, time related running costs, work related running costs and removal costs for payment purposes. The breakdown is usually not done when pricing the BQ but is agreed before the payment application.

- A valuation for the preliminaries (for another project) may look like this:

-

-

- Time-related items may be paid as work-related items if clauses similar to the following are included in the Contract:

- In the event of the amount inserted in respect of an item in this Preliminaries Section for which whole payment or substantially whole payment would normally be made at the outset of the Contract (e.g. insurances) being higher than the amount which the Contractor can substantiate, payment for the excess amount will be effected over the period of the Contract or such prolonged period caused by the Contractor

- Payments for amounts inserted against time related items in this Preliminaries Section such as overtime, plant, foreman, watching etc. will be effected over the period of the Contract or such prolonged period caused by the Contractor in the same proportion as the value of Contractor's work carried out is to the total value of Contractor's work (excluding Preliminaries)

- In the event of no amounts being inserted by the Contractor in respect of this Section, no relative payment whatsoever will be included in interim payments.

(Mistake in swapped use of "time-related" and "work-related" in the first sentence corrected, 11/1/2021)

Arrive at the value

- Proven with photos and records.

- Systematic.

- Clear.

- Reasonable factors.

- Arithmetically correct calculations.

- As soon as possible.

Amounts

Gross valuation

- “Gross valuation” of payment is the estimated value of:

- the work properly executed and of

- the materials and goods delivered to or adjacent to the Works for use thereon.

- Any adjustments to the Contract Sum should also be reflected in the gross valuation.

- This includes variations, remeasurement, loss and expense compensation, etc. based on their currently assessed values, but excludes liquidated damages which are to be handled not as part of the payment valuation or payment certificate but as a separate deduction or set-off procedure against the payment due.

Retention

- “Retention” is a portion of the Gross Valuation retained from payment and is to be released until after Substantial Completion / Practical Completion.

Nett valuation

- “Nett valuation” of payment is gross valuation less retention.

Nett amount due

- “Nett amount due” is the nett valuation less previous payments. The relationship of the various terms can be illustrated by the following example:

Gross valuation

Work properly executed

- The value of work done should include all those items of work partially or wholly done on site but shall exclude those non-conforming or defective work.

- If an item of work is specifically rejected by the Architect, its value should not be included the Gross Valuation.

- If defects are found in an item of work which has partially been done but the defects are not serious enough for rejection of the whole of the work, then when calculating the proportion of the value of the work to be included in the Gross Valuation, some reductions should be made to account for the defects.

- Difficulties would arise upon Substantial Completion / Practical Completion when substantially all items of work are done but there are still defects to be made good. Contractors would obviously not like to see that all items in questions are subject to a reduction. They would argue that there is still retention to be retained. Whether reduction on top of retention should be made would depend on the seriousness of the defects. In theory, defective work should be rejected and therefore not paid. However, if the work is basically all right but with some minor imperfections which require making good but not complete replacement of the work, and if the cost of making good such minor imperfections can be covered by the retention money, then the full value of the work should be included in the Gross Valuation.

- To avoid doubt, it is advisable for the Architect to formally reject the whole of those items of work which have serious defects.

Unfixed materials on site

- A simplified term for “materials and goods delivered to or adjacent to the Works for use thereon” would be “unfixed materials on site”. If the materials and goods have been fixed, their value would be included in the value of work done. If materials are not on or adjacent to the Site, they would not normally be included in the Gross Valuation.

- Materials and goods can be easily taken out of the Site or may be stolen. Unfixed materials and goods are more vulnerable to loss and damage whether due to natural or human causes. Some materials such as cement and lime may easily deteriorate if they are not stored with proper protection. Therefore, to qualify for inclusion in the Gross Valuation, materials and goods must have been:

- reasonably, properly and not prematurely brought to or placed adjacent to the Works

- adequately protected against weather or other casualties.

- Most materials and goods should be delivered not more than one month in advance of the time required for use. Quantities delivered more than one month in advance should be queried.

- Possibly acceptable reasons are:

- The total quantity involved is so small that it is not economical to divide into more than one delivery

- The quantity must be delivered in one batch to ensure consistency in colour, e.g. stone.

- The following reasons which are for the contractor’s own benefit and convenience would not be acceptable:

- Larger quantities are delivered to secure earlier payment

- Larger quantities are delivered to secure the cheaper supply price

- Larger quantities are delivered to reduce off-site storage costs.

- Prompt delivery in accordance with the original programme without regard to the actual progress may still be a premature delivery.

- Quantities delivered more than two months in advance can be reviewed as premature.

Wastage

- Wastage is to be allowed for when considering supply quantities for materials on site.

- Wastage factors are to be used for different items of work, depending on the difficulty of work.

- However, a flat wastage factor may be acceptable as a quick method in case of small differences in the total quantities.

Quantities unfixed

- Can be based on counting or measurement of materials stored on site.

- Can also be done based on:

- Quantities delivered to site evidenced by delivery notes – quantities valued as done x (1 + wastage factor)

- But a check with the materials found on site should still be done to ensure no significant discrepancy.

Acceptability of Contractor’s suppliers’ quotations

- Suppliers’ invoices and receipts should be submitted to support the prices paid or payable by the Contractor.

- Note that quotations are not necessarily contracts.

- Beware of false quotations and contracts.

- Counter-check against BQ rates is required.

Effect of BQ rates on value payable for materials on site

- The materials on site should be paid their costs delivered to site with an allowance for the Contractor’s profit.

- However, in case of underpriced all-in rates, the material costs should not be paid in full but should only be a reasonable proportion of the all-in rates.

Materials off-site

- Payment is not normally made for materials not yet delivered to site.

- If payments for materials off-site are to be permitted, the following conditions should be made and observed:

- The materials or goods are intended for inclusion in the Works

- The materials or goods are in accordance with the Contract

- The Contractor furnishes to the Architect reasonable proof that the premises where the materials or goods have been assembled or stored are owned or leased by the Contractor

- The materials or goods have been and are set apart at the premises where they have been assembled or stored, and have been clearly and visibly marked, individually or in sets, so as to identify

- the person to whose order they are held

- their destination as being the Works

- (i.e. distinguishable from other materials and goods in the same storage place)

- The Contractor furnishes to the Architect evidence that such materials or goods are insured against the perils similar to those set out in the insurance clause of the Contract (i.e. insurance cover against loss or damage after payment and prior to delivery)

- The Contractor furnishes to the Architect reasonable proof that the property in such materials or goods is in the Contractor.

- The last requirement is very important. If the Contractor does not validly possess the property in the materials or goods, the property cannot validly pass to the Employer even if the Employer has paid for it. This is particularly so if the materials and goods are store off-site and mixed with other materials and goods not for the Works.

Total value to-date instead of value since last

- One very important rule in making payment valuation is: always value the total value to-date since the beginning instead of value the value since the last payment. This rule is implied by the Standard Forms of Building Contract and is a golden rule to follow.

- Valuation every month cannot be exact. There could be errors in previous valuations. Work or materials included in previous valuation could subsequent be found to be defective. Therefore, by valuing the total value to-date since the beginning and subtracting from it whatever was previously valued, whether the previously valued was correct or incorrect, previous errors would not perpetuate unnoticed.

Retention

Use of retention

- The primary intention to have retention is to reserve some money in case the contractors fail to make good defects and the Employer has to employ others to do so.

- However, the Employer is entitled to make other deductions from the retention so long as he is entitled to make deductions from the Contract.

No interest paid for retention

- Retention is held by the Employer.

- The Standard Forms of Building Contract state the Employer has no obligation to invest. No interest will be paid for retention upon release.

Retention percentage / percentage of Certified Value retained

- The percentage of the Gross Valuation that the Employer may retain is called “Retention Percentage” (2005/2006 versions) or “Percentage of Certified Value Retained” (pre-2005 versions) where “Certified Value” means the Gross Valuation.

- The percentage is usually 10%.

- The Standard Forms of Building Contract state that the following are not subject to retention:

- Direct loss and/or expense due to delay and disruption

- Value of work carried out by Nominated Sub-Contractors

- Value of materials or goods supplied by Nominated Suppliers

- Value of any adjustment for fluctuations in the costs of labour or materials.

- Retention in respect of Nominated Sub-Contractors shall be dealt with in accordance with the Nominated Sub-Contracts. The provisions and percentages would usually be similar to the Main Contract.

- Nominated Supply Contracts usually do not have retention.

- Nominated Sub-Contractors’ retention is also held by the Employer.

Limit of Retention

- When the amount of retention reaches certain limit, the retention would not be increased further. That limit is called “Limit of Retention” or “Limit of Retention Fund”.

- The Limit of Retention is usually 5% of the Contract Sum.

- If the Contract Sum includes Prime Cost Sums for Nominated Sub-Contracts, the Limit of Retention would be stated as “5% of the Contract Sum excluding prime cost sums for Nominated Sub-Contractors’ works (to the nearest one thousand dollars) plus the Retention Funds held in respect of Nominated Sub-Contractors”. This means that the limit in respect of the Contractor’s own work is calculated separately from the Nominated Sub-Contractors’ works. The Contractor’s own Limit of Retention is calculated based on “the Contract Sum excluding prime cost sums for Nominated Sub-Contracts”. Therefore, this is less than that based on the Contract Sum. However, it should be noted that prime cost sums for Nominated Supply Contracts are not subtracted. This means that the Contractor has to share a burden of retention in respect of the value of Nominated Supply Contracts which usually do not have retention.

Release of one moiety of retention upon Substantial / Practical Completion

- “One moiety” means “half”. One moiety of the retention is to be released upon the issue of the Certificate of Substantial / Practical Completion and the other moiety is to be released upon the issue of the Defects Rectification Certificate / Certificate of Completion of Making Good Defects.

- It the time is not too distant or the Contractor does not have serious objection, the release of the first moiety of retention can be included in the next Interim Certificate following Substantial / Practical Completion, otherwise, a special Interim Certificate should be issued to release the retention.

Release of balance of retention

- The balance of the retention is to be released on the expiration of the Defects Liability Period or on the issue of the Defects Rectification Certificate / Certificate of Completion of Making Good Defects, whichever is the later.

- It is rare that the Defects Rectification Certificate / Certificate of Completion of Making Good Defects would be issued before the expiration of the Defects Liability Period. The Defects Rectification Certificate / Certificate of Completion of Making Good Defects would usually be issued after the expiration of the Defects Liability Period and the completion of the making good of defects discovered prior to the expiration of the Defects Liability Period.

- A payment certificate is to be issued to release the balance of the retention.

Other things to check before release of balance of retention

- The release of the balance of the retention does not have to wait till the settlement of the Final Account. However, the Final Contract Sum assessed at that moment should be checked to see if there has been over-payment. If there has been over-payment, part of the balance of the retention may need to be used to off-set the over-payment.

- The Contract may also specify in the Special Conditions, the Bills of Quantities or the Specification that the release of retention is subject to submission of all guarantees, warranties, bonds, maintenance manuals, operating instructions, as-built drawings, etc. The contract provisions should be checked to ensure compliance before release of the balance of the retention.

Final Certificate and Payment

Final Certificate

- Payment of the balance of the Final Account to the Contractor is certified by means of the Final Certificate.

- The 2005/2006 versions of the Standard Forms of Building Contract states that the Final Certificate is to be issued as soon as practicable after the issue of the Defects Rectification Certificate for the whole of the Works and 28 days after the issuance of the signed Final Account.

- The Final Certificate shall state the balance of money payable to the Contractor or the money owed by the Contractor to the Employer.

- The Contractor may in the end owe money to the Employer due to, without limitation:

- Over-payment of variations and provisional items

- Retention being inadequate to cover the Employer’s cost of making good defects not made good by the Contractor

- Deduction for loss and expense arising from defaults of the Contractor

- Deduction for liquidated damages

- The Employer’s general rights of set off at law.

- Subject to any deductions authorized under the Contract, the Contractor shall be entitled to receive the amount certified 28 days after the issue of the Final Certificate.

- Usually the Final Account shall cover all deductions authorized under the Contract. However, if the Final Account is agreed much earlier than the issue of the Final Certificate, the Final Certificate should take into account of all authorized deductions arising after the agreement of the Final Account. Further deduction from the amount stated as due in the Final Certificate should be a very rare occurrence.

Final payment prerequisites

- Before the Final Certificate is issued, the following should have been done:

- Issue of Defects Rectification Certificate / Certificate of Completion of Making Good Defects

- Settlement of Final Account

- Settlement of extension of time and liquidated damages

- Submission of proof of previous payments to Nominated Sub-Contractors and Suppliers

- Submission of warranties and guarantees

- Submission of as-built records

- Handover of specified spares, and handover of surplus materials supplied by the Employer and specified to be returned.

Final Certificate as conclusive evidence

- Final Certificate is not only a certificate of payment but is also a certificate of satisfaction of the work done by the Contractor.

- The 2005/2006 versions of the Standard Forms of Building Contract state that the Final Certificate shall be conclusive evidence in any proceedings arising out of the Contract whether by arbitration or otherwise that the Works have been properly carried out and completed in accordance with the terms of the Contract and that any necessary effect has been given to all the terms of the Contract which require an adjustment to the Contract Sum:

- except where any defect in or omission from the Works was not reasonably discoverable at the time of the issue of the Defects Rectification Certificate

- except to the extent the Final Certificate has been rendered erroneous by reason of fraud, dishonesty or fraudulent concealment

- unless contested by the dispute resolution proceedings within the specified time and only to the extent contested.

Final Accounts 结算

Final Accounts 结算 KCTangNote

3/4/2020: Rewritten in English.

24/12/2014: Moved from wiki.

Generally

- The principle and practice described below is based on the Standard Forms of Building Contracts Private Editions. The Government General Conditions of Contract are similar. The contract prices are generally fixed as lump sums or unit rates as tendered for at the risks of the Contractor, and will not be changed except for specified circumstances.

- However, the principle and practice used in the family of New Engineering Contract are very different. The core concept is to remove the risk of the Contractor in pricing. The costs are generally reimbursed based on the final quantities carried out and the actual costs paid by the Contractor, with a percentage addition for the Contractor's fees which should cover his profit and overheads not within the definition of "costs".

Preparing Final Accounts and negotiating with the contractors to agree the Final Accounts

- The Final Account process should start as and when a variation instruction is issued and should not be deferred until after Substantial / Practical Completion.

- Any update should be reflected in the Financial Reports.

- The Financial Reports with the column for the amounts estimated by the QS can be issued to the Contractor so as to present a full picture of his claims and QS’s assessment, and more importantly the areas of major differences for priority treatment.

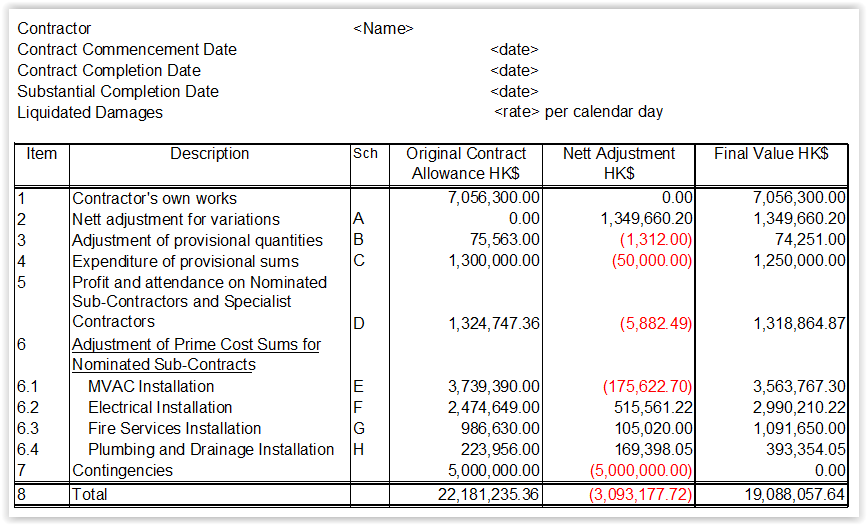

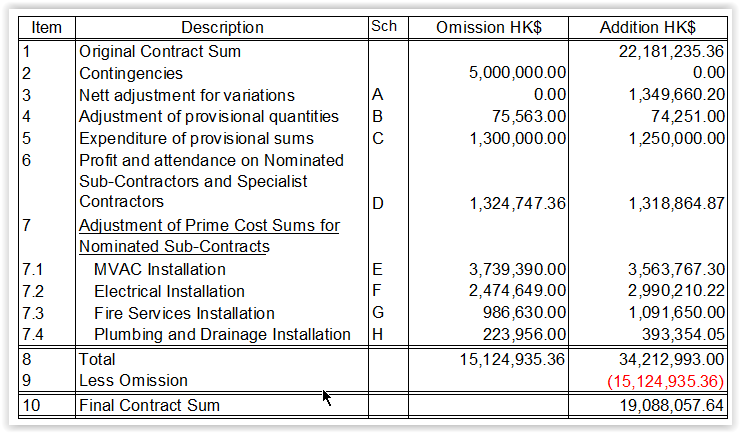

- Upon the agreement of the Final Contract Sum, the Financial Reports can be converted to formal Final Account format for signing.

- The key difference is that the Final Account only needs to show the amounts agreed and usually the gross omissions and gross additions are shown in two columns, while the Financial Reports show more columns as mentioned above, and due to limitation of page width, only a single column for the nett amounts is shown.

Descriptions

- The description of the items in the Financial Reports (to be converted to Final Account) should concisely but properly represent the design change or the scope of the costs.

- Do not copy directly from the description in the Architect’s instruction.

- Traditionally, the descriptions are written in instructive sense meaning the Contractor has to do it, such as:

- Add a concrete plinth at plant room A.

- However, if the Architect’s instruction says “BD general plan amendment submissions are hereby issued for your reference”, then a Financial Report description like the following would not be appropriate:

- Issue BD general plan amendment submissions for reference.

- A more proper description would be:

- Receive BD general plan amendment submissions for reference.

- Therefore, instead of writing in instructive sense, the following neutral style would be more appropriate:

- Addition of a concrete plinth at plant room A.

- Issuance of BD general plan amendment submissions for reference.

Main items adjusting Contract Sums

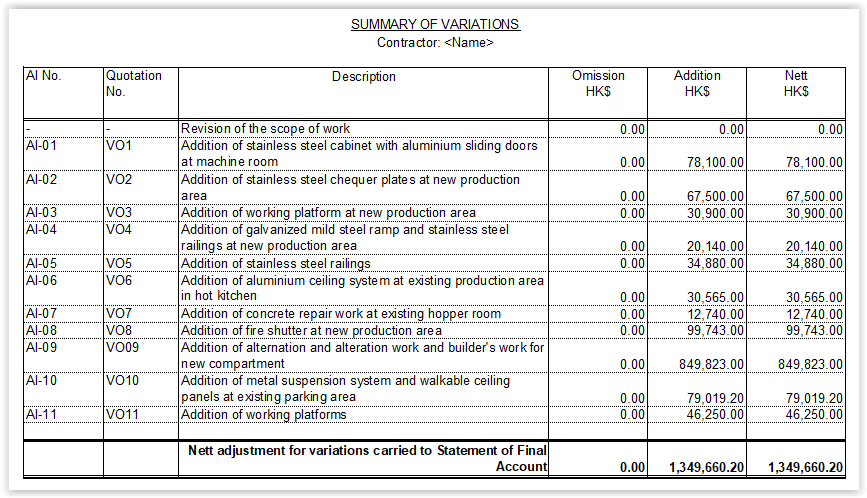

- Variations.

- Adjustment of prime cost rates.

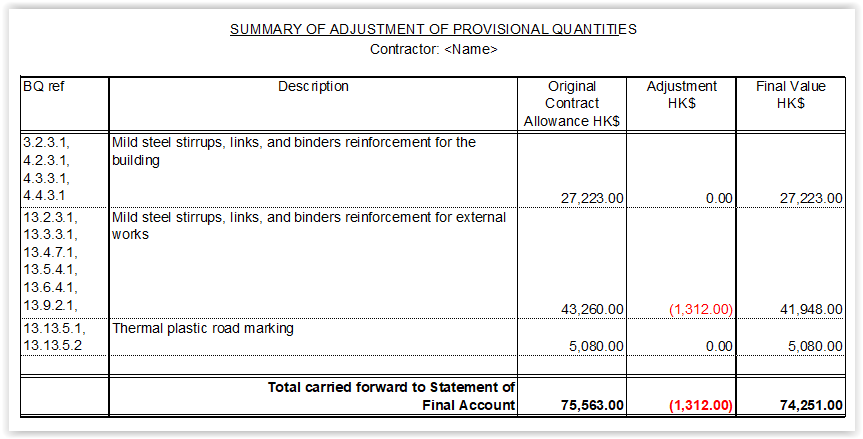

- Adjustment of provisional quantities.

- Adjustment of daywork allowances.

- Adjustment of Provisional Sums (including Contingency Sum).

- Adjustment of Prime Cost Sums and related profits.

- Loss and expense due to disruptions and delays.

- Adjustment for cost fluctuations.

- Others adjustments such as:

- deduction in lieu of correction of errors in setting out the Works

- deduction in lieu of replacement or reconstruction of materials, goods or work that are not conforming

- deduction in lieu of rectifying defects

- addition of statutory fees and charges which are additional to the Contractor's responsibilities

- opening up and testing materials, goods or work which are additional to the Contractors' responsibilities and complying with the Contract

- effecting and maintaining insurances resulting from the Employer’s failure to insure.

Authority

- Except for loss and expense claims and adjustments for cost fluctuations, Architect’s Instructions are required to authorize the work carried out under other items causing cost additions.

- Loss and expense claims do not necessarily arise due to Architect’s Instructions.

- The rules for adjustments for cost fluctuations must have been detailed in the Contract and would not need Architect’s Instructions.

- Provisional quantities by default must be adjusted for the final quantities done with authorization. The authorization may be in the form of the work being shown on drawings issued for general construction. Therefore, arguably, specific Architect’s Instructions may not be required.

- Excessive work done not as instructed will not be entitled to payment even though it may be tolerated without removal.

Abortive work and daywork records

- Abortive work and daywork must be properly recorded by the Contractor with photos, dimensioned measurement details, quantities of labour employed, materials used, plant used, etc.

- Endorsement by the Clerk of Works or the Architect’s / Engineer’s site representatives is required.

- In case no endorsement is available, the Architect’s opinion should be sought.

- Payments made by the Contractor must be supported by invoices and receipts issued by the sub-contractors or suppliers.

Work not done

- Work not done but not yet omitted by an Architect’s Instruction should not be included in interim payment.

- Its omission value should be noted in the Financial Reports to ensure that this would not be missed in the Final Account.

- If eventually the work is not done, the value should be omitted from the Final Account for agreement without necessarily requiring an Architect’s Instruction.

Filing

- The documents relating to the above different items should be filed under different files.

- Architect’s instructions should each be filed under a different file section such that the instruction is put at the front of its section while other documents from estimates before AI, AI pre-approval form, Contractor’s submissions, QS assessment, etc. are filed in chronological order with the latest put on top. This would serve to tell the full history of development.

Drawing register

- For big projects, the Drawing Register used in the Pre-contract stage can continue to be updated, but with the Architect’s Instruction Numbers added at the column headers.

- The Drawing Register can reveal whether a drawing has been revised several times under different Architect’s Instructions.

- It is more efficient to measure the final change against the original instead of measuring changes after changes.

Rates to be used

- Rates used to value variation additions, remeasured provisional quantities and expenditure of provisional sums:

- Contract rates - for work of similar character carried out under similar conditions

- Pro-rata rates - based on contract rates for similar work but adjusted for the differences in character or conditions of work

- Fair market rates - used if it is unreasonable to apply contract rates or pro-rata rates, e.g. work is entirely different

- with reference to similar work in other projects and adjusting for the differences between the two projects

- build-up from first principle

- Daywork rates - to be used when it is unreasonable to measure and value the work based on the quantity of the work, e.g. in case of demolition, piecemeal breaking up of openings.

- Rates used to value variation omissions and omission of original provisional quantities

- Contract rates - for omission of quantities of original work

- Pro-rata rates - if the reduction in the quantities is significant and renders the contract rates for the remaining quantities unreasonable to apply, then the rates for the remaining quantities can be adjusted for the cost differences caused by that reduction. An example is a change in the economy of scale. The contract rates have to share some fixed costs based on the original quantities. If the quantities are reduced significantly, the fixed costs contributed by the remaining quantity will not be sufficient. An adjustment should be made to the contract rate to compensate the contribution so lost.

High or low contract rates

- Contract rates are to be applied no matter whether they are high or low. The same principle applies to adjusting contract rates for pro-rata rates. The adjustment should be for the cost difference between the differences in character or conditions or economy of scale.

Omission and addition

- Generally, when a drawing is revised, the quantities of the items changed are measured as omissions, and the quantities of the items after change are measured as additions.

- However, if only the component design is changed but the quantity remains the same, then it should be more expedient just to apply the rate difference to the quantity to give the net adjustment.

Variations

- The 2005/2006 versions of the Standard Forms of Building Contract define variations as:

Variation: a change instructed by the Architect to the design, quality or quantity of the Works including:

(i) an alteration to the type, standard or quality of any of the materials or goods comprising the Works;

(ii) the addition, substitution or omission of work; and

(iii) the removal from the Site of materials or goods and the demolition and removal of work except where provided for in the Contract or where the materials, goods or work are not in accordance with the contract clause regarding types, standards and quality;

or the imposition of an obligation or restriction instructed by the Architect regarding:

(iv) access to the Site or use of any parts of the Site;

(v) limitation of working space;

(vi) limitation of working hours; or

(vii) the sequence of carrying out or completing work;

or the addition or alteration to or omission of such obligations or restrictions imposed by the Contract.

- The Government General Conditions of Contract are very similar.

- The pre-2005/2006 versions of the Standard Forms of Building Contract do not have scope similar to (iv) to (vii).

- The Architect Instruction number must be stated to indicate the authority.

Errors

- Errors in Tender Documents forming part of the Contract Documents are to be corrected for carrying out the work and the cost effects are to be treated as variations.

- Architect’s Instructions would usually be issued to make the corrections of errors in the Drawings and Specification without being explicit of being an error correction.

- No Architect’s Instruction is required for correction of BQ errors, and the correction is deemed to be a variation. However, the presence of BQ errors would not give a good image of the QS to the Client. If it so happens that the BQ items with errors are also subject to design change, then it is not uncommon that the correction of BQ errors will be made when valuing the design change.

- Errors in the Contractor's pricing of the Tender Documents are not to affect the Contract Sum.

Adjustment of prime cost rates

- The Final Account adjustment items would be like:

- Omission of original quantity x prime cost rate = gross omission

- Addition of original quantity x actual unit cost = gross addition

- Alternatively

- Original quantity x (actual unit cost - prime cost rate) = net adjustment

- The BQ reference should be stated.

- Where available, state also the Architect Instruction number.

- Usually, the Contract specifies that no adjustment will be made for wastage or profit and overheads.

- However, if the actual unit cost is excessively more than the prime cost rate, the Contractor will suffer in the wastage cost with insufficient profit and overheads. A reasonable compensation of the excessive effects of the wastage and profit and overheads should be made.

- On the other hand, there can be savings in other items where the actual unit costs are less than their prime cost rates.

- Therefore, the reasonable compensation should then take a global view considering all prime cost rate adjustments.

- The all-in rate after adjusting the prime cost rate for the actual unit cost is as follows:

- Original all-in rate – prime cost rate + actual unit cost = adjusted all-in rate